Tag: competition

Technological change has always posed a challenge for companies. But, as we saw once again in 2015, it has never occurred as rapidly, or on as large a scale, as today. As innovation sweeps across virtually every sector, from heavy industry to services, it is transforming the competitive landscape, with the most advanced companies – rather than the largest or most established players – coming out on top.

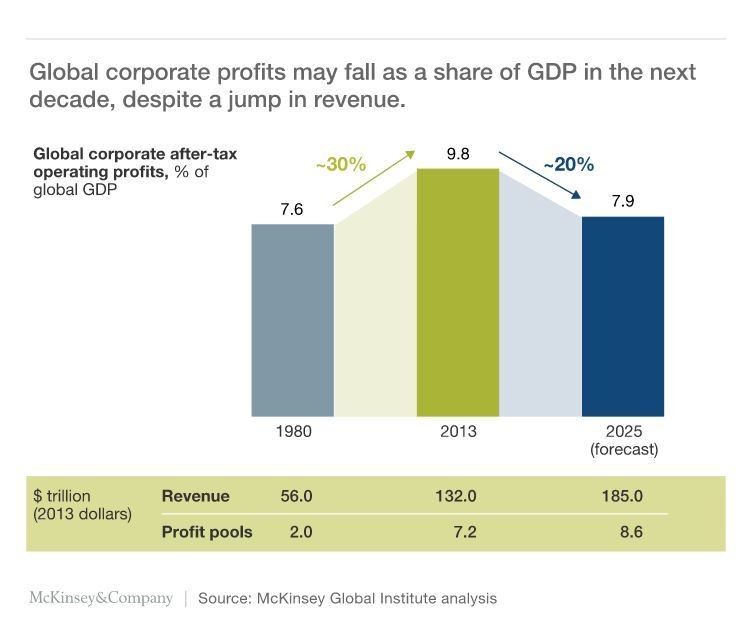

For incumbents, the threat of displacement is very real. The average tenure of a company on the S&P 500 has fallen from 90 years in 1935 to less than 18 years today. Disruptive new players like Uber, which has upended the taxi industry, are tough competitors, often staking out market share by shifting more surplus to consumers. This is part of a broader trend of intensifying competition that, according to recent research from the McKinsey Global Institute, could reduce the global after-tax profit pool from almost 10% of global GDP today to its 1980 level of about 7.9% within a decade.

The effect of technology on competition arises largely from the power of digital platforms and network effects. New digital platforms reduce marginal costs (the cost of producing additional units of a good or service) to nearly zero. Adding, say, a Google Maps user carries negligible costs because the service relies on GPS location data that is already stored on a user’s phone. This allows Google to scale incredibly quickly, and then to leverage this scale (and the convenience of having a single platform) to move into adjacent sectors – such as music (Google Play), payment (Google Wallet), and word processing (Google Docs). In this manner, tech firms can quickly come to challenge incumbents in seemingly unrelated industries.

Of course, tech firms are not the only ones innovating. A handful of leading firms in practically every industry are deploying digital technology in increasingly sophisticated ways – and seeing huge benefits. The use of sensors to monitor livestock, for example, has far-reaching implications for the food industry.

But the most digitally advanced sectors show the greatest progress. Indeed, over the last 20 years, profit margins in these tech-infused sectors have grown 2-3 times faster, on average, than in the rest of the economy. Even within the most advanced sectors, there is a yawning gap between the top-performing companies and the rest of the pack. For example, the retail offerings of digitally advanced multinational banks far outstrip those of local credit unions.

As technology transforms business models and processes, it is also changing the way employees work. Recent McKinsey research finds that already-proven technologies could automate as much as 45% of the tasks individuals are currently paid to perform. In the United States alone, that is the equivalent of about $2 trillion in annual wages.

The potential benefits of this transformation for companies extend far beyond cost savings, as workers gain time to pursue more valuable tasks involving critical thinking and creativity. Financial advisers can spend less time analyzing financials and more time developing solutions that meet clients’ needs. Or interior decorators can shift their attention from taking measurements to devising design concepts, meeting with clients, or sourcing materials.

Technology also allows companies to rethink conventional wisdom on organizational design and governance. New information-sharing technologies deliver greater transparency, making organizations more efficient and, in many cases, less hierarchical.

For example, the CEOs of Apple, Inditex (a multinational clothing company), and Zappos (a large online retailer) have adopted broad spans of control (the number of subordinates directly reporting to a manager) that far exceed the traditional model of “one to four to eight.” Haier, the Chinese white goods manufacturer, reorganized its 80,000-person workforce into 2,000 independent units, each responsible for managing its own profits and losses. Since the move, its market capitalization has soared, tripling from 2011 to 2014.

Moreover, digitization allows companies to operate as “platforms,” not structures, and make greater use of resources outside their company. The insurance company Allstate used the crowdsourcing platform Kaggle to invite programmers to develop a new car accident injury algorithm; the eventual “winner” was 271% more accurate than its existing model.

Likewise, China’s DJI became the world’s largest drone manufacturer by focusing on its products’ core technology, while giving away developer kits for free online so that others could build apps. This approach meant that DJI’s drones were equipped with attractive features far earlier than competitors’ products, which relied on in-house app development.

Similar technology-driven innovations in thought processes and business models can be seen across the economy, reflected in changes in companies’ planning processes. Some have begun creating separate business plans with two-month and 20-year views, reallocating their resources more aggressively, and using new analytical techniques to identify, attract, develop, and retain talent.

Technological innovation enables – indeed, requires – companies to boost their agility and thus their competitiveness. That’s why CEOs’ top priorities in 2016 should be to digitize the core components of their business and rethink organizational design and governance processes. Catching this fast-moving – and rapidly growing – “digital wave” is the only way to avoid getting left behind.

Author: Dominic Barton is the global managing director of McKinsey & Company.

Source: weforum.org

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read