Author: Hubtel

Hubtel, Expresspay, IT Consortium Deserve National Awards For Designing Ghana.GOV – Finance Minister

July 14, 2021 | 4 minutes read

Finance Minister Ken Ofori-Atta has recommended national awards for three Ghanaian Fintechs, Hubtel, Expresspay and IT Consortium for designing and managing the Ghana.GOV platform to stop revenue leakage in state institutions.

He was speaking at the launch of the platform at the Jubilee House in Accra.

Ken Ofori-Atta, who described himself as the happiest man in the room during the launch, said “if I had any power I am sure the Order of the Volta will be conferred on each of them.”

Ghana.GOV is a single point online channel through which the public can access all government services at the various MMDAs and make payments digitally without any human intervention.

The platform can be accessed on laptops, smartphones/tablets, desktop computers and via short code *222# on feature phones.

It was designed by Hubtel, Expresspay and IT Consortium and it has so far proven to be the most efficient service delivery and revenue collection platform the state has ever built, given the several challenges with previous interventions.

For the first 12 months of piloting Ghana.GOV, data available from digitization of the revenue collection process already indicates that the platform have processed more 5.8 million transactions settling over GHS 20.4 billion as at 4pm of the 13th of July 2021.

All these funds were settled directly and timely into the relevant public fund accounts with full visibility and without any administrative delays as compared to previous arrangements that took several months to achieve same.

So far, some 624,000 persons have registered to pay for about 37 government services including various direct taxes, indirect taxes, levies, royalties, and stamp duties to the accounts of the Ghana Revenue Authority (GRA).

Users of the platform can also pay for services from Passport Office, Lands Commission, Ghana Standards Authority, Food and Drugs Authority, Public Procurement Authority, Registrar General’s Department, Ghana National Service Scheme, Births and Deaths Registry and others.

The Finance Minister is full of hope that the trend shows that Ghana.gov will seal the leakage in the government revenue collection and ensure the needed locally generated revenue for national development.

He noted that COVID-19 has negatively impacted foreign direct investment so the way to go for every country is to develop very robust internal revenue collection systems and technology is key to that process, hence the importance of Ghana.GOV.

Ken Ofori-Atta, for instance, stated that currently 80% of government’s tax revenue comes from the Greater-Accra region, other big regions like Ashanti Region account for only 7%, Western Region – 8% and Eastern Region – 6%.

He believes Ghana.GOV will correct that anomaly, urging Ghana Revenue Authority (GRA) to make full use of the platform to ensure that business in the Eastern, Ashanti and Western regions met their tax obligations fully.

The Minister also noted that the national ID registration has captured over 22,000 professionals in Ghana who do not pay their professional taxes and plans are afoot to ensure that they do so regularly.

Minister of Communications and Digitalization, Ursula Owusu-Ekuful said when the three local Fintechs were selected for the project, the decision faced some amount of opposition both internally and externally, but the result of their work has vindicated the decisionmakers.

She is confident government can now see its revenue flow at all MMDAs in real time, adding that the various state agencies like the Data Protection Commission and National Cybersecurity Center have put measures in place to protect the data of persons on the platform.

Vice President Dr. Mahamudu Bawumia who launched the platform said he believes Ghana.GOV will stem corruption to a large extent and improve government revenue by about GHS3 billion a month.

“Ghana.gov will chase out all the demons and principalities in the public sector and safeguard government revenue – in fact, the gains so far even shows it is chasing them out already,” he said.

He gave the example of how piloting the platform on revenue collection in the tourism sector saw a four-fold revenue gain at some of the state’s tourist sites, adding that the system is kicking our middlemen and human interventions that often facilitate corruption and embezzlement.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Vice President Dr Mahamudu Bawumia has praised indigenous company Hubtel and others for the development of Ghana.Gov, a one-stop platform to enable citizens to easily access government services, simplify payments for public services.

In a Facebook post after the launch of the platform on Wednesday July 14, he said “I am excited that once again we did not have to go beyond our shores to develop and manage a platform to address a local challenge.”

“Indeed, the spirit of collaboration and innovation exhibited by the local technology companies ( Hubtel, expresspay and IT Consortium) is worth commending.”

He added “At the Jubilee House today [Wednesday July 14, I launched Ghana.Gov, a one-stop platform to enable citizens to easily access government services, simplify payments for public services, ensure prompt payments for the services and promote transparency and visibility of internally generated funds dubbed Ghana.Gov and can be accessible via www.ghana.gov.gh or shortcode *222# on any mobile phone.

Ghana.GOV will offer a simple and single convenience for all government services and will also make it easy for everyone to find and pay for government services.”

He explained that the convenience of enabling all persons to pay for government services with mobile money, bank cards, the new GHQR code, “our fintech apps on our phones or at any bank branch will eliminate the hassle of going through long queues and hopping from office to office just to make a payment for a government service.

“I congratulate and thank all who worked hard to turn this idea into reality, leapfrogging bottlenecks in public administration, accelerating our economic transformation.”

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Accra, June 14, 2021 – Ghana’s direct bank-to-any-account contactless payment service myGhQR.com has been officially launched today by leading payments service provider, Hubtel, in collaboration with Ghana Interbank Payments and Settlement Systems (GhIPPS).

myGhQR.com is Ghana’s first-ever self-service portal to enable direct bank-to-bank transfers. The service eliminates the need of paying in cheques or using POS card machine or displaying your bank account details in order to receive payments into your bank account. To receive payment you simply generate your GHQR code on www.myGHQR.com, display it at your point of payment and get paid instantly into your account when anyone scans to pay you.

The service allows anyone (businesses, small merchants and mobile money users) to receive payments from bank customers who have GHQR on their bank app.

The introduction of myGhQR.com follows efforts to make Ghana’s Universal Quick Response (QR) camera scan & pay service, one of the regular modes of payment that is easily accessible to customers and business outlets of any size.

The GHQR payment gateway was launched in March, 2020 by the Vice President Mahamudu Bawumia to add up to Ghana’s existing electronic payment channels as part of the larger cash-lite agenda.

Since its launch several banks have rolled out GHQR in their smartphone apps, including Ecobank, GCB Bank, Fidelity Bank, Calbank and GT Bank. Customers that use these bank apps can simply scan a GHQR code to pay an associated business or merchant.

In an interview at the press launch, Hubtel’s Head of Products, Patrick Asare-Frimpong, emphasized the value myGhQR.com presents. “For the first time, we have a self-service portal that enables businesses and mobile money users of all kinds to generate a unique GHQR Code, link it to your account and receive payments instantly from GHQR users. You can pay anyone with a bank account by simply scanning a QR code from your bank’s app. This is simply a game-changer.” he said.

Generating a QR code is free. This makes it very convenient for anyone to generate a GHQR code. Businesses, everyday service providers among others can create their own unique QR codes to receive payments into their bank accounts by visiting www.myGHQR.com

The introduction of myGHQR.com will further allow anyone with a bank account or mobile money to easily generate, print and display their own GHQR on any material to receive instant payment at standard industry fees of 1% capped at GHS 10 for the highest transaction values.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

A revolutionary new digital payments service, myGhQR.com is set to transform the payments landscape and position Ghana among the top cashless economies of the world.

The service is developed by Hubtel, a leading enhanced payments service provider, and is set to launch in the coming days as a quick-no-contact and direct bank-to-bank payment service.

The service, which will be managed in collaboration with the Ghana Interbank Payments and Settlement Systems (GhIPPS) will allow users to make and receive payments from any bank app into their bank accounts directly via a GhQR Code. The service is designed to make all bank payments simple and interoperable without any physical contact.

GhQR is Ghana’s National Quick Response (QR) camera scan & pay service available on smartphone applications of all licensed commercial banks and financial technology providers. The GhQR payment gateway was launched in March 2020, by the Vice President Mahamudu Bawumia to add up to Ghana’s existing electronic payment channels as part of the larger cash-lite agenda.

Since its launch, several banks have rolled GhQR payment codes at various retailer and merchant points. The introduction of myGhQR.com will further allow any merchant of any size to easily generate, print, and display their own GhQR on any material to receive payment.

Customers that use bank apps can simply scan a GhQR code to pay an associated business or person.

The information available on the portal of the service indicates that the service allows anyone with a smartphone and a bank app to make payments to all categories of businesses, including even tabletop retailers and even food sellers once both the buyer and seller are registered on the GhQR Code.

In an internal communication to the staff of Hubtel, its Head of Products, Patrick Asare-Frimpong announced the upcoming launch as a major milestone for cashless payments in Ghana. Stating that “… for the first time I can pay anyone with a bank account by simply scanning a QR code from my bank app. This is simply a game-changer.”

The payment via this process is taken directly from the bank account of the buyer and paid directly into the seller’s bank account via their various bank apps on their respective phones.

This contactless payment process allows the buyer or the one making the payment to scan the GhQR Code on the device of the seller or receiver and follow the prompts to make payment.

Currently, the GhQR Code works perfectly with apps like the Hubtel App, as well as with Fidelity Bank, GCB Bank, Cal Bank, Ecobank, and GTBank Apps.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Hubtel Honors 1% Pledge With Donation to Support International Youth Day 2021

June 3, 2021 | 2 minutes read

Ghana’s fast-pacing eCommerce, SMS messaging, and leading enhanced payments service provider, Hubtel, has honored its annual 1% Pledge with a donation to support International Youth Day 2021, organized by the African Business Centre for Developing Education (ABCDE).

The donation makes Hubtel, the first sponsor to support the preparation and organization of the upcoming event in August 2021. International Youth Day 2021 is an educational initiative, which focuses on helping business communities deliver various services towards improving the educational sector. A goal that aligns with Hubtel Pledge’s mission of supporting causes that enhance the quality of life in our communities.

The Hubtel Pledge Team, led by the General Manager, Ernest Apenteng, made the donation on Thursday, June 3rd 2021, to Dr Ekow Spio-Garbrah and his Team, at the premises of the African Business Center for Developing Education Africa House, Nyadji Crescent, Asylum Down Accra, Ghana.

Ernest Apenteng in addition, emphasized on the main reason for the donation and the long-term benefits that would be derived from the partnership, especially for the youth from mentorship programs and career guidance to future projects, and Hubtel’s participation in the International Youth Day 2021 event.

Dr. Ekow Spio-Garbrah acknowledged and expressed his profound gratitude and appreciation towards the kind gesture, iterated the fact that the partnership between Hubtel and ABCDE would not be a one-time thing, and further pronounced that the donation would go a long way to help with the initiative at hand.

About Hubtel Pledge

The Hubtel Pledge supports causes that enhance the quality of life in the communities where we live and work. We commit 1% of profit, 1% of paid employee time, and 1% of products to serve our communities. By committing to the global Pledge 1% in 2017, Hubtel became the first local tech company to join the ranks of Salesforce, Atlassian, TechCrunch, among a legion of other Silicon Valley companies. Read more here.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Hubtel Expands eCommerce in Ghana with Opening of Kumasi Customer Experience Center

May 31, 2021 | 3 minutes read

Hubtel has formally opened its very first customer experience center within the Kumasi City Mall. This follows the rapid adoption of eCommerce by residents within the Accra. Having warmed the hearts of thousands of very happy customers in Accra, Hubtel is now extending the convenience of fast store-to-door deliveries to Kumasi.

The move aligns with the company’s continuous quest of helping businesses grow sales and connect better to changing customer needs.

It also follows the 2019 re-introduction of Hubtel’s refreshed eCommerce platform which is seamlessly merging the shopping experience for customers in-store and online with fast same day delivery.

Recently licensed by Bank of Ghana as an Enhanced Payment Service Provider, Hubtel is positioning itself to become a very useful companion for mobile users, just as it has done with its transformational work in pioneering mobile airtime content services, fintech and bulk SMS messaging.

The opening of the Hubtel experience center will serve as a base of operations for its eCommerce activities within the Kumasi metropolis. This will also provide a point of call for users of Hubtel to get first-hand experience of features and also get help from customer service officers.

The center will in addition provide walk-in assistance to business owners to set-up Hubtel POS to manage inventory, sales and payments.

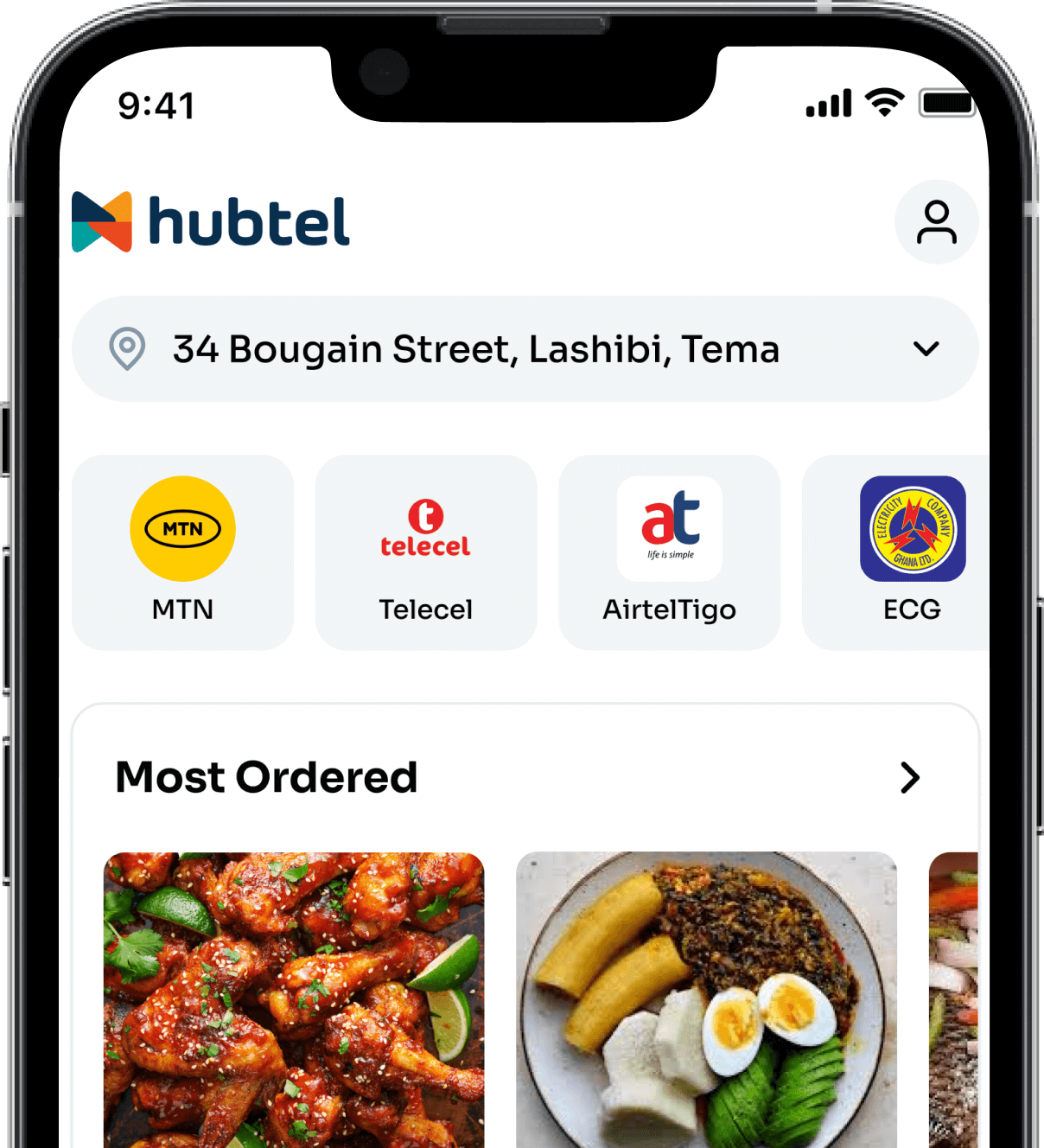

Hubtel Smartphone App

The center’s opening also coincides with the introduction of the Hubtel smartphone app to residents of Kumasi. The app enables consumers to find and buy anything from stores in Kumasi and receive it within 90 minutes to a few hours.

It also has features for users to instantly top up data, buy airtime, send money and pay for services with any mobile money or bank card.

The app also includes features to track delivery orders and receive notifications from the time an order is prepared, picked up and delivered.

In an interview at the opening, CEO of Hubtel, Alex Bram urged retailers to boldly embrace the changing shopping landscape by getting their inventory onto Hubtel.

“If you run any retail business such as a supermarket, pharmacy or restaurant, your customers are becoming more mobile, so it’s time to fit your store into their mobile lifestyle.” he stated.

In a speech to formally open the center, the Chairman of the company, Hans Nilsson said, “If you’re a consumer, Hubtel is bringing all retailers to your smartphone. This puts the city on your phone, making it possible to order anything and have it delivered to your door.”

He therefore urged everyone to install the Hubtel app, and link to a mobile money wallet or bank card to try it out.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Report an Issue, Order Tracking, Item Reviews & More…

See what’s new in this update

Report an Issue on Prepaid Balance or Transfer Funds

Need help with your Prepaid Balance or Transfer Funds details? Simply tap on the “Help” button, then select your issue from the list provided or choose “Other” to type your issue and tell us what happened, for immediate assistance.

Report an Issue on Messaging

For assistance with any challenge at the Messaging section of your account, just tap “Report an Issue” at the bottom right and let us know what happened, for immediate assistance.

Report an Issue on Payment History

Receive immediate response on Payment History details as required by simply tapping on the “More button” under “History of Payment”, then select “Report an Issue” to share your concern.

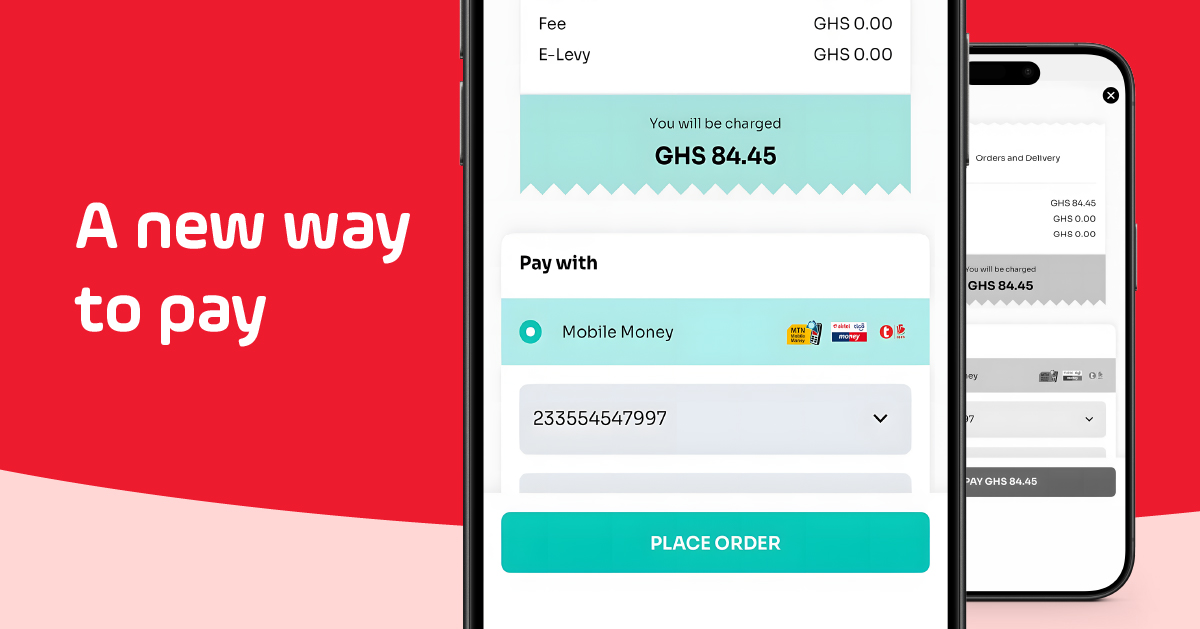

Mobile Money Verification on Web Checkout

Customers can now verify their mobile money numbers during payment with just a one-time verification pin, and receive verification prompt to complete their payment process.

Bank Card Verification on Web Checkout

New and existing card users are now required to provide their bank card details if they have already been verified by Visa, to confirm verification and receive a one-time pin to complete the payment process.

Add Card on Hubtel Pay

Customers can also add their cards as a wallet on Hubtel Pay by linking it to their numbers after the payment process.

Item Varieties

Customers can now select different options of the same item as they prefer, for items with different options available.

Item Extras

An item could have other “Add-ons” that sweeten the deal which can now be added to orders when adding items to cart.

Improved Search

Search suggestions now makes it easier to get preferred search details on items.

Item Reviews

Customers can now post reviews or share feedback on orders and delivery with photos.

Order Tracking

Tracking now includes updates at every stage of the delivery process. From order placement, pickup to delivery.

Related

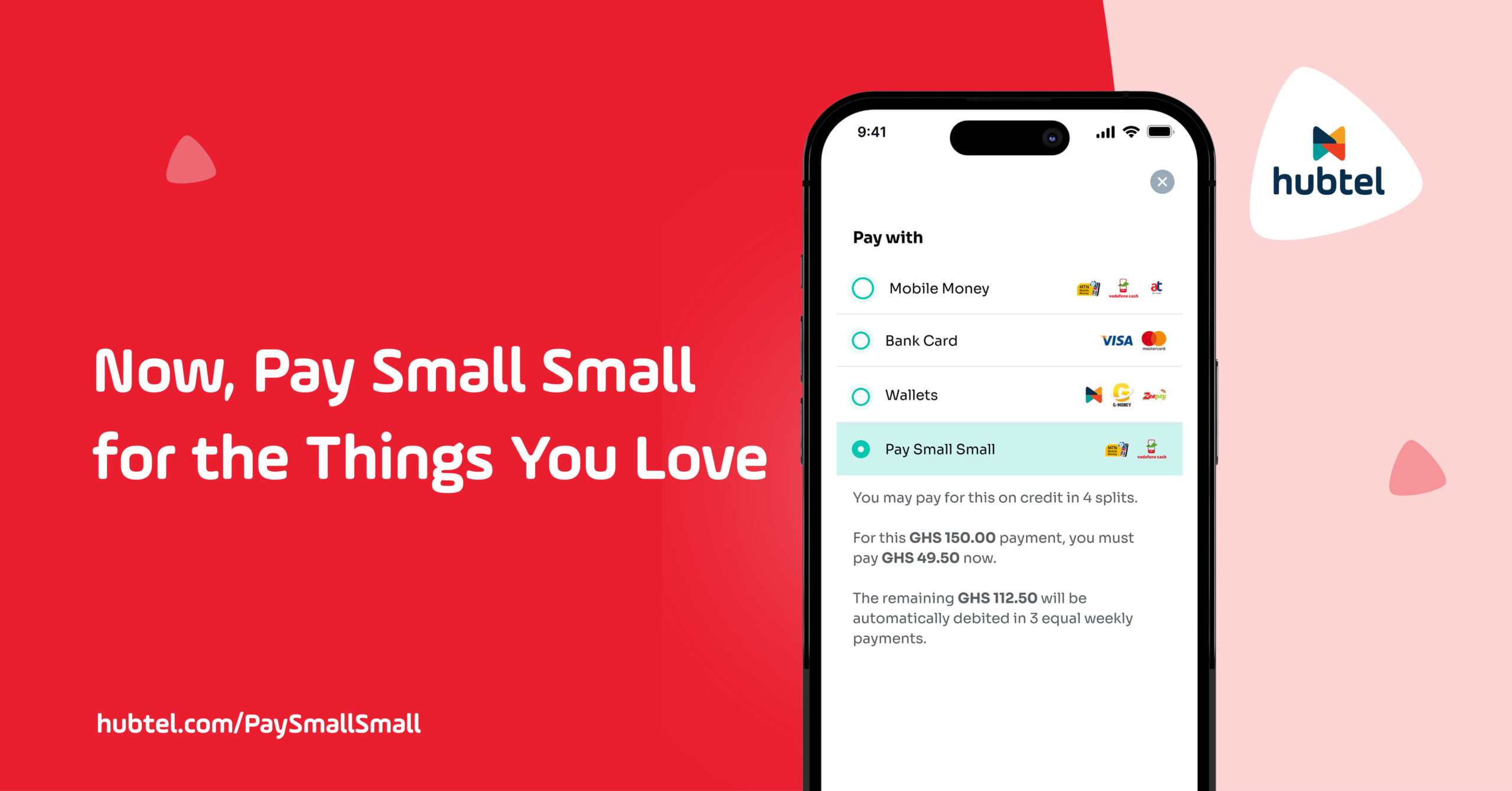

Now, Pay Small Small for the Things You Love

December 23, 2024| 2 minutes read

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

May 9, 2024| 2 minutes read

3 Ghanaian FinTechs Build Ghana.GOV to Block State Revenue Leakages

May 7, 2021 | 4 minutes read

Three leading Ghanaian FinTech companies, Hubtel, ExpressPay and IT Consortium, have built Government’s maiden fully-integrated payments processing and settlements platform, Ghana.GOV to ensure efficiency in government services and revenue collection.

The online platform, commissioned by the Office of the Vice President in collaboration with the Ministries of Finance and of Communication, is a major step in the pursuit of the government’s vision of digitizing the economy and modernizing the way Government pays its bills, collects fees and charges for the benefit of all citizens, residents and visitors.

Hubtel, ExpressPay and IT Consortium are all local financial technology (FinTech) companies with many years of experience in providing digital payments and settlements among many other services to financial institutions, corporate organization, retail merchants, telcos, media organizations, utility service providers, schools and many more with high efficiency.

They each run platforms that, for instance, enable Ghanaians to easily pay utility bills digitally, either with mobile money, other digital wallets, or with their bank account.

They therefore designed the Ghana.GOV platform to enable all Ministries, Departments and Agencies (MDAs) and Metropolitan, Municipal and District Assemblies (MMDAs) to also provide services to the public, take and make payments on a digital platform.

In effect, Ghana.GOV, which is yet to be launched, is intended to be a digital services and revenue collection platform for the public sector, created to provide a single point of access to Government of Ghana services.

The homepage of the Ghana.GOV site indicate the public can access services from state institutions categorized under Passport Office, Ghana Revenue Authority, Ghana Immigration Services, Births, Deaths and Marriages, as well as Police, Justice and Safety.

Other categories are on the portal are Social Services and Welfares, Health and Food Services, Energy and Petroleum, as well as Driving and Transportation. So when a visitor clicks on any of the categories, they will be directed to the respective institutions for service.

The services the portal seeks to deliver include processing of all payments and transfers (both electronic and cash) against predefined service flows of each MDA and MMDA, as well as managing post-payment workflow, customer notification, feedback and service ratings.

This, according to information available to TechGH24, will enable the Government of Ghana fulfil its ultimate goal of creating a cash-lite economy.

Block the leakage

But a key rationale for creating the Ghana.GOV platform is to cure the inefficiencies in Government’s domestic revenue collection, particularly MMDA collections, which leads to huge revenue losses every year.

For instance, the 2017 Auditor-General’s Report indicates that, inefficiencies in revenue collection by the MMDAs alone resulted in losses of over GHS2 billion.

It is also estimated that about 10 -15 per cent of Government’s collections are lost through theft, fraud and other schemes.

Indeed, government observed that with about 254 MMDAs and some 127 public organizations operating more than 2,000 physical points of services and revenue collection through mostly manual processes, it is not surprising that revenue collection is facing such challenges.

It is therefore government’s considered view that modern technologies presents a simple, proven solution to address the identified inefficiencies, block the leakages and significantly grow revenues, and the three local fintechs have proven efficient in providing such solutions.

Revenue boost

With the implementation of the Ghana.GOV platform, therefore, government expects to see a significant boost in revenue collection as a result of the impact of electronic payment on the systemic collection losses that are prevalent today.

Government estimates that digitizing collections via the Ghana.GOV platform will enable the it improve revenue by an some GHS3billion annually.

These expectations are rooted in scientific studies results, which have confirmed that providing simple to use electronic payments increases government collection by two times in some cases as people embrace the convenience that digital platforms offer.

Indeed, government also expects a a further positive boost in the revenue gains as the platform will help to expand the tax-net to include the informal sector tax payments, while offering the possibility for additional revenue from premium expedited services.

Ghana.GOV was originally scheduled for launch in June last year, but it has been postponed to later this year.

Source: techgh24

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Ghana’s indigenous eCommerce & SMS messaging company, Hubtel.com has entered into a partnership with Visa, to expand access to seamless payments on its eCommerce platform.

This partnership with Visa provides consumers with access to more merchant services on Hubtel’s eCommerce platform. It also allows Hubtel to explore further innovative payment services such as “tap to phone,” amongst others, to reduce the dependency on cash, especially among small businesses.

The onset of the pandemic saw more Ghanaians turn to eCommerce as well as safe and secure marketplaces like Hubtel.com. This upsurge subsequently led to an increase in the usage of digital payments.

In partnering with Visa, Hubtel’s merchants will be able to access payments made by customers in real-time avoiding delays sometimes experienced in the settlement process. In addition, consumers can count on Visa’s trusted security tools and solutions to make their transactions secure.

Country Manager for Visa Ghana, Adoma Peprah commenting on the partnership said, “Working with Hubtel is part of our overall strategy to eliminate barriers to global commerce for merchants and consumers. Through this partnership, we aim to help them navigate the exciting opportunities in payments, develop game-changing products that address real consumer challenges, and enhance their speed to market.

We believe that partnerships are key to strengthening Ghana’s innovation pipeline, drive emerging technologies and, over the long-term, safeguard the sustainable growth of the payment’s ecosystem,” Adoma added.

Since 2005, Hubtel has delivered billions of business-critical SMS messages and pioneered mobile banking and online payments in Ghana.

Hubtel has positioned itself to dominate in eCommerce just as it has done with its transformational work in fintech and bulk messaging, and the company has continued to innovate for retailers and their customers; through seamless integration of shopping experiences in-store, online and on mobile.

Hailing the partnership with Visa, Alex Bram, CEO Hubtel noted that: “Payments are the core of our business which is why we have collaborated with Visa to continue delivering convenient, secure and seamless payment capabilities to our customers who have embraced eCommerce in the wake of the pandemic.“

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

An upcoming update will help keep your messaging contacts refreshed and up to date…

March 18, 2021 | 1 minute read

An upcoming update will help keep your messaging contacts refreshed and up to date…

A recent review of all contact groups saved on Hubtel accounts revealed that 84.33% of mobile numbers within groups have not received an SMS in the past 36 months.

SMS messages to contact groups that are up to date drastically improves the efficiency of your message delivery. In view of this, the latest update coming this end of March 2021, has been designed to put you in better control of your SMS messaging contacts on Hubtel.

Save your existing contacts

We strongly advise that you download your contact groups from your Hubtel account to your computer. Once there, please review and update the contacts with the latest details to support efficient delivery the next time you need to send a bulk SMS message.

Please note that contact groups that have not been updated since January 1st, 2021, will no longer be available after 20th March, 2021.

45 Days Expiry Tags

The latest update will also affix expiry tags of up to 45 days to your contact groups to help you review, resend or update them with the latest active mobile numbers only.

Please contact your account manager or email [email protected].

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Now, Pay Small Small for the Things You Love

December 23, 2024| 2 minutes read

February 2021 Product Update

Save Time Making Bulk Payments to Suppliers

See what’s new in this update

Faster Payments, Happier Merchants.

Pay hundreds of suppliers at a go, to any mobile money wallet or bank account. Set up bulk payments for your vendors, workers, contractors, or commission payments.

How?

Simply download and update the sample excel file provided, with details of suppliers you want to pay.

– Upload your updated excel sheet for data validation.

– Select your preferred debit account and confirm funds transfer.

– Approve or reject requests as you deem fit.

“A more detailed overview of your daily sales performance”

More on your sales patterns

Additional information meaningful to your business has been added to your daily sales report, to help you monitor sales trends and patterns.

Sales summary of multiple branches are also sent individually.

Related

Now, Pay Small Small for the Things You Love

December 23, 2024| 2 minutes read

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

May 9, 2024| 2 minutes read

ACCRA, GHANA – February 10, 2021 – Award-winning banking, finance, and insurance executive Patience Akyianu has joined Hubtel as a Non-Executive Director.

Hubtel is one of Africa’s fast-evolving fintech-shopitality platforms and the largest messaging service provider with operations in Ghana and Kenya. The company has been expanding in innovative ways focused on helping retailers sell and deliver to nearby communities.

In August 2020, Hubtel was given regulatory approval by the Bank of Ghana to operate as a licensed Enhanced Payment Services Provider. This also followed the company’s international certification for PCI-DSS and ISO 27001 bank card information security and general management standards.

The inclusion of Patience Akyianu to the leadership of the company brings her an impressive wealth of expertise as a solid executive with over 26 years of experience in Finance, Banking, and Insurance.

Patience is currently the Group CEO of Hollard Ghana Holdings, a subsidiary of Hollard International – South Africa, and a Director on both boards of the company’s subsidiaries, Hollard Insurance Ghana, and Hollard Life Assurance Ghana.

She was also the first Ghanaian woman to become the Managing Director of Barclays Bank in Ghana (now ABSA Bank).

In a chat from his base in London, the Chairman of Hubtel, Hans Nilsson, said that “….we are very very excited to have a Director of that kind of caliber on our board. A company with the type of ambition that Hubtel is pursuing needs the experience and advice of people who have done it at the highest levels. And that’s exactly what we know we will get with someone like Patience.”

Under her visionary leadership, the Hollard brand has now gained prominence and visibility in Ghana and has introduced some innovative products, including Ghana’s first virtual insurer, a Chatbot nicknamed Araba Hollard.

Her tremendous leadership skills and execution capabilities have been recognized with prestigious awards and accolades including Marketing Woman of the Year 2019, Outstanding Group CEO of the Year 2019, Woman of Excellence 2019, and Best Woman CEO of the Year 2018.

Patience is a certified professional accountant and a member of the Institute of Chartered Accountants, Ghana. She is also on the board of Ecobank Ghana Limited, and a founding member of both the Executive Women Network and the International Women’s Forum, Ghana.

She is married to Lawyer Kwame Akyianu and has two children, Awurama Ampima Akyianu and Nana Banyin Kojo Akyianu.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read