Month: February 2016

We are in the golden age of technology. Within the larger movement; however, each one of us is directly influenced by the take off of a more recent and rapidly developing financial technology (FinTech) space—an industry projected to attract approximately $20 billion in funding by 2017, estimates Statista.

Financial technology is a democratizing force that can change our lives by making financial tools and services accessible, faster and more easily understood — most times at a lower cost. Complex algorithms now often take the place of traditional advisors, perhaps offering more efficient and personalized products for end users.

From budgeting tools to alternative lending and investment options, payments processing, and philanthropic platforms, we have a lot to gain from the advent of financial technology startups. Learn below about just a few ways in which you can leverage these hot new platforms before they inevitably become common applications for the entire public.

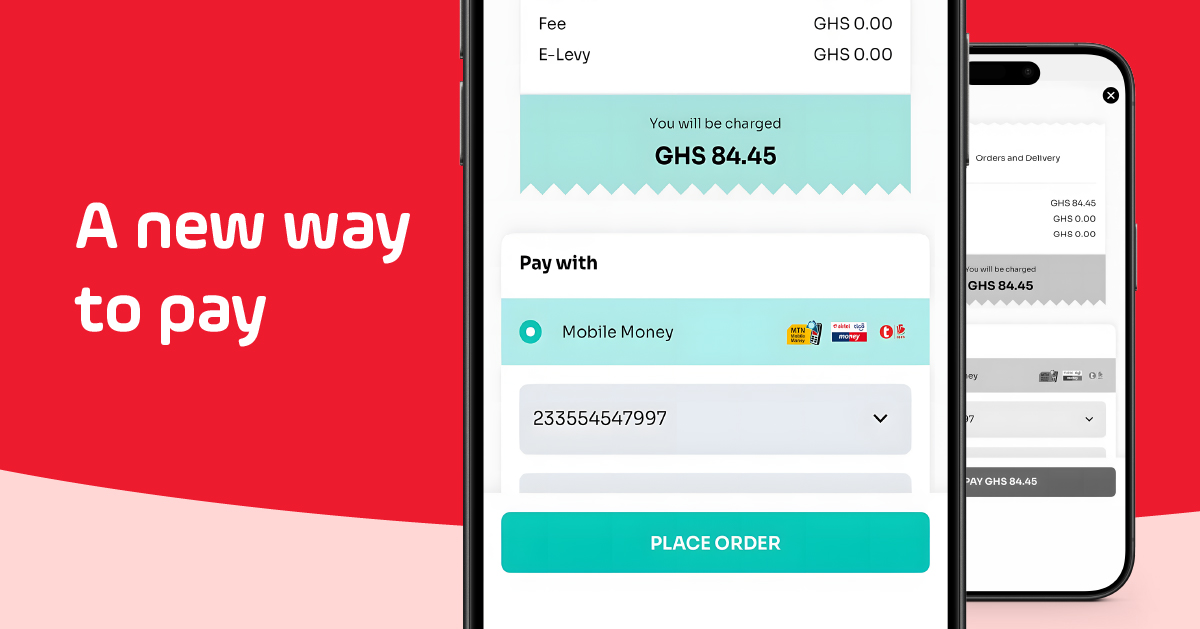

Payments Made Easy

The advent of payments technology has made consumer spending, and all other forms of payment easier, faster, and more secure. Payments technology startups, such as Square, help small businesses get off the ground by adopting easy to use and cheaper credit card payments processing. Instant, reliable transactions are important for day-to-day sales, along with employee payroll processing.

Venmo, a payments app, has provided a “free digital wallet” to the mobile devices of thousands, by allowing friends to connect quickly and securely via Facebook to request and send money to each other in a few taps on their phones. Furthermore, on the consumer side, platforms such as Apple Pay and Bitcoin continue to disrupt the traditional method of pay. When sending money abroad, individuals should consider using money transfer services such as TransferWise to save on international transfer fees.

Lend a Helping Hand

Peer-To-Peer (P2P) business models have fueled a new sharing economy revolution, with many products and services such as home rentals, cleaning services, and anything else under the sun being “uberized.” New FinTech startups have uberized the online lending space, allowing you to access funds through unconventional ways, without the help of big-name banks or a network of established lenders.

Platforms such as U.S.-based LendingClub and Prosper, and U.K-based Zopa have individually issued millions of dollars in loans, joining the rising number of tech unicorns in today’s entrepreneurial space.

Crowdfunding: The New Venture Capital

Investment in crowdfunding platforms may surpass venture capital funding in 2016. Popular sites Indiegogo and Kickstarter have helped thousands of ideas get off the ground – from bizarre video games to social projects and multi-purpose jackets, small businesses and entrepreneurs can now look to the general public for support. Countless other sites such as GoFundMe, which took off by bootstrapping, allow individuals to raise money for any project they like.

A ‘Bankless’ World

The headline of loan refinancing startup, SoFi’s website reads, “Great news: we’re not a bank.” Over the past few decades, we’ve seen a general distrust and loss of confidence in our traditional banking system, dominated by the big banks. After the Global Recession in the late 2000s, a new generation of startups hopes to fix the transparency issue facing big banks and provide consumers with more personalized and comprehensive services online.

Nasir Zubairi, venture partner at FinLeap in Berlin, commented on the FinTech industry, stating that “3 billion people, 50% of the world, do not have access to a banking system, and I think that FinTech can help in solving the problem around credit. There’s a huge opportunity for FinTech companies and of course for people who will benefit from their solutions.” Startups such as Kabbage, a small business lender, take into account a myriad of factors such as eBay data into account when determining risk, providing more of a data-driven service unhindered by the same regulations that restrict the traditional banking system. Countless other platforms such as CreditKarma offer credit risk services at zero or low cost.

Democratizing Investment Products and Services

Robo-advisors continue to gain traction as a provider of investment services once solely accessible to wealthier individuals who could afford their own financial advisor. An online advisor is now available through multiple platforms such as Wealthfront and Betterment. Wealthfront manages your first $10,000 free for a small fee of .25% after that while Betterment charges .35% to .25% annually or $3 per month. A series of questions, including an individual’s age, determines a user’s risk tolerance, which then determines the portfolio allocation for each specific individual. If you are unwilling or unable to invest your money yourself, or through a trusted financial advisor, an online platform is a much better way to direct your savings to their most effective use.

FinTech startups aren’t stopping at stock investment, however. For the growing number of Americans who seek involvement in alternative investing and philanthropic projects, the FinTech industry continues to deliver. Take Neighborly, a social venture helping you get involved in the municipal bond market. Neighborly’s Community Investment Marketplace allows you to make an impact directly in your community through safe and lucrative investing.

Budgeting: A Virtual Piggy Bank

As many tech startups target millennials, there’s a significant opportunity for business to facilitate the process of a new generation beginning to save, lend, and invest their money. Millennials don’t simply want to watch the purchasing power of their money wither away in a bank account; instead, they’re using budgeting and educational platforms to help them with a financial strategy. Alongside their robo-advisors, individuals can use budgeting platforms such as LevelMoney and Acorns that automatically track spending and income to give users a daily allowance for the day. This helps people grasp exactly how they are spending their hard earned dollars. Other platforms find creative ways to save you a dime. For example, Paribus scans users emails for receipts following a purchase to get money back in the case of a price drop.

The Bottom Line

FinTech is on the fast track to growth, and it’s not just investors who can benefit from the success. Be sure to stay up to date on the rapidly evolving FinTech sector, which will help drive a democratization of financial tools and services, from payments to wealth management and philanthropy. Ultimately, whether FinTech will take the place of traditional banking entirely is up for debate. However, the plethora of cost efficient and accessible financial tools and services will undoubtedly force the entire financial sector to transform.

Credit: Investopedia & JumpFon.com

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Short Code – The Definitive Guide to Mobile Messaging & Marketing

February 9, 2016 | 4 minutes read

“Text HOT to short code 1901 for the best music from your favourite artistes on your phone!”

“Be the first to know! Text NEWS to 1944.”

“Win airtime every day! Text FREE to 1902.”

You have most likely seen hundreds of these text messaging campaigns or heard about them, but wondered what these funky 4 or 5 digit numbers are, or where they come from.

Well, here’s your answer.

They’re called Short Codes.

As an individual or business, reaching out to friends, clients and customers in the most personal way – their mobile phones – should be of great interest to you. These days, more organizations and businesses are turning to short codes as the backbone of their SMS messaging and marketing campaigns, as they have realized that text message marketing is a very quick, inexpensive, and more productive way to reach their customers (or potential customers).

Short codes have also been made more popular in the last few years by a number of television shows that allow viewers to text a message to a short number. Examples include viewers sending a text message to a short code to vote for their favorite contestant of a reality TV show, or to make a charitable donation.

What is a Short Code?

An SMS short code is short numeric number (typically 4-5 digits) that is used to opt-in consumers to SMS programs, and then used to send text and multimedia messages, offers, promotions and more, to those customers that had previously opted-in. A consumer interacts with an SMS short code by composing a new text message on their mobile device, and addressing it to the SMS short code. In the examples below, the SMS short codes used are 1901, 1944 and 1902.

SMS Keywords

When a customer wants to opt-in to an SMS campaign, they’ll not only need to know the SMS short code, but they’ll also need to know the SMS keyword for that specific campaign. The SMS keyword helps a provider like SMSGH determine which SMS campaign the consumer is trying to opt-in to. Once received, the SMS provider routes the message through the SMS software, which then would send back a confirmation text message to the subscriber who originated the message. In the first example above, the SMS short code used by this business is 1901, and the SMS keyword is “HOT”.

Here are five things to appreciate about short codes, and how and where to get them.

1. An SMS short code service is one of the quickest and most effective ways to get your marketing campaign off the ground.

2. SMS marketing enables you to engage your prospective customers at the point of display, and you can quickly generate sales leads using SMS marketing. Wireless subscribers send text messages to common short codes with relevant keywords to access a wide variety of mobile content.

3. There are two kinds of short codes: shared and dedicated. Dedicated short codes are owned and managed by one body, are costly and take a while to set up. In Ghana it can cost anywhere from GHs5,000 to GHs7,000 per year and take up to 72 hours to get ready. Click here to get more info.

4. Shared short codes are used by many different bodies. Each business sharing a short code would be assigned a unique SMS keyword, which helps an SMS provider like SMSGH determine which SMS campaign a user is trying to opt-in to. The cost involved in setting up a shared short code is less than that for a dedicated short code.

5. If you text STOP or HELP to a short code, the service would respond. This is implemented to help users respectively end a subscription or learn more about the short code service, and is useful for managing these services.

Can’t wait to see what you can do with short codes? Get started today. Talk to a sales expert now. Or see short code pricing here.

Related

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

May 9, 2024| 2 minutes read

What You Need To Know To Run A Successful SMS Marketing Campaign

February 4, 2016 | 10 minutes read

If you haven’t started looking for ways to add Short Messaging Services to your marketing mix, now is the time.

Yes, I know apps are the craze these days but we’re still at about 15% smartphone penetration in Ghana.

That means there may still be a lot of your customers that don’t have smartphones. Also, just because they have a smartphone doesn’t mean they use it for all that it’s capable of. Just ask my dad—he has the latest and greatest of phones at all times and all I get from him are texts with photos of my niece.

One of the greatest things about SMS is that nearly 100% of all devices on the market are SMS enabled, making it the mobile channel that offers the widest reach possible.

Some of the top brands invest heavily in SMS today to communicate with customers because over 90% of SMS messages are read within 3 minutes of receipt.

Yes, that immediate!

In fact, it’s been reported that Coca-Cola historically has invested 70% of its mobile budget in SMS marketing.

When asked why, Tom Daily, the Director of Mobile, Search, and Global Connections replied, “It is important to invest your energy into things you know work, and we know that SMS works and is a thing to focus on.”

In addition to its reach and immediacy, SMS is very affordable and offers an amazing ROI for marketers when used properly.

If you’re ready to dive into SMS marketing and leverage this amazingly powerful channel it’s important that you’re set up for success and not just using mobile for mobile sake.

- Understand Your Goals

When diving into mobile marketing, it’s common to approach it as its own initiative.

That’s typically the worst direction to take.

Businesses that approach mobile as a silo will almost never get the results they were hoping for or even expected.

Before diving into your execution, it’s wise to review your business and marketing goals so that you’re creating your SMS campaign through a lens that takes your current business goals into account.

Having S.M.A.R.T goals (Specific, Measurable, Achievable, Relevant, and Time Specific) will assure your SMS campaign is executed in a way that meets your objectives.

It’s important to understand that your SMS campaign will likely impact many parts of your organization, so communicating your goals and strategy clearly throughout the organization is critical.

- Build An Ark

Your SMS mobile campaign will impact many departments of your company. Having a cross-functional team to help conceive and operate the SMS programs will be one of the most important parts to winning with SMS.

For example, let’s say you’re building a mobile loyalty list to drive customers to retail.

Having led the mobile efforts for Cabela’s previously, I know very well just how many people this type of effort can impact.

We had a cross-functional team that included members from teams responsible for retail, in-store signage, digital creative, email, IT, social media, promotions, and the discounts budget, as well as two external teams.

Build out your ark and make sure everyone is on the same page when it comes time for execution.

- Clear Call-To-Action

One of the most common reasons SMS campaigns fail is that the call-to-action isn’t presented in a way that the consumer recognizes or understands what to do.

Take this example from Pepsi. They tell consumers to Text “PEPSIMAX” to 710710.

Having been involved in SMS since 2005, I can tell you that a significant amount of people probably texted with quotations around the keyword, which actually doesn’t trigger the campaign.

SMS campaigns are driven by two factors – the keyword and a short code. In this example, PEPSIMAX is the keyword and 710710 is the short code.

It’s common and best practice to capitalize the keyword and shortcode to make them stand out within the call-to-action.

One thing Pepsi is doing really well here is making the SMS call-to-action the focal point of the creative. I’ve found SMS CTA’s in the fine print far too many times.

If you want to drive engagement, give your SMS CTA the priority it deserves.

For instance, JumpFon, a premium content provider employs this catchy creative banner to advertise its Lifestyle content services.

The call-to-action is bold and straightforward, well highlighted by the difference in color to draw emphatic attention to the focus of the banner, which is the Keyword and Shortcode.

This presents the message clearly to users avoiding any ambiguity in the expected action to take to subscribe to the service.

- Leverage Incentives

Let’s not kid ourselves. Our mobile device is one of if not the most personal device we have. The consumers that welcome you into their phone, especially through SMS, should be considered some of your most loyal customers.

With that said, you want to treat your most loyal customers with some extra love, and a great way to do that is to incentivize customers to opt in by giving something of value.

Typically, you’ll see brands doing a percent off or dollar off coupons to save a few bucks.

In the early stages of your SMS campaign, as you’re building your list, starting with a low-value offer (say up to $20 off) can really help drive opt-ins and spark your initial list growth.

Once you’ve got people opted-in, you can leverage “spend and get” campaigns or “Buy One Get One” campaigns (also known as BOGOs).

I personally love “spend and gets” because they can really help you increase your average order value (AOV) while self-funding the campaign (great when your discount budget is super tight).

Let’s look at an example:

Say your AOV is $100.

Sending an SMS message to your database with an offer: “Get $20 when you spend over $150” can be really effective.

A customer will come in and be inclined to spend $50 more than they usually do knowing they’ll get back $20.

For the sake of the example, let’s say they spend $150 exactly.

You’ve just increased your AOV by $50. When you give the customer their $20 voucher, you’re left with a $30 incremental lift for that customer.

Multiply that by the soon-to-be hundreds, if not thousands of people that redeemed your offer, and you just drove some significant revenue with one message.

Now remember, incentives don’t always have to be monetary.

I know a lot of brands that are not “discounters”. I worked for one of them.

You can still have an effective SMS campaign by offering non-monetary incentives.

Your non-monetary incentives can focus on:

- Personalization – “We’ll notify you when your favorite item comes in.”

- Reminders – “Your shipment will be delivered today.”

- Engagement – “Tell us how we can help you.”

- Access – “Here is early access to this special thing just because you’re a loyal SMS subscriber.”

- Privileges – “Here is this special thing we only share with our SMS VIPs.”

Try incorporating your incentives in your call-to-action from number three and really drive opt-ins.

- Permission Is Required

Just like email, SMS is a permission-based opt-in channel.

Your customer needs to clearly opt in to receive what you’re offering.

This can happen in one of two ways:

- By texting a keyword to a short code (such as the Pepsi and JumpFon example from above), or

- By submitting their number via a web form.

Either way, it needs to be obvious the customer has consented to receive these messages.

You can’t just look through old customer records and add mobile numbers to your database and then message those customers.

- Leverage Immediacy

Over 90% of SMS messages are read within 3 minutes.

That makes SMS one of, if not the most immediate channel available to connect with your audience.

Understanding this immediacy is important to your success and driving customer action.

If you have an event on Friday evening, sending an SMS message any time before Thursday evening is too soon.

With your messages guaranteed to reach your customer and disrupt whatever it is they are doing, it’s important that you aim to deliver extremely high value via a very clear and concise call to action.

Since SMS messages only allow for 160 characters (some of which require your compliance language from above) it’s important to be short, sweet, and to the point.

- Consistency

One of the biggest mistakes businesses make when using SMS is not sending messages consistently enough.

Like any other aspect of marketing, you should be leveraging any marketing or promotional character at your disposal. If there isn’t one, you should be sure to create one and use that as the foundation for your messaging calendar.

When it comes to messaging your customers, you obviously want to have something of value to say within each message, but going months without connecting via SMS is likely going to cause a high unsubscribe rate with every send.

Some of the most successful businesses leveraging SMS today, such as Starbucks, Target, Macy’s, and JC Penney, are sending at least one message a week to stay at the top of the minds of their customers.

- Media Integration

In general, mobile is one of the most dependent marketing channels that exist. When it comes time to promote your SMS program and drive adoption, it’s important to leverage all of your existing media outlets, whether that’s TV, radio, print, in-store signage, online, social, email, etc.

Performing an audit of your existing media assets to identify where you can integrate your SMS calls-to-action will help align you with the right teams to make sure the creative development process includes SMS integration.

Remember, you’ll want to make sure the SMS CTA is clear and easy to read—not buried somewhere in the signage.

Your goal isn’t to check a box by having an SMS CTA integrated within your existing media; it’s to extend the reach and interactivity of your existing media and create an opportunity for continued engagement.

Performing an audit will identify all of the media outlets to integrate your CTA so that you can be on the same page as the rest of your cross-functional team.

- Measurement

The only way to determine if your SMS campaign is successful or not is by measuring.

When it comes to SMS there are a handful of things you can do from a measurement perspective. The great thing is that they are all fairly easy to manage. Here are a few metrics to follow when executing an SMS campaign:

- Subscriber Growth: Monitor your growth rate each week and identify which activities make the list grow.

- Subscriber Churn Rate: This is the frequency at which people are opting out of your SMS program over time. Ideally, your program never goes over a 2-3% churn rate.

- Cross Channel Engagement (by keyword): By using different SMS keywords within different media outlets, you can quickly measure which types of media and media locations are performing best and optimize based on engagement.

- Redemption Rate: This is something you’ll monitor on a campaign-by-campaign basis (or by message) to determine the percentage of customers that redeem your offers and what rates.

- Cost Per Redeeming Subscriber: From the redemption rate, you can determine the cost of communicating with each customer that receives your SMS messages.

When it comes time to plan and launch your next SMS marketing campaign, be sure to account for these 10 components and you’ll be well on your way to a successful SMS marketing campaign.

Have you tried using SMS yet in your business? If so, have you seen success? If you haven’t started, are you thinking of giving it a shot? Sign up for business messaging tools on MYtxtBOX.com.

Original story found at convinceandconvert.com

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read