Month: May 2021

Hubtel Expands eCommerce in Ghana with Opening of Kumasi Customer Experience Center

May 31, 2021 | 3 minutes read

Hubtel has formally opened its very first customer experience center within the Kumasi City Mall. This follows the rapid adoption of eCommerce by residents within the Accra. Having warmed the hearts of thousands of very happy customers in Accra, Hubtel is now extending the convenience of fast store-to-door deliveries to Kumasi.

The move aligns with the company’s continuous quest of helping businesses grow sales and connect better to changing customer needs.

It also follows the 2019 re-introduction of Hubtel’s refreshed eCommerce platform which is seamlessly merging the shopping experience for customers in-store and online with fast same day delivery.

Recently licensed by Bank of Ghana as an Enhanced Payment Service Provider, Hubtel is positioning itself to become a very useful companion for mobile users, just as it has done with its transformational work in pioneering mobile airtime content services, fintech and bulk SMS messaging.

The opening of the Hubtel experience center will serve as a base of operations for its eCommerce activities within the Kumasi metropolis. This will also provide a point of call for users of Hubtel to get first-hand experience of features and also get help from customer service officers.

The center will in addition provide walk-in assistance to business owners to set-up Hubtel POS to manage inventory, sales and payments.

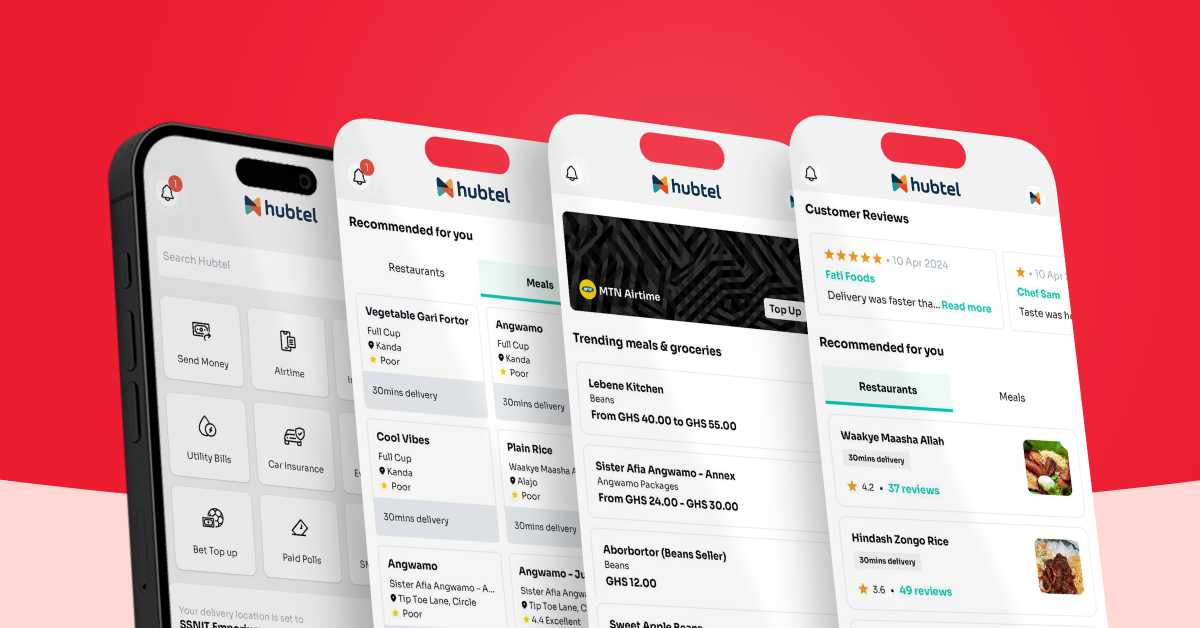

Hubtel Smartphone App

The center’s opening also coincides with the introduction of the Hubtel smartphone app to residents of Kumasi. The app enables consumers to find and buy anything from stores in Kumasi and receive it within 90 minutes to a few hours.

It also has features for users to instantly top up data, buy airtime, send money and pay for services with any mobile money or bank card.

The app also includes features to track delivery orders and receive notifications from the time an order is prepared, picked up and delivered.

In an interview at the opening, CEO of Hubtel, Alex Bram urged retailers to boldly embrace the changing shopping landscape by getting their inventory onto Hubtel.

“If you run any retail business such as a supermarket, pharmacy or restaurant, your customers are becoming more mobile, so it’s time to fit your store into their mobile lifestyle.” he stated.

In a speech to formally open the center, the Chairman of the company, Hans Nilsson said, “If you’re a consumer, Hubtel is bringing all retailers to your smartphone. This puts the city on your phone, making it possible to order anything and have it delivered to your door.”

He therefore urged everyone to install the Hubtel app, and link to a mobile money wallet or bank card to try it out.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Report an Issue, Order Tracking, Item Reviews & More…

See what’s new in this update

Report an Issue on Prepaid Balance or Transfer Funds

Need help with your Prepaid Balance or Transfer Funds details? Simply tap on the “Help” button, then select your issue from the list provided or choose “Other” to type your issue and tell us what happened, for immediate assistance.

Report an Issue on Messaging

For assistance with any challenge at the Messaging section of your account, just tap “Report an Issue” at the bottom right and let us know what happened, for immediate assistance.

Report an Issue on Payment History

Receive immediate response on Payment History details as required by simply tapping on the “More button” under “History of Payment”, then select “Report an Issue” to share your concern.

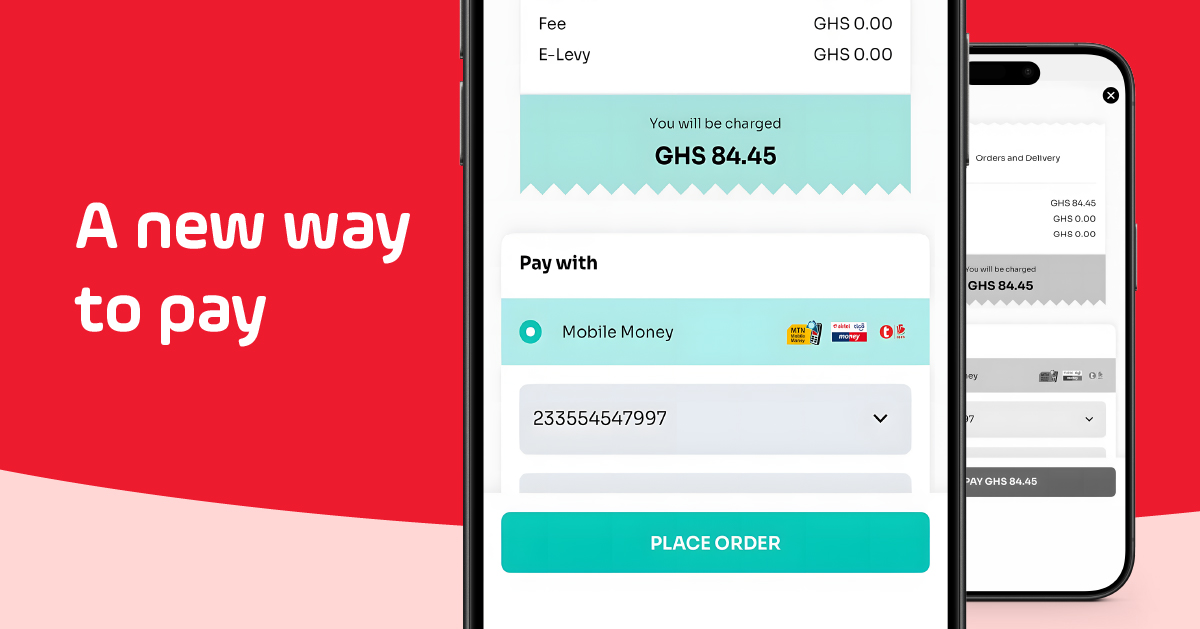

Mobile Money Verification on Web Checkout

Customers can now verify their mobile money numbers during payment with just a one-time verification pin, and receive verification prompt to complete their payment process.

Bank Card Verification on Web Checkout

New and existing card users are now required to provide their bank card details if they have already been verified by Visa, to confirm verification and receive a one-time pin to complete the payment process.

Add Card on Hubtel Pay

Customers can also add their cards as a wallet on Hubtel Pay by linking it to their numbers after the payment process.

Item Varieties

Customers can now select different options of the same item as they prefer, for items with different options available.

Item Extras

An item could have other “Add-ons” that sweeten the deal which can now be added to orders when adding items to cart.

Improved Search

Search suggestions now makes it easier to get preferred search details on items.

Item Reviews

Customers can now post reviews or share feedback on orders and delivery with photos.

Order Tracking

Tracking now includes updates at every stage of the delivery process. From order placement, pickup to delivery.

Related

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

May 9, 2024| 2 minutes read

Improved features for a smooth experience

April 19, 2024| 3 minutes read

3 Ghanaian FinTechs Build Ghana.GOV to Block State Revenue Leakages

May 7, 2021 | 4 minutes read

Three leading Ghanaian FinTech companies, Hubtel, ExpressPay and IT Consortium, have built Government’s maiden fully-integrated payments processing and settlements platform, Ghana.GOV to ensure efficiency in government services and revenue collection.

The online platform, commissioned by the Office of the Vice President in collaboration with the Ministries of Finance and of Communication, is a major step in the pursuit of the government’s vision of digitizing the economy and modernizing the way Government pays its bills, collects fees and charges for the benefit of all citizens, residents and visitors.

Hubtel, ExpressPay and IT Consortium are all local financial technology (FinTech) companies with many years of experience in providing digital payments and settlements among many other services to financial institutions, corporate organization, retail merchants, telcos, media organizations, utility service providers, schools and many more with high efficiency.

They each run platforms that, for instance, enable Ghanaians to easily pay utility bills digitally, either with mobile money, other digital wallets, or with their bank account.

They therefore designed the Ghana.GOV platform to enable all Ministries, Departments and Agencies (MDAs) and Metropolitan, Municipal and District Assemblies (MMDAs) to also provide services to the public, take and make payments on a digital platform.

In effect, Ghana.GOV, which is yet to be launched, is intended to be a digital services and revenue collection platform for the public sector, created to provide a single point of access to Government of Ghana services.

The homepage of the Ghana.GOV site indicate the public can access services from state institutions categorized under Passport Office, Ghana Revenue Authority, Ghana Immigration Services, Births, Deaths and Marriages, as well as Police, Justice and Safety.

Other categories are on the portal are Social Services and Welfares, Health and Food Services, Energy and Petroleum, as well as Driving and Transportation. So when a visitor clicks on any of the categories, they will be directed to the respective institutions for service.

The services the portal seeks to deliver include processing of all payments and transfers (both electronic and cash) against predefined service flows of each MDA and MMDA, as well as managing post-payment workflow, customer notification, feedback and service ratings.

This, according to information available to TechGH24, will enable the Government of Ghana fulfil its ultimate goal of creating a cash-lite economy.

Block the leakage

But a key rationale for creating the Ghana.GOV platform is to cure the inefficiencies in Government’s domestic revenue collection, particularly MMDA collections, which leads to huge revenue losses every year.

For instance, the 2017 Auditor-General’s Report indicates that, inefficiencies in revenue collection by the MMDAs alone resulted in losses of over GHS2 billion.

It is also estimated that about 10 -15 per cent of Government’s collections are lost through theft, fraud and other schemes.

Indeed, government observed that with about 254 MMDAs and some 127 public organizations operating more than 2,000 physical points of services and revenue collection through mostly manual processes, it is not surprising that revenue collection is facing such challenges.

It is therefore government’s considered view that modern technologies presents a simple, proven solution to address the identified inefficiencies, block the leakages and significantly grow revenues, and the three local fintechs have proven efficient in providing such solutions.

Revenue boost

With the implementation of the Ghana.GOV platform, therefore, government expects to see a significant boost in revenue collection as a result of the impact of electronic payment on the systemic collection losses that are prevalent today.

Government estimates that digitizing collections via the Ghana.GOV platform will enable the it improve revenue by an some GHS3billion annually.

These expectations are rooted in scientific studies results, which have confirmed that providing simple to use electronic payments increases government collection by two times in some cases as people embrace the convenience that digital platforms offer.

Indeed, government also expects a a further positive boost in the revenue gains as the platform will help to expand the tax-net to include the informal sector tax payments, while offering the possibility for additional revenue from premium expedited services.

Ghana.GOV was originally scheduled for launch in June last year, but it has been postponed to later this year.

Source: techgh24

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read