Month: July 2017

Makola… Kantamanto… Nima… We visit busy marketplaces like these and very often worry about being robbed, getting change for our high denomination currency notes, and accounting for every cedi spent. What we really would want is to visit these same markets with no cash but our mobile phone, yet return with bags full of foodstuff, clothes and more. Sounds too easy? Well, that’s what a country with a cashless society looks like.

Most countries have set the year 2030 as a target to reach a totally cashless society as more citizens resort to the use of mobile payments to complete business transactions. In Ghana, despite the boom in mobile money transactions and ample data that predicts phenomenal drive towards a cashless society, no certain date has been set to get the country to run a fully cashless society. That notwithstanding, the country can be seen as one in Sub-Saharan Africa that is making significant strides in terms of mobile money adoption and usage.

Mobile telecom companies in Ghana are leading the way into the cashless future, and this is evident in the stiff competition among themselves for mobile money subscriber share. For some years now, telecom companies have been spending millions of cedis to educate Ghanaians on mobile money usage through intensive media campaigns and promotions. This has had a direct impact on the drive to get Ghana cashless by 2030 because these activities acquire new mobile money customers each day.

Industry watchers are fascinated by how fast countries like Denmark, India, Norway, and Sweden have moved to cashless transactions. In Sweden, retailers are legally entitled to refuse coins and notes, and street vendors – and even churches – increasingly prefer card or phone payments. Here in Ghana, a number of churches have begun receiving offerings and tithes via mobile money platforms. Instead of the usual practice of congregants dancing their way to the altar, it is rather becoming common practice for the church to display phone numbers on their screens at the end of each service and ask members to pay their tithes and offerings via mobile platforms.

Some retail shops have also begun receiving payments via Mobile Money and POS and this has led to increased profit margins as they are able to transact business in a more secure, faster, user-friendly and convenient way. The public sector has not been left behind as government programs such as the School Feeding Program and National Service Scheme also make use of mobile money to pay vendors and service personnel. Despite these gradual developments that is propelling Ghana to be a cashless society, a definite target date cannot be set to when it will become the norm. And even as technology-backed payment services have gained momentum in the urban centers of the country, penetration in the hinterlands is yet to reach satisfactory levels.

History has always demonstrated that technology disrupts the status quo and this is very evident in the introduction of cashless payments, particularly via mobile. Before your business misses out on this new wave that is soon becoming the norm, you can jump on board Hubtel’s integrated payment solution called Hubtel POS that enables businesses of all sizes to receive payments from customers via cards and mobile money on all networks. It’s safer, much more convenient, and very secure.

Of course, achieving a cashless society is not an end in itself. It is a means to help advance financial inclusion, security, and prosperity. Hubtel aspires to be a key force in bringing everyone into the financial sector, drastically improving the lives of the millions who are now under- and unbanked while supporting economic prosperity and security. Before too long, buying “plantain chips” in traffic could be a seamless cashless transaction that fully satisfies both the vendor and consumer.

Related

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

The soul of crime in the country has found some new bravado and as a result, our law enforcement bodies are tweaking and turning the cogwheels of their logistical machinery so they can adequately face these crimes.

As part of this, the Ghana Police Service is embarking on a Police Transformation Initiative to deploy systems and initiate changes that will allow the outfit to tackle the increasing complexity of criminal offenses and face new threats squarely. The Initiative is also aimed at making the Ghana Police Service one of the top ten in the world within four years.

Dissemination of information in a convenient, secure, and timely manner is very crucial to the success of this Programme. This is why the Ghana Police Service has partnered with Hubtel as a key technology partner.

Under the arrangement, Hubtel will offer its platform for the delivery of text-based communication to and from over 30,000 police personnel across the country. This is to facilitate the collection of data to gain reliable insights on important public opinion through mobile feedback, and swiftly deliver emergency information to millions of citizens.

Hubtel is a company that delivers simple, practical tools to help Ministries, Municipalities, Districts and Authorities (MMDAs) manage and organize payments, send vital notifications via SMS and citizen self-service via USSD, towards better citizen engagement, as a key technology partner.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

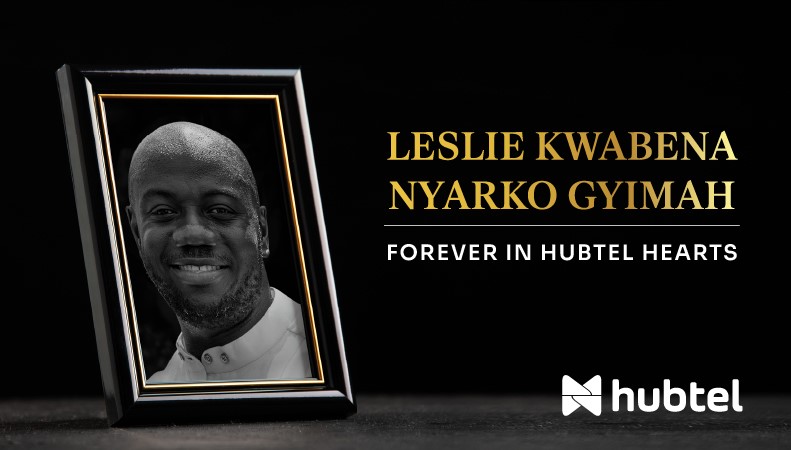

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Akumiah, a young man boarded a trotro from Osu headed to Spintex. Halfway through the journey, the trotro mate began his routine collection of transport fares and as it got to Akumiah’s turn he reached for his wallet and realized he had left it at his workplace. Distraught, he frantically searched his bag to see if he would find some loose change to pay his fare.

To his utter dismay, he had no change left in his bag and at that point, the impatient trotro mate had already started hurling abusive words at him whilst demanding his fare. Akumiah remembered he had some money in his mobile money wallet and immediately asked the mate in the local parlance “Wo gye Mobile Money?” This question infuriated the mate even more and if it wasn’t the timely intervention of a passenger who paid Akumiah’s transport fare, the situation would have been quite a messy one.

In the face of the fast-spreading Mobile Money payment revolution, there is always a dilemma on whether or not one needs to keep some money in their Mobile Money wallet or if it’s better to move around with cash. In an active economy like Ghana’s, where everything from getting breakfast to catching a ‘trotro’ at the bus stop and even using the public urinal all requires monetary transactions, one is always forced to keep some cash on them to avoid any embarrassment like Akumiah’s.

Kofi Asare, a driver’s mate at the Kaneshie trotro station working in a Circle bound commercial bus says he has never accepted transportation fares via Mobile Money because he believes it will be a very tedious and inconveniencing process. However, he has received money via Mobile Money and is appreciative of the convenience it offers him in sending money to his mother in a village in the Ashanti Region.

For two sisters who retail dresses at the Rawlings Park in Accra, collecting cash only was the best business decision they had made until one day they were attacked by knife-wielding robbers after a day’s work and rid of all their sales. This compelled the two to now make Mobile money the preferred payment option for all their transactions.

A 2016 Ericsson Consumer Insight Report, titled ‘Financial Services for Everyone: Bridging the gap between the banked and the unbanked in sub-Saharan Africa’ stated that despite the risk associated with cash, 8 out of 10 consumers suggest that the convenience and wide acceptability of cash makes it the dominant mode of transaction.

The report however said that the data for mobile money usage in Ghana is very promising. With 69 percent of Ghanaians using mobile money agents, consumers see mobile network providers as the top preferred service provider for a mobile money agent.

Safety and convenience are two major keys most people look out for when it comes to the use and management of their monies.

Despite the fact that these two features are characteristic of Mobile Money payments and puts it in a better place to enhance businesses and enable growth, cash transactions still enjoy some dominance in the system.

As more individuals and businesses revolve and are caught in the Mobile Money frenzy owing to its safety, convenience, and reliability, it is likely to become the primary mode of financial transaction in the next few years, although businesses will still need cash to top up their wallets.

Taking the step to stay ahead of the competition in this regard can be done effectively through a payment solution such as Hubtel’s POS which is an integrated Point-of-sale solution that works with a phone or tablet to process payments.

The POS solution enables small businesses receive and make payments in a safe, secure manner to help them make more profits and expand their businesses.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Just recently, a busy fabric retailer at Accra Central received a call from an unknown man claiming he had sent her GHs 800 mistakenly and therefore requested that she send the money back to him.

She was busy at the time so she quickly reached for her phone to immediately authorize the transfer of the said amount, but thought to quickly check her balance first. Upon checking her balance she realized that there was no such credit to her account. It was then that she became suspicious and did not authorize the transfer. That was how close she was to being a victim of one of the fastest-growing fraudulent mobile money tricks in Ghana.

The introduction of Mobile Money in Ghana has enabled businesses make and receive payments from others conveniently and remotely. The fast evolution of payment systems and drive into a cash-lite or cashless society in Ghana is being realized gradually with the growth of Mobile Money.

This innovative technology has also created an avenue for some unscrupulous persons to attempt exploring possible security lapses within the system to fraudulently withdraw money and tamper with users’ data. Although Mobile Money users are responsible for securing their end of the system to prevent ‘intruders’ from performing transactions on their behalf, they still stand at risk of the least security breach.

The Ministry of Communications in 2016 reported that mobile phone subscriptions in Ghana had soared to over 35 million. This coupled with the increasing financial literacy in the country, projects a boom in Mobile Money usage in Ghana. Although most mobile payment services/platforms are safe, cyber crooks are constantly trying to outsmart the system and users.

Basic security tips for users include;

– Avoiding sharing passwords with third parties

– Avoiding the usage of weak PINs

– Being vigilant not to fall prey to tricksters

For small and medium-scale enterprises in retail, healthcare, and hospitality among other sectors that look to take advantage of the new technology; the current Mobile Money infrastructure should give the confidence of effectively take charge of business finances in a more secure and convenient way.

In addressing the challenge of having to turn away customers who do not have cash to make payments, leading mobile technology company Hubtel, has introduced a fully integrated payment acceptance solution that enables companies receive payments from customers via Mobile Money and cards securely. While helping businesses make extra profit, it enables them to record and accurately track records of all financial transactions. It’s safer, much more convenient, and very secure.

Despite the ongoing efforts of the authorities to minimize the possible security lapses exploited by fraudsters, ultimately Mobile Money users are responsible for securing their end of the system by utilizing all the tools and information to secure their money.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read