The time is 4:30am Monday morning and the signs on the doors of most banks in Ghana will read “Closed”. Yes, the “brick and mortar” bank at the corner of the busy road is closed, but not your mobile phone, not your telecom network, not your mobile money which you carry in your pocket wherever you go. With a smile on your face, you can stare at that sign reading “closed” and yet get the chance to transfer the funds to your son in university who needs to purchase that textbook tomorrow. Mobile money has caused a stir in traditional banking in Ghana in the last 5 to 10 years, and like it or not, its impact would be greatly felt.

Just as every new idea and improved ways of doing things comes with its own benefits and implications across various civilizations, cultures, and industries, the banking and financial sector in Ghana is currently experiencing another phase in its life through the Calvary charge of the “mobile phone” which is quickly sweeping over the country like a wildfire or a plague.

Financial inclusion: Out of every 10 Ghanaians about 4 of them have traditional bank accounts and only 3 may have their accounts active. The introduction of mobile money has given the banking industry the opportunity to reach out to the unbanked through their mobile phones. One can now open a traditional bank account even with a mobile phone. The days of needing to walk into a bank and fill out some forms are fast fading away. Currently, almost all telecom companies are making moves to synchronize one’s mobile money account with traditional banks in order to have ease of moving funds across accounts. This will expand the banking industry in terms of deposits through mobile money, and having a bank account could be as easy as dialing “1,2,3”

Cash-lite banking: Do you recall the smell of notes and money when you enter a typical banking hall? Or perhaps it is the sound of the money-counting machine. What about the “bam-bam” stamp sounds of the teller as she stamps the white band on the bank notes… All of these familiar things in traditional banks may be experienced less if mobile money continues to be successful in making the Ghanaian economy cash-lite. One may not need to carry thick wads of cash which may attract thieves as soon as one steps out of a banking hall. With the dawn of mobile money, hundreds of cedis can be wired across the nation without moving a foot. If mobile money gains more ground and capacity is built to handle bigger transactions and transfers, physical cash may exchange hands less often and traditional banks may equally be visited far less often.

General fear of unemployment: It is feared that with automation and making transactions electronic and convenient, fewer people may actually visit a traditional bank occasionally to make transfers or withdrawals. Introducing the automatic teller machine (ATM) saw a drop in walk-in clients making withdrawals. This move into automation and mobile money is speculated to cut down on the number of staff traditional banks may actually need for that aspect of operations (account opening, money transfers, and others) in the long run. However, mobile money has created thousands of employment opportunities for mobile money agents across the country. Traditional banks can equally innovate and provide core banking services to telecom firms that do not have banking as their core business. In the long run, traditional banking may move from being more staff to client related when mobile money takes over certain traditional frontline banking roles.

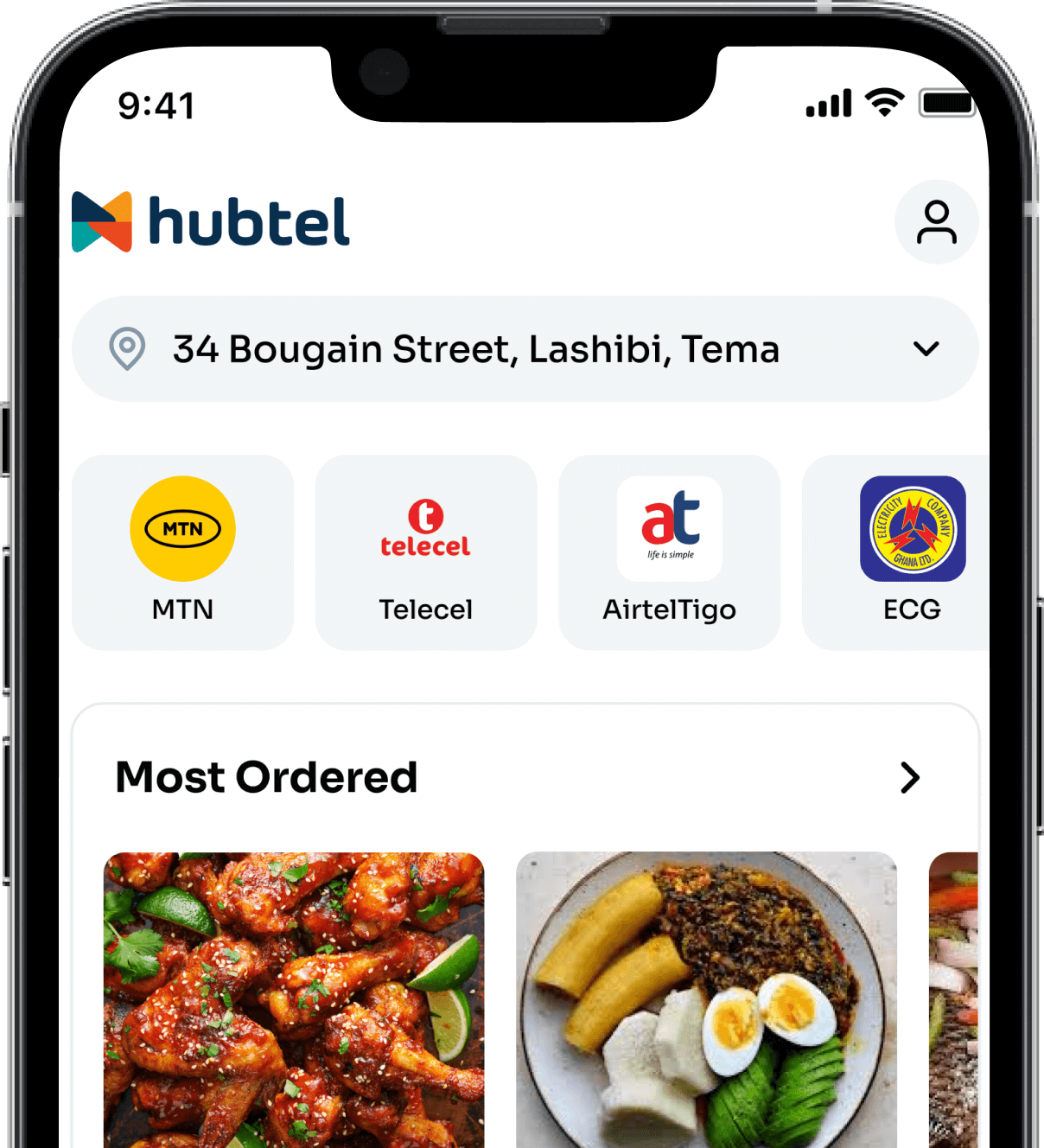

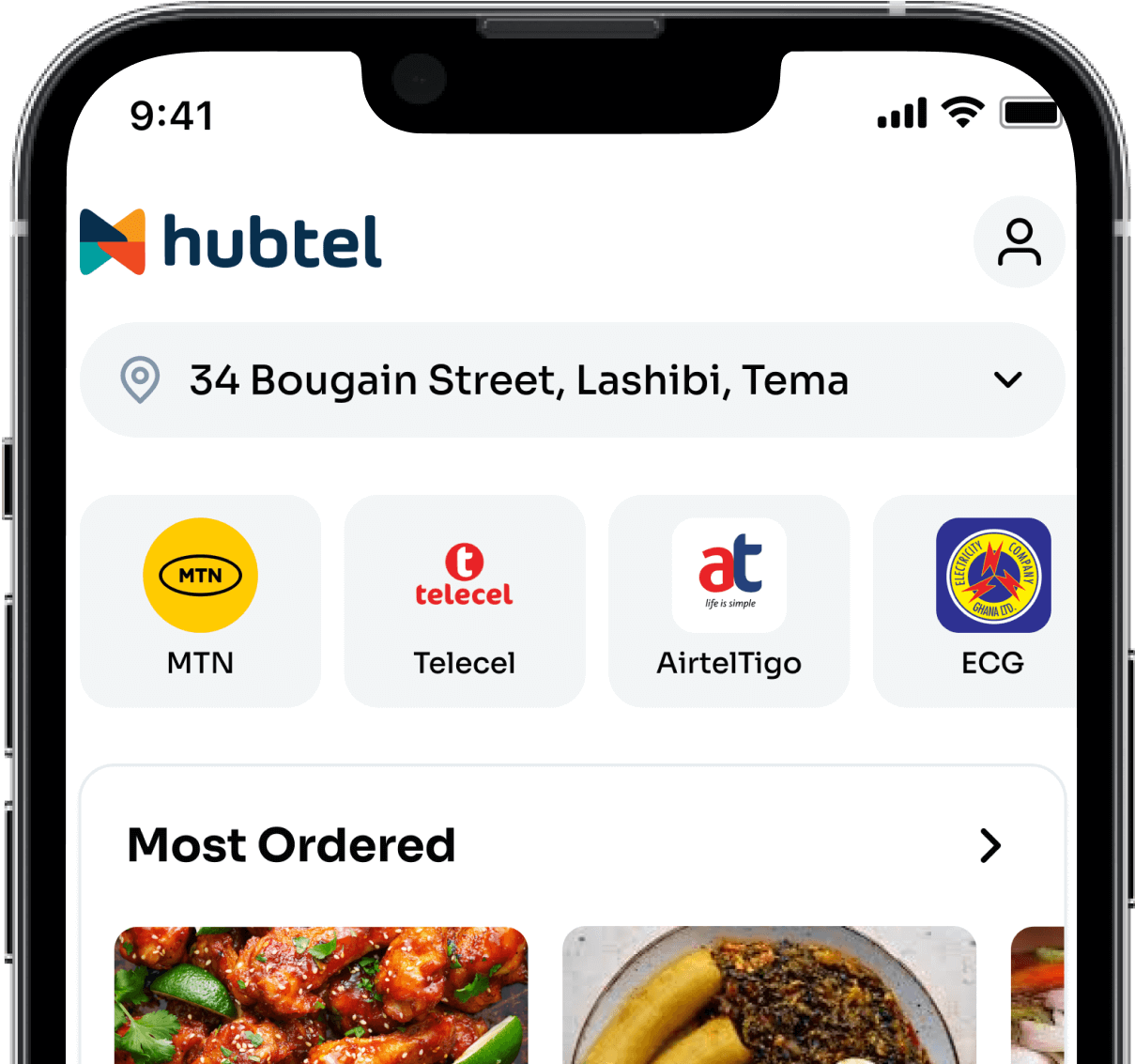

It is however important to note that with moves of merging mobile money accounts with traditional bank accounts through financial technology, your Mobile Money account may gradually be an extension of your traditional bank account, only this time, you will carry the “brick and mortar bank” in your pocket everywhere you go.

Related

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

Hubtel Announces Completion of Commercial Agreement with ECG

March 28, 2024| 6 minutes read