Month: May 2020

Accra – Ghana’s indigenous eCommerce & SMS messaging company, Hubtel.com, has donated furniture and equipment valued at Eighty Thousand Cedis (GHS 80,000) to support the refurbishment of a new call center. The call center is an initiative of the Ministry of Communication in the fight against Covid-19.

Hubtel.com made the donation in response to requests made by the Minister of Communications, Hon. Ursula Owusu-Ekuful, at a recent press briefing urging the private sector to augment the government’s efforts at making accurate, reliable information about this novel virus accessible to the public. By ensuring the flow of useful information, the ministry hopes to improve early detection, reporting, and surveillance, and provide an avenue for prompt interventions. The donation which was received at the National Information Technology Agency (NITA) on behalf of the Minister by its Director General, Richard Okyere-Fosu, and his Deputy Director General, Kwaku Kyei Ofori, included office furniture, laptops, call center headsets, Covid-19 sanitation materials and several meters of network cables.

The donation forms part of Hubtel’s commitment to invest in the fight against the Covid-19 pandemic by ensuring that staff, customers, suppliers, and the community at large are supported in diverse ways to stay safe. In her note of acknowledgment, the Minister of Communication stated that “It’s a remarkable gesture. I have the utmost pleasure of saying ‘Thank you’, to Hubtel on behalf of the government and people of Ghana”. The Minister further commented that the donation will go a long way to help set up the unit.

Speaking at the presentation, the General Manager of Hubtel, Ernest Apenteng emphasized that “Our donation to this call center is motivated by people’s desire for accurate, credible and timely information about Covid-19, especially in this era where so much fake news and information abounds.” “Hubtel’s contribution in this war is to give support to those areas that we are not doing so well for lack of poor information delivery, for example, some recovered patients are reportedly been stigmatized on return to their communities. And there are many to whom access to essential information is not so simple. Therefore, we have committed to prioritize delivering information on these essential needs.”

Present at the donation were some management and staff members of Hubtel who urged the general public to continue to heed the health advice by maintaining physical distancing, wearing face masks,s and washing hands regularly. They also urged the public to use technology services as much as possible to avoid personal contact.

Ghana has confirmed over 5000 cases of the novel coronavirus and 22 deaths. In the wake of the pandemic, the government has put in place measures to help with containment, treatment, and accurate information dissemination.

The Covid-19 call center is set up to respond to inquiries from the public about the virus. The center can be reached via 0307007001

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Thank you for making us a part of your business and lifestyle.

Kokomlemle, Accra. May 12, 2020 — This month, indigenous e-commerce and SMS messaging company, Hubtel is celebrating 15 years of helping businesses connect meaningfully with customers. From its humble 2005 beginnings, Hubtel has grown into a vibrant and nimble company with over 80 employees.

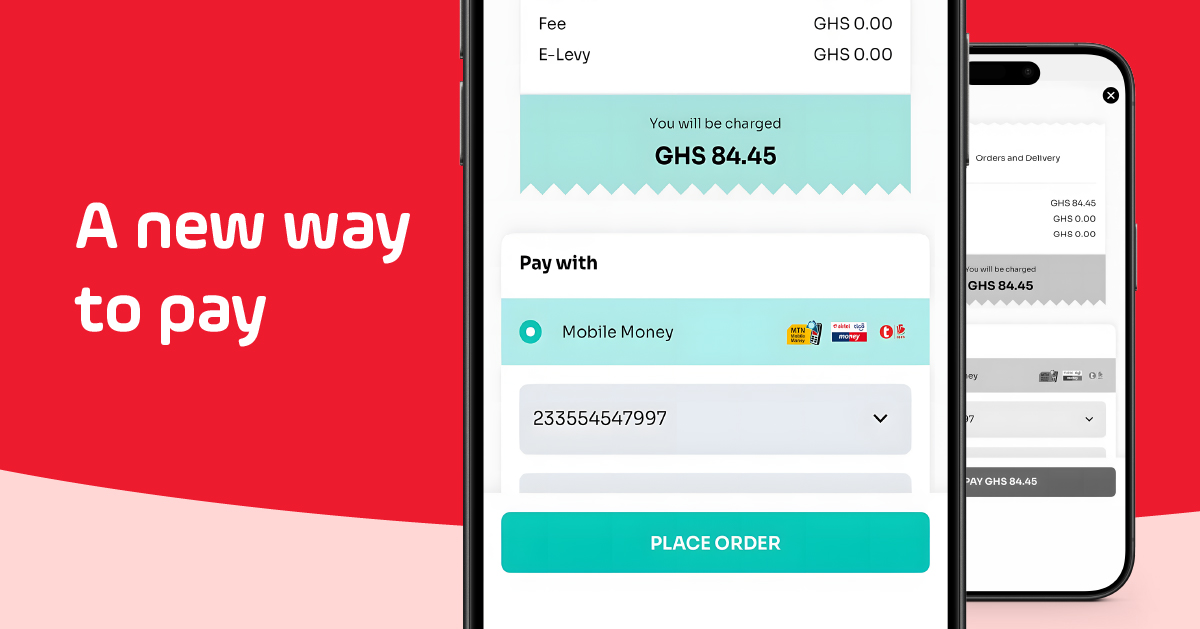

In the buildup to this anniversary, Hubtel has positioned itself to dominate e-commerce just as it’s done with its transformational work in fintech and bulk messaging. In 2019, the company overhauled its entire eCommerce infrastructure and released an impressive set of features for retailers and their customers; seamlessly merging the shopping experience in-store, online, and on mobile.

A growing number of neighborhood shops, popular restaurants, retailers, grocery stores, and service providers are making their products and services available to customers on hubtel.com; as consumers change lifestyles and routines to Internet-first.

As businesses and individuals buckle under a pandemic and scramble for technology to work, shop, sell, connect with family and friends, entertain, or find community, technology’s power to improve our lives has never been more evident. Hubtel is best placed to help businesses of all sizes, transition from brick-and-mortar to clicks and orders with fast same-day delivery.

“Looking forward to the future,” CEO, Alex Bram clarifies “Our continuing success as an organization is dependent on our ability to continue to retain the confidence and trust businesses have in us. We will keep improving obsessively, not just our platforms and infrastructure, but our people, our values, and our culture!”

“We want to be Africa’s most-loved shopitality platform; helping retailers sell and deliver to nearby communities, whiles blurring the lines between in-store and online shopping for consumers.”

For more information, visit blog.hubtel.com/updates

Related

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Africa Banks, Fintech CEOs Call for a Consolidated Payment System

May 8, 2020 | 4 minutes read

Africa Fintech firms and banks have called for a consolidated effort to provide as much information and access to digital information as a way of evolving the payment ecosystem under coronavirus (Covid-19).

The call was made during a webinar session COVID-19 Pandemic discussed by African Tech Leaders’ Outlook: under the topic: “The Fintech Outlook: How will the Payments landscape evolve?”

The 2 hour session moderated by Adedoyin Odunfa, CEO Digital Jewels, was attended by Dr. Diane Karusisi, CEO Bank of Kigali; among other Managing Directors like Michell Elegbe, Interswitch Group; Alex Bram, Hubtel, ; Agnes Gathaiya, CEO IPSL Kenya.

During the discussions, panelists said that the coronavirus pandemic lock down caught the financial and fintech sector unprepared but has left them with lessons to enable the sectors improve especially in payments and clients digital experiences.

Karusisi said that with the current Covid-19 lockdown Africans need to build an eco-system that brings aboard clients digital engagement to shift trends of clients having to walk to agents and bank branches to make payments or withdraw money.

Using her experience in Rwanda, Karusisi said during the Covid-19 lockdown, it has been difficult to process all the information and needs of clients who applied for digital services almost at the same time.

“There is a lot to be done and there is change in client’s digital behavior at this time, of which we have been overwhelmed by the demand for services when the partial covid-19 lockdown was announced,” Karusisi said.

Karusisi called on fintechs and banks to look for better solutions moving forward without waiting for clients to ask for them.

As part of the solution to this Karusisi said that Bank of Kigali has embarked on building interactive interfaces (between financial institutions) which are user friendly, to mitigate the challenge of being understaffed to meet each of the client’s needs.

So far in Rwanda, banks like BK have managed to integrate personal bank data with the mobile money subscription services offered by telecommunication companies, and the Rwanda Central Bank has scrapped all service fees on points of sale and on mobile money sending.

Karusisi also suggested that fintech should use the data collected on clients’ needs to create a tailor made digital payment plan for each of the clients since not all clients were equally affected by the lockdown.

Other panelists also agreed with her suggestion but insisted on building trust of clients on their financial data and how it is used with accountability and transparency.

For example Alex Bram, CEO Hubtel in Ghana said the country has faced a challenge of access to client financial information, but with their central bank trusting and opening up data to fintech companies they have managed to ease movement of clients from bank to bank.

“We thus have to be more open on transactions to increase trust of clients. Openness empowers clients to trust us. They will not need to go to the banks or branches and this will make us invest more in digital tech to see more change,” Bram said.

For Agnes Gathaiya, CEO IPSL Kenya, she said that client digital experience has to be the main focus of changing the rudiment financial payment systems (of going to the banks) before coronavirus into effective trusted digital payments.

“Once a person has tasted a user friendly and trusted digital payment system, they get caught up in it, and can never go back; unless it is not trusted. So fundamentally we should have clients use these systems and stay there,” Gathaiya.

Africa’s fintech ecosystem raised $320m and grew a 60% in the last two years accounting for approximately $395.7 million accounts out of a global total of $866 million- equivalent to 46% of global mobile money.

Interestingly, despite having the highest level of mobile phone and internet penetration, only 10% of all payments and transactions in the continent are based on technology.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

April 2020 Product Update

Your New Business Dashboard, Repeat Payments & More…

See what’s new in this update:

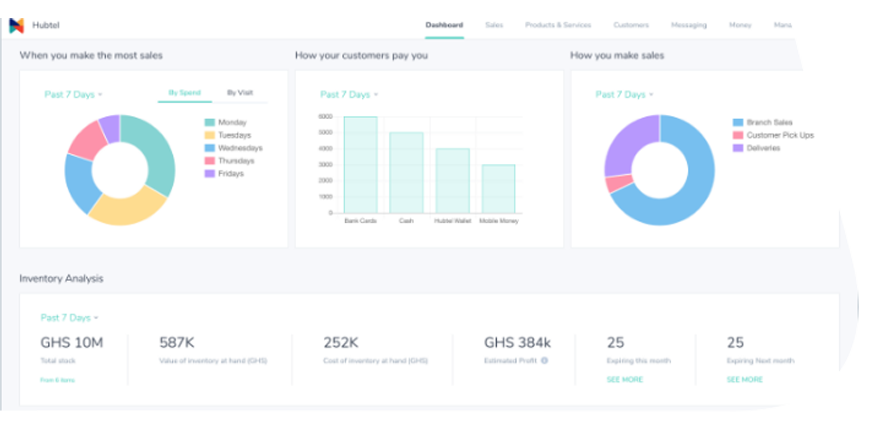

New Business Dashboard

Your new business headquarters where you see the major trends in your business.

New Business Dashboard

View your sales, estimated profit, customer trends and other vital information that helps you manage your sales and deliveries.

Sell on USSD

Request for your USSD Shop Code (*713*000#) and attach items or a service, for your customers to quickly choose and pay for on any device.

Repeat Payments on Favorite Services

As a vendor of digital services on Hubtel, your customers can now set Repeat Payments on their frequently purchased services to occur automatically on a periodic basis.

Allow Repeat Payments on your services

By ticking the “Allow Repeat Payment on this service” button when adding a service to your business, your customers will be able to create a simple standing order for the service on all Hubtel portals (Mobile app, Web and POS)

Customers opt in to complete their Repeat Payment setup

Your customers can easily set Repeat Payments on their frequently purchased services, using their MTN mobile money wallet, Hubtel wallet or their Bank Cards.

Customers can also set frequency

Customers can select their preferred billing interval as well as the date on which the Repeat Payment should end. This could be daily, weekly, monthly and quarterly intervals.

Integrated Notifications

Customers receive notifications on all Repeat Payment activities which includes successful setup notifications, pre-billing notifications, successful payment notifications and payment cancellation notifications.

Personal Control

Customers have total control in managing their Repeat Payment. They can view and cancel their Repeat Payments either on the Hubtel App or by dialing *713*51#.

How does this work on Web?

- Customer visits hubtel.com/services to purchase your service.

- Provide all the service details based on the interaction. Eg: phone number for airtime.

- At the Confirmation stage, customer selects “I want to make this a Repeat Payment” checkbox.

- Select the duration and the end date of the Repeat Payment.

- Confirm and pay for the service based on the customer’s desired wallet.

- Customer receives a confirmation SMS.

How does this work on Mobile?

- Customer chooses the “Repeat Payment” button on a previously purchased service receipt.

- Selects the frequency and payment option for the repeat payment.

- Customer receives a confirmation message in stream.

Related

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

May 9, 2024| 2 minutes read