Month: September 2017

It is another Monday morning in the busy city of Accra, the year is 2048, and the rains are just setting in. Kwame dashes out of the door and hastens to his car, double-checking his watch as he runs late for work. He speeds out of the driveway and gets a beep from his vehicle as an alert flashes on his dashboard screen. His utility bills are due. With his eyes still on the road he initializes payment with a few words and confirms payment with a fingerprint scanner. Bills paid. The receipt of payment was sent to his email. Welcome to the future. Welcome to a cashless society.

Though this may sound like a scene in a science fiction movie, “the future” with respect to money, monetary transactions, and monetary value may not be that far at all from the excerpt above…But will the case probably be the same in Africa in the next 20 or 30 years? Let’s find out.

Money as a medium of exchange is also a means of exchanging value. From the days of barter trading to the use of precious metals such as gold and silver, to cowries, shells, and cola nuts, and more recent coins, paper notes, and plastic, all forms of money had one aim in mind, exchange of value and transfer of purchasing power.

It is however important to note that for any form of money to be generally accepted to survive the test of time, it needs certain key characteristics: the trust of the masses or the society in which it is being used; the ability to stand the wear and tear of multiple exchange of hands and other natural elements; specific in value or quantifiable in denominations; convenient in carrying around and making payments and transfers; and it also ought to be scarce.

These characteristics and more have caused the boost or fall of many various forms of money in different African societies. Imagine having to carry a scale where ever you go just to measure the right quantity of gold for every transaction. To top it up, you would have the weight of gold jiggling in your pouch hanging around your waist. You may need to wheel a cart of gold if you wanted to purchase a house perhaps.

In Ghana, the “rejection” of the 1 Ghana pesewa by its users was largely due to its small size. Most Ghanaians complained it was too small to handle and the rigors of inflation doubled up the facing out of the 1 Ghana pesewa due to the social inconvenience. Today, the 1 pesewa coin is hardly heard of. Central banks across the world monitor the reaction and acceptance of society to banknotes and coins and take needed steps such as reducing the quantum of the not so accepted denomination to ensure fiscal stability in the economy.

Amongst the various characteristics of money, a key and promising feature which has drastically changed the face of money in the 21st century, and still promises to drastically metamorphose money in the future has to do with convenience. The future of money innovation seems to simmer in the three-legged pot of convenience. “Money Convenience” in carrying around, convenience in making payments for goods or services, convenience in money transfers.

In our world today, we seem to be skewing towards the tangent of convenience, and money is not left out in this new development. The astronomical expansion of technology in recent times has led the Harvard University Economist, Kenneth Rogoff, to argue in his new book “The Curse of Cash” that bank notes are outdated due to currently available technology. He also argues that physical cash is a “honey pot” for criminals who love the big notes. The birth of e-currencies such as bitcoin, dash, and litecoin amongst many others signify the move towards a cashless society.

Online payment, money transfer, and money wallet platforms and apps and other fintech companies provide a means of convenient mobile banking and online money transfer and payments. But how ready is Africa for the foreseeable future of money, a cashless or “cash-lite” society?

Despite Africa having a large trench of unchartered opportunity in expanding its digital banking and e-money space, the continent seems to have a population that is still cash conservative to a large extent according to a report from KPMG issued in November 2016 on e-payments in Africa. The continent still lags behind the developed world in high-speed internet connection and literacy which are both vital in the use of technology in e-money transactions.

Though today is the future we expected yesterday, the future of money in Africa and how long it will take us to be a cashless or “cash-lite” economy lies largely in the hands of technology, government and central bank policies, and “monetary convenience” but one thing I know for sure is that the future of money in Africa will be one great story to tell as the hands of time unwind.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

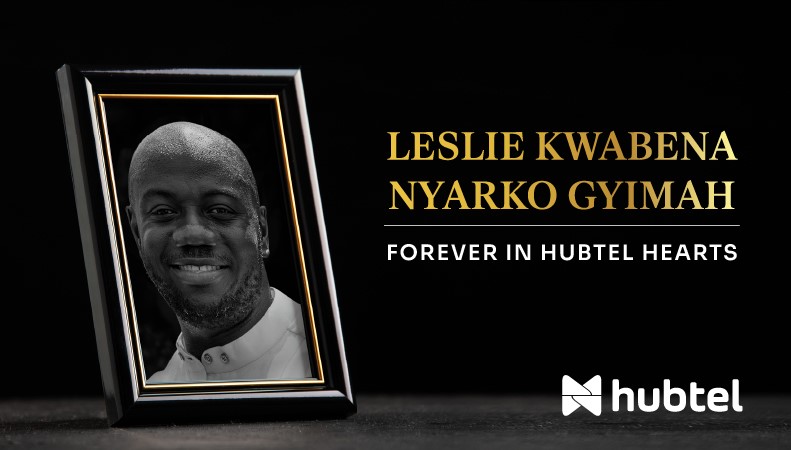

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

With the premium placed on customer experience at an all-time high, an unforgettable pleasant experience with your company is one sure way to boost customer retention. Customers are more likely to relay remarkable experiences they have with companies to their friends and family. This implies that every single contact from a customer, be it a phone call, an email, or a tweet, requesting information or after-sales support, is a unique opportunity for you to positively influence their perception of your brand.

As Sam Walton put it, “There is only one boss – the customer. And he can fire everybody in the company from the Chairman on down, simply by spending money somewhere else.” In order to ensure that customers keep spending their money on your products and services even when presented with other compelling and cheaper options from competitors, it is prudent to rethink your approach to customer service delivery. Let us consider four ways to earn your customer’s loyalty using great customer experience.

- Be personal with customers: Let’s face it. Bureaucracy is boring. Giving straitjacket, extremely formal, and pre-written scripts out to customers as answers to their queries will most likely hurt your brand reputation. Customers want to speak to real people because they feel they are more likely to relate and empathize with them. A friend of mine, Kojo, shared an experience he had when he spoke to a contact center agent last week. He told me that from the way the agent spoke to him, it might have been better if the agent had played back a pre-recorded message instead. He had a lot of questions to ask but felt the agent was in a hurry to go grab a bite so he just thanked her and ended the call. A similar experience Kojo has had with this service provider has robbed him of any attachment he could feel towards them. Customers care more about the quality of their experience than the service being delivered because there are numerous alternatives on the market. If Kojo is presented with a slightly better alternative, he will most likely ditch his current service provider on a whim.

- Take customer feedback and suggestions seriously and revise your offerings: To quote Steve Jobs, “A lot of times, customers do not know what they want until you show it to them”. While this may be true, in most cases, customers actually do know exactly what they want. End-users can be an amazing, cost-free source of extremely valuable feedback that can be baked into future iterations of your products and services. Pay attention to the comments that customers pass on social media and the “unsolicited” suggestions they give you when they call your contact center. If current customers feel you care about their experience more than your profit, it will be very difficult for them to switch to a competitor. They are likely to endure quirks in your offerings only because they are confident that once they complain, you will quickly move to resolve them. They may even be willing to spend a couple of cedis more on your product even if a competitor sells the same product for much less.

- Ensure that support personnel are very knowledgeable about your products and services: Ever spoken to a call center agent and wondered how they got their job? When support personnel doesn’t sound certain about the answers they’re giving to a customer, the little faith that customers have in their ability diminishes. When support personnel constantly put customers on hold in one conversation and refer to manuals, product documentation, and their superiors before giving answers, brand loyalty will most likely be an issue. Customers understand that products and services may not be perfect all the time. They can take that. But what they cannot take is a sub-standard after-sales support experience.

- Reward loyalty: Long-term users who have been using your products and services for years can become emotionally attached to your brand and become brand ambassadors. Companies can reward loyalty by offering long-standing customers discounts and exclusive access to new products and services they have created before rolling out, calling customers on their birthdays and providing them with branded paraphernalia, creating focus groups, and soliciting suggestions for future versions of product offerings. Once loyal customers feel like they are a part of your company, they will personally market your products and services to their friends and family, defend your brand when an ill-comment is passed on social media, and even volunteer to offer after-sales support services within their circles all at no charge.

So there you have it. When your customers feel delighted by the quality of service and support your company offers, they are more likely to be emotionally attached to your brand. This makes them more willing and committed to using your products and services over a long period of time. The resulting benefits are that you get shielded from the harsh realities of stiff competition and a dwindling customer base. You also get to grow your revenue by easily upselling and cross-selling to existing customers. What’s more, existing customers will help grow your customer base by augmenting your marketing efforts.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

If you think automation of after-sales support and customer engagement with chatbots is some science fiction idea slated for execution in the distant future, then let this post serve as a reality check.

Advances in Artificial Intelligence have resulted in the creation and development of bots that can understand, relate to and participate in human conversations. Traditional chatbots are wired to answer a finite set of hard-coded questions. New AI-based chatbots are trained with data sets of human conversations so that they can learn on their own and identify the intent behind every request or conversation, a technique known as Natural Language Processing. This makes them more relatable and natural for current and prospective customers to interact with.

IBM Watson, a cognitive system enabling a new partnership between people and computers, has already begun replacing paralegals and junior lawyers in top law firms. With IBM Watson, you can build virtual contact center agents to answer any queries your current and prospective customers may have for you. If you’re familiar with the American legal drama Suits, you’re no stranger to the fact that the character Mike Ross is always buried in paperwork before court cases. Researchers at the University of Toronto have already created an AI lawyer named Ross. Ross can take any legal question posted by an attorney and sift through its database of legal documents, statutes, and cases to come up with the correct answer. The system grows more accurate over time, as it learns more about a firm’s specific areas of practice and preferences.

In the next couple of years, AI bots are expected to take on a huge chunk of the work currently done by customer experience agents. This paradigm shift will address some of the major challenges faced in managing customer contact centers. Studies indicate that the average contact center representative lasts only about six months in their job. Also, contact centers have a whopping 40% average annual turnover rate. What’s more, bots will neither have off-days, unless they have to go offline for maintenance and software updates, nor call in sick, unless malware impacts their normal flow of operations. Replacing human customer experience agents with chatbots will allow multiple queries to be efficiently and promptly responded to.

After-sales support is usually about providing answers and clarity to questions your prospective and current customers may have. These questions are likely to be repetitive, so who (or what) is better to perform repetitive tasks in a better, more efficient, and faster manner than the bots we have created?

Perhaps you’re currently wondering how much capital and expertise is needed to deploy the solutions we have discussed above. Do not fret. In Hubtel’s bouquet of offerings, you will find some products and services that will allow your outfit to automate certain sections of the customer experience journey. We will discuss some related low-cost tech in the coming weeks, so be on the lookout.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read