Month: October 2017

In the early 2000’s, researchers found out that some mobile phone users would sell their airtime to friends and family for cash. This clever, but improvised use of airtime as a substitute for money transfer was the precedent on which mobile money was created.

Over the years, mobile money in Ghana has seen significant development because of the many advantages it carries. The service, which was introduced in Ghana in 2009 by Ghana’s leading Telecommunications Company MTN is now offered by tiGO, Airtel and Vodafone. In fact, one out of every five Ghanaians has a mobile money account.

Setting up a mobile money account is fairly easy. Once you have a valid national ID card and a SIM card, you just visit your network provider and an account will be created and linked to your mobile number. The only thing you need to make transactions is your PIN number. Fin. Comparing this with traditional banking, where you would actually have to walk into banking hall, fill out documents, make a minimum deposit and walk out with a cheque book and an ATM, it is easy to understand why many Ghanaians are opting for mobile money instead.

The fact that there are many mobile money agents in Ghana makes it easier and more convenient when you have to withdraw money. Let’s say you live and work in Kumasi and need to transfer some money to your sister in a village. Before the onset of mobile money, you may have had to transfer the money through someone, say a friend or a distant relative. This comes with some delay and risk of your sister receiving less than expected. But with mobile money, no matter which network you use, there is at least one agent who can assist your sister cash out almost immediately you transfer the cash.

Gone are the days when local traders would ply long distances without fear of being robbed of valuables by armed bandits in the middle of their journey. Rather than carrying large amounts of money and hoping for event-free trips, more and more traders now transferring money to their mobile money accounts, travelling light and redeeming their money when they arrive safely at their destination.

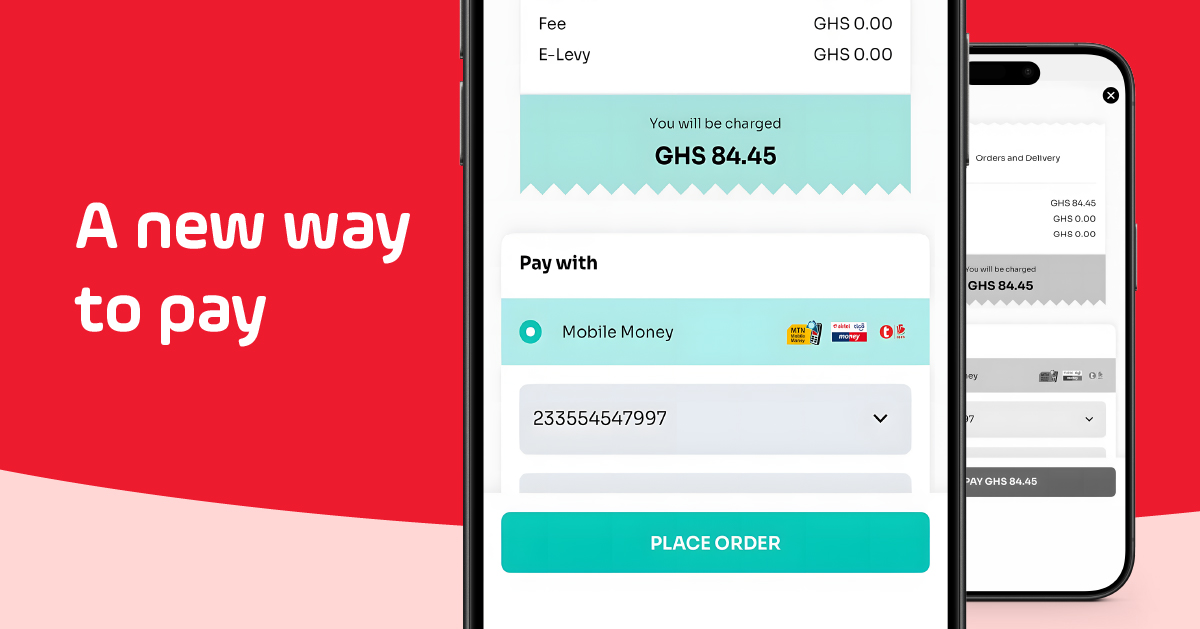

Even though there has been a mass adoption of the service, Ghanaians primarily use the service for cash in/cash out transactions. They do not use mobile money to pay for utilities and make other online purchases as is the norm in Kenya and Tanzania. This indicates that the service is guaranteed to get better as companies begin to take advantage of the unique opportunities opened up by mobile money. Hubtel, for one, offers a Point of Sale (POS) software for businesses who have products or services to sell and want to give their customers the convenience of paying with a variety of payment options including mobile money.

With the burgeoning and innovative use of the service, mobile money in Ghana is guaranteed to continue rising. Who knows, it could even disrupt traditional banking.

Related

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Hubtel Joins 30-year-old’s GHc87,000 Fundraising Bid To Help Him Walk Again

October 3, 2017 | 3 minutes read

Ever since we at Hubtel heard Baffour Awuah Tabury’s touching story on Citi FM, we have made it one of our 2017 goals to “Make Baffour Walk Again.”

Before everything changed on the road to realizing his dreams and making his mother proud, Baffour was a final-year student at the University of Cape Coast and getting ready to graduate. He was involved in a motor accident that left him paralyzed from his waist down in 2007. Due to this unfortunate turn of events, Baffour had difficulty controlling his urine and bowels. Like any loving and caring mother will do, Baffour’s mum resolved to do everything in her power to see her son walk again. This included burning over GHS 200,000 of her personal savings and investments on various procedures and two surgeries in Ghana. Last year, Baffour successfully had another surgery in China which restored his urinary and bowel control.

For Baffour to walk again, the next step will be to undergo physiotherapy at NextStep Orlando (no pun intended). This physiotherapy center in Orlando, Florida treats patients who have injured their spinal cords so they can fully recover their functions. Amazing right? Yes, but this procedure will cost a cool GHS 87,000 ($19,200). And this is where Hubtel comes in.

We have developed a Point of Sale platform called the Hubtel POS. This platform is tailored to allow businesses to accept payments and charity organizations to receive funds from all mobile money wallets and bank cards in their stores, online, or on the go into one account. With our POS, we eliminate the burden of having to hold four different phone numbers to receive payments. Making it easier for everyone who is touched to help resolve situations like Baffour’s, to make a donation to help Baffour walk again.

So now how do I donate to this cause? It’s simple – just dial *713*7140# on your phone – it doesn’t matter which network you’re on, follow the instructions, and make a donation. Think of it this way: if 8,700 individuals make a donation of GHS10, Baffour’s dream of walking again will be realized.

Hubtel has not only provided this shortcode to ease Baffour’s access to donations for his surgery, we are also waiving all network charges associated with mobile money transfers made to this donation.

So go ahead. Dial *713*7140#, and let’s make Baffour walk again!

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Credit to Cedi

We at Hubtel are obsessed with finding ways to simplify our pricing, and we have great news. We are making two changes that make your Hubtel experience a lot better.

Firstly, the value of your top-up has previously been displayed as the number of messaging credits. Starting Sunday, 1st October this will now be shown as currency balance in Cedi, or Dollars in your account.

Bundles

Second, we have introduced some great value bundles for you to make significant savings. Campaigns that you run when you have not paid for a bundle will be charged at a flat standard rate of 0.03 for local messages.

Your new bundles give you up to 40% savings! Choose the monthly or quarterly bundles that best suit your needs.

Before the end of the bundle period, you can roll over your remaining value by buying another bundle or allowing your current bundle to expire. Your main currency balance will not expire so you can always buy more value bundles whenever you are ready.

Log into your account to purchase any of our nearly 40% cheaper bundles. If you need help or want more information we are always just a call or email away. Just call us toll-free on 0800 222 081.

Related

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Since we relaunched as Hubtel we have been offering the lowest bulk SMS messaging rate through our new bundles.

To enable us offer the same competitive rates on other services such as USSD, toll-free SMS, and payments, we are making some important changes from this weekend.

Starting this Sunday, 1st of October 2017, we are changing our credit-based balance to a currency-based balance.

This means if you had 380 SMS credits you will now see it as a balance in your local currency (e.g. Ghc10) on your account.

From this currency balance, you can buy a corresponding SMS bundle.

If you need help or want more information we are always just a call or email away. Kindly call toll-free number 0800 222 081.

#RethinkCustomerService

Related

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

May 9, 2024| 2 minutes read