Month: January 2022

Kokomlemle, Accra. January 27, 2022 –– Jonathan Ansah has joined Hubtel as the company’s new Chief Financial Officer.

Jonathan has 20 years of experience spanning five industries, with a proven track record of delivering profitable growth for businesses. His previous roles demonstrate his expertise in business restructuring, financial engineering, and operational efficiencies.

He is a certified Chartered Accountant with extensive auditing experience. He has worked with the global auditing firm Deloitte––Ghana and served as Audit Director at the National Lottery Authority. His seven-year tenure as Finance Director at Cadbury Ghana is highlighted by his leadership of the financial and business strategic planning process, which resulted in the company turning around in two years with positive cashflows and shareholder investment.

Before joining Hubtel, he served as the Chief Commercial Officer of the Ghana Post Company Limited, leading the organization to create its first commercial division since its inception. During this period, he also led the development of e-Commerce, e-Services, and Financial Services expansion strategies, resulting in $5 million in World Bank support. Two banks joined forces under his leadership to form the Post Bank (Agency Banking).

As CFO, Jonathan will lead Hubtel’s finance strategy and be responsible for the accounting, treasury, financial planning and analysis, tax, in business plans, strategies, capitalisation and investor relations of the company.

Jonathan holds a Master of Business Administration degree in Finance from the prestigious University of Ghana Business School, with an ACCA professional certification from the Emile Woolf College in London, United Kingdom.

He is passionate about driving business performance, including transformation, revenue. optimization, efficient business processes, internal controls to ensure business growth and continuity.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

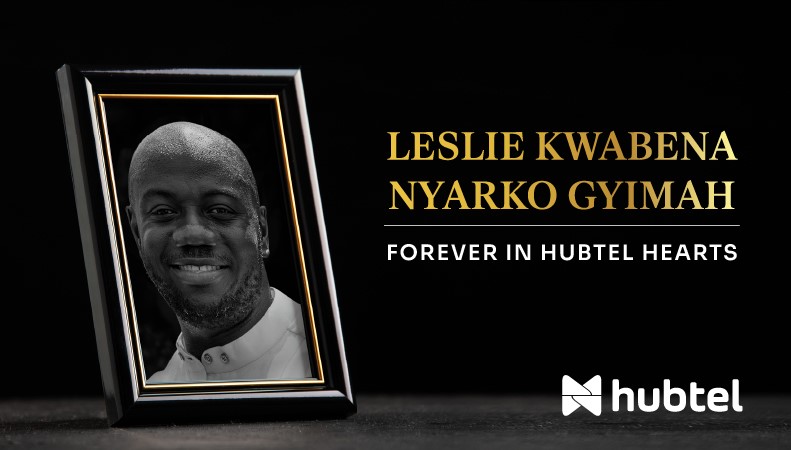

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Hubtel’s Management Trains for Anti-Money Laundering Compliance.

January 25, 2022 | 2 minutes read

Kokomlemle, Accra, Ghana. Thursday, 20th January 2022: Board of Directors and management staff of Hubtel undertook anti-money laundering compliance training in accordance with its regulatory obligations under the Anti-Money Laundering Act, 2020 (Act 1044).

In addition to meeting the company’s regulatory obligations, the training was also crucial to raise awareness of the negative impact of money laundering and terrorist financing on society, the economy, the organization, our customers, and employees.

Hubtel recognizes the risk that financial companies are exposed to, such as terrorist financing. The Anti-Money Laundering procedures will provide a guide to protect the vulnerability of our industry by facilitating accurate and reliable KYC. We believe that investing in such compliance is a good investment in our customers’ trust and loyalty, which are values that we cherish.

The e-Crime Bureau and officers of the Financial Intelligence Centre (FIC) led the team through a three-part session to cover various important topics. e-Crime Bureau is a cybersecurity and investigations firm that has provided unparalleled cyber security, digital forensics training, capacity building, and other investigation-related consultancy services to organizations in various sectors since 2011.

Some of the areas highlighted include:

- Overview of Anti-Money Laundering and Terrorist Financing

- Situational Analysis of Money Laundering – Ghana in Perspective

- Money laundering risks associated with fintech

- Know Your Customer Procedures & Best Practices

- Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

- Risked-based approach to Anti-Money Laundering / CFT for Fintech

- Transaction Monitoring in Fintech

- AML / CFT in Ghana –– Legal & Regulatory Framework

- Sanctions for AML Compliance Breaches

- Anti-Money Laundering Reporting (Suspicious Transactions Report [STRs]

- AML Data Solutions for Fintech

On behalf of the board of directors and management staff, Cornelis Rouloph Otoo, Head of Legal and Corporate Affairs, pledged the company’s continued commitment to staying compliant and continually engaging regulatory agencies to safeguard the security of the company, its customers, and the economy at large.

With an increasing number of financial terrorism cases in our society, financial institutions must be well-equipped with the necessary resources to mitigate the economic impact.

We are increasingly looking for long-term relationships with compliance institutions and professionals so that our team can provide solutions to any new and unexpected demand for checks or related services.

Related

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read