Five years ago, banking clients in Nairobi had to spend an hour queuing to pay their utility bills. Fast forward to the present day, and these clients can now pay their bills at the touch of a button from the comfort of their home.

The digital economy is creating a watershed moment for the banking industry, and – in many ways – clients in Africa are at the forefront of these changes with their widespread adoption of mobile phones.

High expectations

Across the globe, increasing numbers of people are now accessing financial services from their mobile devices, their expectations set to ‘high’ by digitally native technology players, like Alibaba and Apple.

Client loyalty is built on ease of use, security, 24/7 access and a fuss-free user experience. In banking, it’s about clients being offered the most relevant savings and credit cards, based on their past usage. For example, if you have just received a bonus and are looking to grow your wealth, you will want to be offered an investment product that fits your risk profile.

The lesson for banks is clear: value your interactions with clients – especially via digital channels – and invest in data analysis. Clients will be loyal to a bank that knows them and makes banking convenient and easy.

The race to deliver the best digital client experience is particularly intense in Asia and Africa, where a new generation of young, affluent clients are coming to the fore. The number of middle class households in key Sub-Saharan African countries is set to grow rapidly. These households will be digitally savvy and more likely to embrace new types of financial service providers, including those outside the banking industry.

The future is here

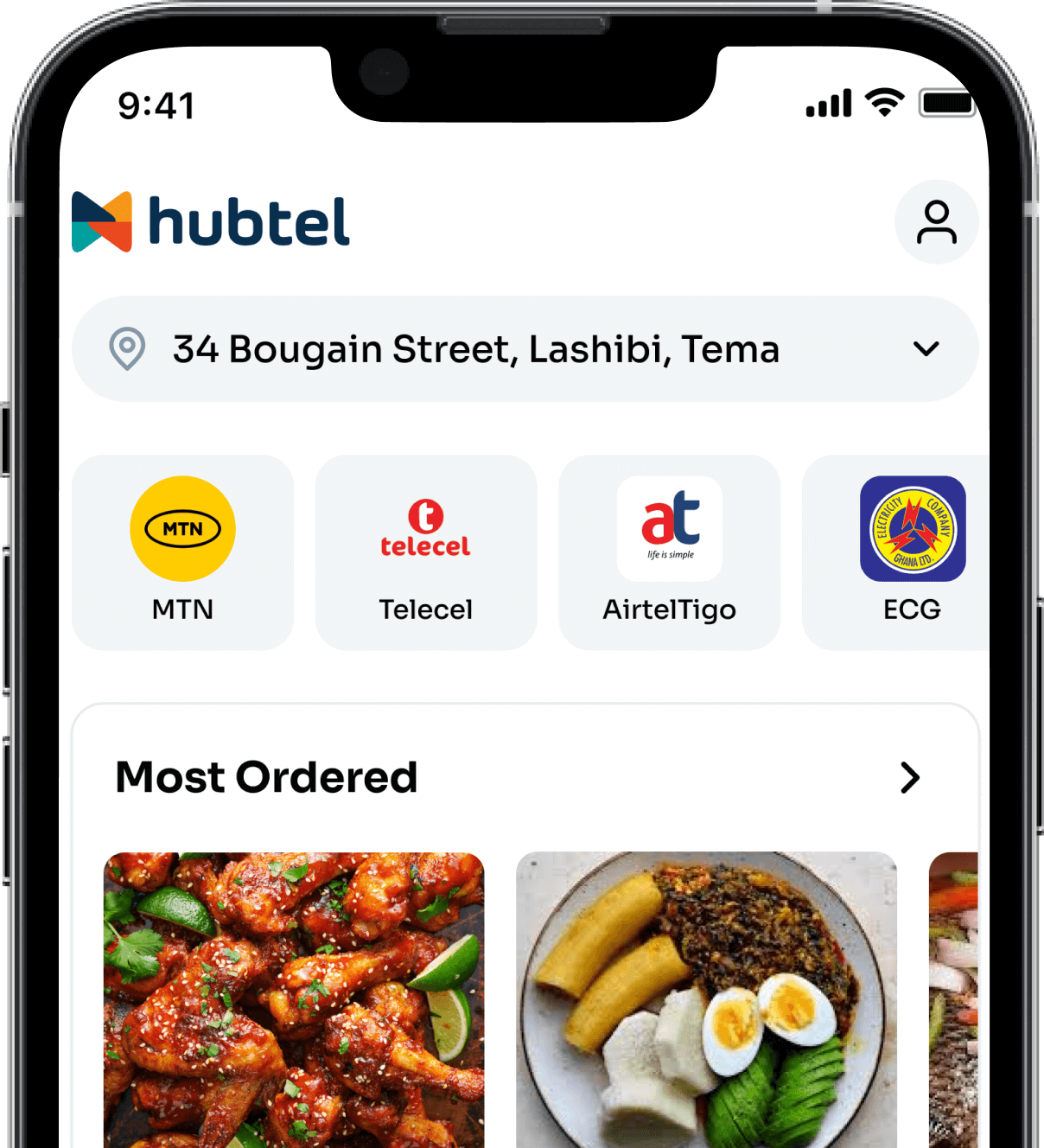

In the past five years, Sub-Saharan Africa has been the fastest-growing region in the world for mobile telephony, paving the way for a proliferation of mobile wallets. In Kenya, around 18 million adults, or 85 per cent of the population, now use mobile money services, such as M-Pesa, Mobikash or Airtel money.

When it comes to digital banking in Africa, things are changing fast too. Imagine sitting in a taxi in Lagos traffic: you log on to your mobile device, and see all your banking activities at a glance. You have a question about what investment options are available to plan for your future, so you press a button to talk to your relationship manager. Via video, your relationship manager links you to an investment advisor, who answers all your questions and gives you options that meet your needs. This will be the norm not too far in the future.

Clients are expecting banks to reverse the service pyramid: instead of being offered digital channels incrementally, they want to receive all services digitally in the first instance.

At Standard Chartered, we are changing our business model fundamentally, to be ‘digital by design’, but we acknowledge that to move nimbly and bring more convenience to clients, we need to partner financial technology companies in niche areas.

In Africa, we have teamed up with mobile payments aggregators, such as Selcom in Tanzania, Cellulant in Kenya, Zambia and Botswana, and eTranzact in Nigeria and Ghana, to enable bill payment on mobile from our clients’ bank accounts; client transactions via this channel are increasing by over 50 per cent annually. We have also made it easier for our corporate clients to make mobile-wallet payments to individuals, whether or not they have bank accounts through our Straight2Bank Wallet mobile app.

Banks need to jealously guard their reputation as trustworthy counterparties and custodians – virtues that are increasingly valuable in a digital economy beset with trust and privacy issues.

There are challenges to getting it right, but the good news for clients in Africa is that they are certain to be the big winners as banks invest to understand and serve them better.

By Karen Fawcett, CEO (Retail Banking, Standard Chartered)

Related

October 11, 2019| 2 minutes read

October 4, 2019| 2 minutes read

The History of Online Shopping

September 20, 2019| 2 minutes read