Author: Hubtel

It is another Monday morning in the busy city of Accra, the year is 2048, and the rains are just setting in. Kwame dashes out of the door and hastens to his car, double-checking his watch as he runs late for work. He speeds out of the driveway and gets a beep from his vehicle as an alert flashes on his dashboard screen. His utility bills are due. With his eyes still on the road he initializes payment with a few words and confirms payment with a fingerprint scanner. Bills paid. The receipt of payment was sent to his email. Welcome to the future. Welcome to a cashless society.

Though this may sound like a scene in a science fiction movie, “the future” with respect to money, monetary transactions, and monetary value may not be that far at all from the excerpt above…But will the case probably be the same in Africa in the next 20 or 30 years? Let’s find out.

Money as a medium of exchange is also a means of exchanging value. From the days of barter trading to the use of precious metals such as gold and silver, to cowries, shells, and cola nuts, and more recent coins, paper notes, and plastic, all forms of money had one aim in mind, exchange of value and transfer of purchasing power.

It is however important to note that for any form of money to be generally accepted to survive the test of time, it needs certain key characteristics: the trust of the masses or the society in which it is being used; the ability to stand the wear and tear of multiple exchange of hands and other natural elements; specific in value or quantifiable in denominations; convenient in carrying around and making payments and transfers; and it also ought to be scarce.

These characteristics and more have caused the boost or fall of many various forms of money in different African societies. Imagine having to carry a scale where ever you go just to measure the right quantity of gold for every transaction. To top it up, you would have the weight of gold jiggling in your pouch hanging around your waist. You may need to wheel a cart of gold if you wanted to purchase a house perhaps.

In Ghana, the “rejection” of the 1 Ghana pesewa by its users was largely due to its small size. Most Ghanaians complained it was too small to handle and the rigors of inflation doubled up the facing out of the 1 Ghana pesewa due to the social inconvenience. Today, the 1 pesewa coin is hardly heard of. Central banks across the world monitor the reaction and acceptance of society to banknotes and coins and take needed steps such as reducing the quantum of the not so accepted denomination to ensure fiscal stability in the economy.

Amongst the various characteristics of money, a key and promising feature which has drastically changed the face of money in the 21st century, and still promises to drastically metamorphose money in the future has to do with convenience. The future of money innovation seems to simmer in the three-legged pot of convenience. “Money Convenience” in carrying around, convenience in making payments for goods or services, convenience in money transfers.

In our world today, we seem to be skewing towards the tangent of convenience, and money is not left out in this new development. The astronomical expansion of technology in recent times has led the Harvard University Economist, Kenneth Rogoff, to argue in his new book “The Curse of Cash” that bank notes are outdated due to currently available technology. He also argues that physical cash is a “honey pot” for criminals who love the big notes. The birth of e-currencies such as bitcoin, dash, and litecoin amongst many others signify the move towards a cashless society.

Online payment, money transfer, and money wallet platforms and apps and other fintech companies provide a means of convenient mobile banking and online money transfer and payments. But how ready is Africa for the foreseeable future of money, a cashless or “cash-lite” society?

Despite Africa having a large trench of unchartered opportunity in expanding its digital banking and e-money space, the continent seems to have a population that is still cash conservative to a large extent according to a report from KPMG issued in November 2016 on e-payments in Africa. The continent still lags behind the developed world in high-speed internet connection and literacy which are both vital in the use of technology in e-money transactions.

Though today is the future we expected yesterday, the future of money in Africa and how long it will take us to be a cashless or “cash-lite” economy lies largely in the hands of technology, government and central bank policies, and “monetary convenience” but one thing I know for sure is that the future of money in Africa will be one great story to tell as the hands of time unwind.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

With the premium placed on customer experience at an all-time high, an unforgettable pleasant experience with your company is one sure way to boost customer retention. Customers are more likely to relay remarkable experiences they have with companies to their friends and family. This implies that every single contact from a customer, be it a phone call, an email, or a tweet, requesting information or after-sales support, is a unique opportunity for you to positively influence their perception of your brand.

As Sam Walton put it, “There is only one boss – the customer. And he can fire everybody in the company from the Chairman on down, simply by spending money somewhere else.” In order to ensure that customers keep spending their money on your products and services even when presented with other compelling and cheaper options from competitors, it is prudent to rethink your approach to customer service delivery. Let us consider four ways to earn your customer’s loyalty using great customer experience.

- Be personal with customers: Let’s face it. Bureaucracy is boring. Giving straitjacket, extremely formal, and pre-written scripts out to customers as answers to their queries will most likely hurt your brand reputation. Customers want to speak to real people because they feel they are more likely to relate and empathize with them. A friend of mine, Kojo, shared an experience he had when he spoke to a contact center agent last week. He told me that from the way the agent spoke to him, it might have been better if the agent had played back a pre-recorded message instead. He had a lot of questions to ask but felt the agent was in a hurry to go grab a bite so he just thanked her and ended the call. A similar experience Kojo has had with this service provider has robbed him of any attachment he could feel towards them. Customers care more about the quality of their experience than the service being delivered because there are numerous alternatives on the market. If Kojo is presented with a slightly better alternative, he will most likely ditch his current service provider on a whim.

- Take customer feedback and suggestions seriously and revise your offerings: To quote Steve Jobs, “A lot of times, customers do not know what they want until you show it to them”. While this may be true, in most cases, customers actually do know exactly what they want. End-users can be an amazing, cost-free source of extremely valuable feedback that can be baked into future iterations of your products and services. Pay attention to the comments that customers pass on social media and the “unsolicited” suggestions they give you when they call your contact center. If current customers feel you care about their experience more than your profit, it will be very difficult for them to switch to a competitor. They are likely to endure quirks in your offerings only because they are confident that once they complain, you will quickly move to resolve them. They may even be willing to spend a couple of cedis more on your product even if a competitor sells the same product for much less.

- Ensure that support personnel are very knowledgeable about your products and services: Ever spoken to a call center agent and wondered how they got their job? When support personnel doesn’t sound certain about the answers they’re giving to a customer, the little faith that customers have in their ability diminishes. When support personnel constantly put customers on hold in one conversation and refer to manuals, product documentation, and their superiors before giving answers, brand loyalty will most likely be an issue. Customers understand that products and services may not be perfect all the time. They can take that. But what they cannot take is a sub-standard after-sales support experience.

- Reward loyalty: Long-term users who have been using your products and services for years can become emotionally attached to your brand and become brand ambassadors. Companies can reward loyalty by offering long-standing customers discounts and exclusive access to new products and services they have created before rolling out, calling customers on their birthdays and providing them with branded paraphernalia, creating focus groups, and soliciting suggestions for future versions of product offerings. Once loyal customers feel like they are a part of your company, they will personally market your products and services to their friends and family, defend your brand when an ill-comment is passed on social media, and even volunteer to offer after-sales support services within their circles all at no charge.

So there you have it. When your customers feel delighted by the quality of service and support your company offers, they are more likely to be emotionally attached to your brand. This makes them more willing and committed to using your products and services over a long period of time. The resulting benefits are that you get shielded from the harsh realities of stiff competition and a dwindling customer base. You also get to grow your revenue by easily upselling and cross-selling to existing customers. What’s more, existing customers will help grow your customer base by augmenting your marketing efforts.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

If you think automation of after-sales support and customer engagement with chatbots is some science fiction idea slated for execution in the distant future, then let this post serve as a reality check.

Advances in Artificial Intelligence have resulted in the creation and development of bots that can understand, relate to and participate in human conversations. Traditional chatbots are wired to answer a finite set of hard-coded questions. New AI-based chatbots are trained with data sets of human conversations so that they can learn on their own and identify the intent behind every request or conversation, a technique known as Natural Language Processing. This makes them more relatable and natural for current and prospective customers to interact with.

IBM Watson, a cognitive system enabling a new partnership between people and computers, has already begun replacing paralegals and junior lawyers in top law firms. With IBM Watson, you can build virtual contact center agents to answer any queries your current and prospective customers may have for you. If you’re familiar with the American legal drama Suits, you’re no stranger to the fact that the character Mike Ross is always buried in paperwork before court cases. Researchers at the University of Toronto have already created an AI lawyer named Ross. Ross can take any legal question posted by an attorney and sift through its database of legal documents, statutes, and cases to come up with the correct answer. The system grows more accurate over time, as it learns more about a firm’s specific areas of practice and preferences.

In the next couple of years, AI bots are expected to take on a huge chunk of the work currently done by customer experience agents. This paradigm shift will address some of the major challenges faced in managing customer contact centers. Studies indicate that the average contact center representative lasts only about six months in their job. Also, contact centers have a whopping 40% average annual turnover rate. What’s more, bots will neither have off-days, unless they have to go offline for maintenance and software updates, nor call in sick, unless malware impacts their normal flow of operations. Replacing human customer experience agents with chatbots will allow multiple queries to be efficiently and promptly responded to.

After-sales support is usually about providing answers and clarity to questions your prospective and current customers may have. These questions are likely to be repetitive, so who (or what) is better to perform repetitive tasks in a better, more efficient, and faster manner than the bots we have created?

Perhaps you’re currently wondering how much capital and expertise is needed to deploy the solutions we have discussed above. Do not fret. In Hubtel’s bouquet of offerings, you will find some products and services that will allow your outfit to automate certain sections of the customer experience journey. We will discuss some related low-cost tech in the coming weeks, so be on the lookout.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Makola… Kantamanto… Nima… We visit busy marketplaces like these and very often worry about being robbed, getting change for our high denomination currency notes, and accounting for every cedi spent. What we really would want is to visit these same markets with no cash but our mobile phone, yet return with bags full of foodstuff, clothes and more. Sounds too easy? Well, that’s what a country with a cashless society looks like.

Most countries have set the year 2030 as a target to reach a totally cashless society as more citizens resort to the use of mobile payments to complete business transactions. In Ghana, despite the boom in mobile money transactions and ample data that predicts phenomenal drive towards a cashless society, no certain date has been set to get the country to run a fully cashless society. That notwithstanding, the country can be seen as one in Sub-Saharan Africa that is making significant strides in terms of mobile money adoption and usage.

Mobile telecom companies in Ghana are leading the way into the cashless future, and this is evident in the stiff competition among themselves for mobile money subscriber share. For some years now, telecom companies have been spending millions of cedis to educate Ghanaians on mobile money usage through intensive media campaigns and promotions. This has had a direct impact on the drive to get Ghana cashless by 2030 because these activities acquire new mobile money customers each day.

Industry watchers are fascinated by how fast countries like Denmark, India, Norway, and Sweden have moved to cashless transactions. In Sweden, retailers are legally entitled to refuse coins and notes, and street vendors – and even churches – increasingly prefer card or phone payments. Here in Ghana, a number of churches have begun receiving offerings and tithes via mobile money platforms. Instead of the usual practice of congregants dancing their way to the altar, it is rather becoming common practice for the church to display phone numbers on their screens at the end of each service and ask members to pay their tithes and offerings via mobile platforms.

Some retail shops have also begun receiving payments via Mobile Money and POS and this has led to increased profit margins as they are able to transact business in a more secure, faster, user-friendly and convenient way. The public sector has not been left behind as government programs such as the School Feeding Program and National Service Scheme also make use of mobile money to pay vendors and service personnel. Despite these gradual developments that is propelling Ghana to be a cashless society, a definite target date cannot be set to when it will become the norm. And even as technology-backed payment services have gained momentum in the urban centers of the country, penetration in the hinterlands is yet to reach satisfactory levels.

History has always demonstrated that technology disrupts the status quo and this is very evident in the introduction of cashless payments, particularly via mobile. Before your business misses out on this new wave that is soon becoming the norm, you can jump on board Hubtel’s integrated payment solution called Hubtel POS that enables businesses of all sizes to receive payments from customers via cards and mobile money on all networks. It’s safer, much more convenient, and very secure.

Of course, achieving a cashless society is not an end in itself. It is a means to help advance financial inclusion, security, and prosperity. Hubtel aspires to be a key force in bringing everyone into the financial sector, drastically improving the lives of the millions who are now under- and unbanked while supporting economic prosperity and security. Before too long, buying “plantain chips” in traffic could be a seamless cashless transaction that fully satisfies both the vendor and consumer.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

The soul of crime in the country has found some new bravado and as a result, our law enforcement bodies are tweaking and turning the cogwheels of their logistical machinery so they can adequately face these crimes.

As part of this, the Ghana Police Service is embarking on a Police Transformation Initiative to deploy systems and initiate changes that will allow the outfit to tackle the increasing complexity of criminal offenses and face new threats squarely. The Initiative is also aimed at making the Ghana Police Service one of the top ten in the world within four years.

Dissemination of information in a convenient, secure, and timely manner is very crucial to the success of this Programme. This is why the Ghana Police Service has partnered with Hubtel as a key technology partner.

Under the arrangement, Hubtel will offer its platform for the delivery of text-based communication to and from over 30,000 police personnel across the country. This is to facilitate the collection of data to gain reliable insights on important public opinion through mobile feedback, and swiftly deliver emergency information to millions of citizens.

Hubtel is a company that delivers simple, practical tools to help Ministries, Municipalities, Districts and Authorities (MMDAs) manage and organize payments, send vital notifications via SMS and citizen self-service via USSD, towards better citizen engagement, as a key technology partner.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Akumiah, a young man boarded a trotro from Osu headed to Spintex. Halfway through the journey, the trotro mate began his routine collection of transport fares and as it got to Akumiah’s turn he reached for his wallet and realized he had left it at his workplace. Distraught, he frantically searched his bag to see if he would find some loose change to pay his fare.

To his utter dismay, he had no change left in his bag and at that point, the impatient trotro mate had already started hurling abusive words at him whilst demanding his fare. Akumiah remembered he had some money in his mobile money wallet and immediately asked the mate in the local parlance “Wo gye Mobile Money?” This question infuriated the mate even more and if it wasn’t the timely intervention of a passenger who paid Akumiah’s transport fare, the situation would have been quite a messy one.

In the face of the fast-spreading Mobile Money payment revolution, there is always a dilemma on whether or not one needs to keep some money in their Mobile Money wallet or if it’s better to move around with cash. In an active economy like Ghana’s, where everything from getting breakfast to catching a ‘trotro’ at the bus stop and even using the public urinal all requires monetary transactions, one is always forced to keep some cash on them to avoid any embarrassment like Akumiah’s.

Kofi Asare, a driver’s mate at the Kaneshie trotro station working in a Circle bound commercial bus says he has never accepted transportation fares via Mobile Money because he believes it will be a very tedious and inconveniencing process. However, he has received money via Mobile Money and is appreciative of the convenience it offers him in sending money to his mother in a village in the Ashanti Region.

For two sisters who retail dresses at the Rawlings Park in Accra, collecting cash only was the best business decision they had made until one day they were attacked by knife-wielding robbers after a day’s work and rid of all their sales. This compelled the two to now make Mobile money the preferred payment option for all their transactions.

A 2016 Ericsson Consumer Insight Report, titled ‘Financial Services for Everyone: Bridging the gap between the banked and the unbanked in sub-Saharan Africa’ stated that despite the risk associated with cash, 8 out of 10 consumers suggest that the convenience and wide acceptability of cash makes it the dominant mode of transaction.

The report however said that the data for mobile money usage in Ghana is very promising. With 69 percent of Ghanaians using mobile money agents, consumers see mobile network providers as the top preferred service provider for a mobile money agent.

Safety and convenience are two major keys most people look out for when it comes to the use and management of their monies.

Despite the fact that these two features are characteristic of Mobile Money payments and puts it in a better place to enhance businesses and enable growth, cash transactions still enjoy some dominance in the system.

As more individuals and businesses revolve and are caught in the Mobile Money frenzy owing to its safety, convenience, and reliability, it is likely to become the primary mode of financial transaction in the next few years, although businesses will still need cash to top up their wallets.

Taking the step to stay ahead of the competition in this regard can be done effectively through a payment solution such as Hubtel’s POS which is an integrated Point-of-sale solution that works with a phone or tablet to process payments.

The POS solution enables small businesses receive and make payments in a safe, secure manner to help them make more profits and expand their businesses.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Just recently, a busy fabric retailer at Accra Central received a call from an unknown man claiming he had sent her GHs 800 mistakenly and therefore requested that she send the money back to him.

She was busy at the time so she quickly reached for her phone to immediately authorize the transfer of the said amount, but thought to quickly check her balance first. Upon checking her balance she realized that there was no such credit to her account. It was then that she became suspicious and did not authorize the transfer. That was how close she was to being a victim of one of the fastest-growing fraudulent mobile money tricks in Ghana.

The introduction of Mobile Money in Ghana has enabled businesses make and receive payments from others conveniently and remotely. The fast evolution of payment systems and drive into a cash-lite or cashless society in Ghana is being realized gradually with the growth of Mobile Money.

This innovative technology has also created an avenue for some unscrupulous persons to attempt exploring possible security lapses within the system to fraudulently withdraw money and tamper with users’ data. Although Mobile Money users are responsible for securing their end of the system to prevent ‘intruders’ from performing transactions on their behalf, they still stand at risk of the least security breach.

The Ministry of Communications in 2016 reported that mobile phone subscriptions in Ghana had soared to over 35 million. This coupled with the increasing financial literacy in the country, projects a boom in Mobile Money usage in Ghana. Although most mobile payment services/platforms are safe, cyber crooks are constantly trying to outsmart the system and users.

Basic security tips for users include;

– Avoiding sharing passwords with third parties

– Avoiding the usage of weak PINs

– Being vigilant not to fall prey to tricksters

For small and medium-scale enterprises in retail, healthcare, and hospitality among other sectors that look to take advantage of the new technology; the current Mobile Money infrastructure should give the confidence of effectively take charge of business finances in a more secure and convenient way.

In addressing the challenge of having to turn away customers who do not have cash to make payments, leading mobile technology company Hubtel, has introduced a fully integrated payment acceptance solution that enables companies receive payments from customers via Mobile Money and cards securely. While helping businesses make extra profit, it enables them to record and accurately track records of all financial transactions. It’s safer, much more convenient, and very secure.

Despite the ongoing efforts of the authorities to minimize the possible security lapses exploited by fraudsters, ultimately Mobile Money users are responsible for securing their end of the system by utilizing all the tools and information to secure their money.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Last month, a logo I designed 12 years ago was retired.

I made a better one, then joined the company I made it for. I was fascinated by one thing.

They wanted to offer customer service as software to spur entrepreneurship, drive development and raise service quality standards across Africa.

I couldn’t resist.

To have that size impact we would have to enable customer-facing businesses to scale their customer service delivery at very low cost while maintaining optimal control and in one of the toughest places in the world to do business. Either that’s noble genius or absurd ambition. Either way, I wanted in.

Even the smallest of businesses in advanced countries can and often do offer a high level of professional and endearing service. Across Africa, many small to mid-size businesses have yet to feel the urgency to improve the customer service they offer. Service is often not seen as mission-critical for fast growth.

I’m a big believer in companies with a massive transformative purpose, like a company that wants to organize the world’s information. (Google)

It took a while but we found a way to better explain our vision.

“We believe Africa will be a better place when businesses make their customers happy.”

A statement so simple and obvious you could easily overlook the innovation and scale it would take to begin to have any such impact.

Today’s technologies can enable the free exchange of information for almost frictionless decision-making.

So, why not a company that gives any size business in Africa direct access to its entire market and the best tools to serve every single customer equally well. That’s just about crazy enough to work.

David Coleman

David Coleman is Chief Marketing Officer at Hubtel. He loves to read, hang out with his sons, and swim a few laps every weekend.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

On the 21st of December 2015, I got a notification on LinkedIn from one of the directors of a certain company. In his email he stated “We are one of Africa’s leading mobile value added services companies with operations in Ghana, Kenya, Cameroon, and Nigeria. We’re looking to expand our product offering to include some mobile applications. I’ve been looking at your profile and have realized that you would be a good fit for our team”.

I don’t remember exactly where I was or what I was doing when I got this message but boy, was I thrilled! Anyway, I went for what would be a life changing interview and I got in. What followed, is history.

Last month, this same company rebranded from SMSGH to Hubtel Limited with an audacious tagline – Rethink Customer Service – to help serve our customers better and deliver suitable tailor-fit solutions for all businesses.

In an ideal world, every business should know their customers enough to be able to deliver quality and convenience when it comes to service delivery. The interaction between businesses and customers should be seamless and pleasant.

The journey for most businesses is tough, and we at Hubtel understand this. We believe customers are the lifeline of every business and being able to harness that information is key to survival. Visit our website to get more information.

I’m grateful for the opportunity and privilege to work with such an amazing team of great minds.

We are here to stay, change lives and promote growth for businesses.

Benjamin J. T Sackey.

Benjamin is a Product Designer (UX) at Hubtel. Together with his team, they build payment solutions for businesses. He spends time honing his swimming skills or playing table tennis when he’s not behind his Mac.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

A five-man delegation from the Ministry of Information led by Deputy Minister, Kojo Oppong Nkrumah on Tuesday, June 6, 2017, paid a courtesy visit to the Hubtel Offices.

The visit was in part to congratulate Hubtel on its business growth and to officially commence engagement on ways to enhance efforts at growing more technology entrepreneurs.

Key among the discussions was how to drive national development by encouraging the use of engagement tools between public and government agencies and private institutions.

CEO of Hubtel, Alexander Adjei Bram later took the team on a tour of the office.

See highlights from the visit below:

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Since our founding on the 12th of May 2005, our mission has been to make it easier for companies to connect with their customers.

Our work helps ease the customer service challenges businesses face. From delivering millions of business-critical mobile alerts to pioneering mobile banking & online payments, we have continuously sought out the most effective engagement channels and crafted solutions around the most important pain points within our environment.

Thanks to our customers, today we have grown beyond Ghana, set up in new markets, and continue to help businesses rethink customer service across the continent. Through it all, we have literally outgrown both the “SMS” and the “GH” in our name.

Today, we become Hubtel.

Hubtel is built on the singular belief that loyal customers build great businesses. We have come to believe in customer service that blends neatly into the busy lives of consumers.

With the help of our customers, we are on a mission to provide businesses with the tools to build lasting relationships with their customers.

Our new brand marks a new era in which we set higher standards and goals for the value we deliver to our customers as we continue to deepen our offering.

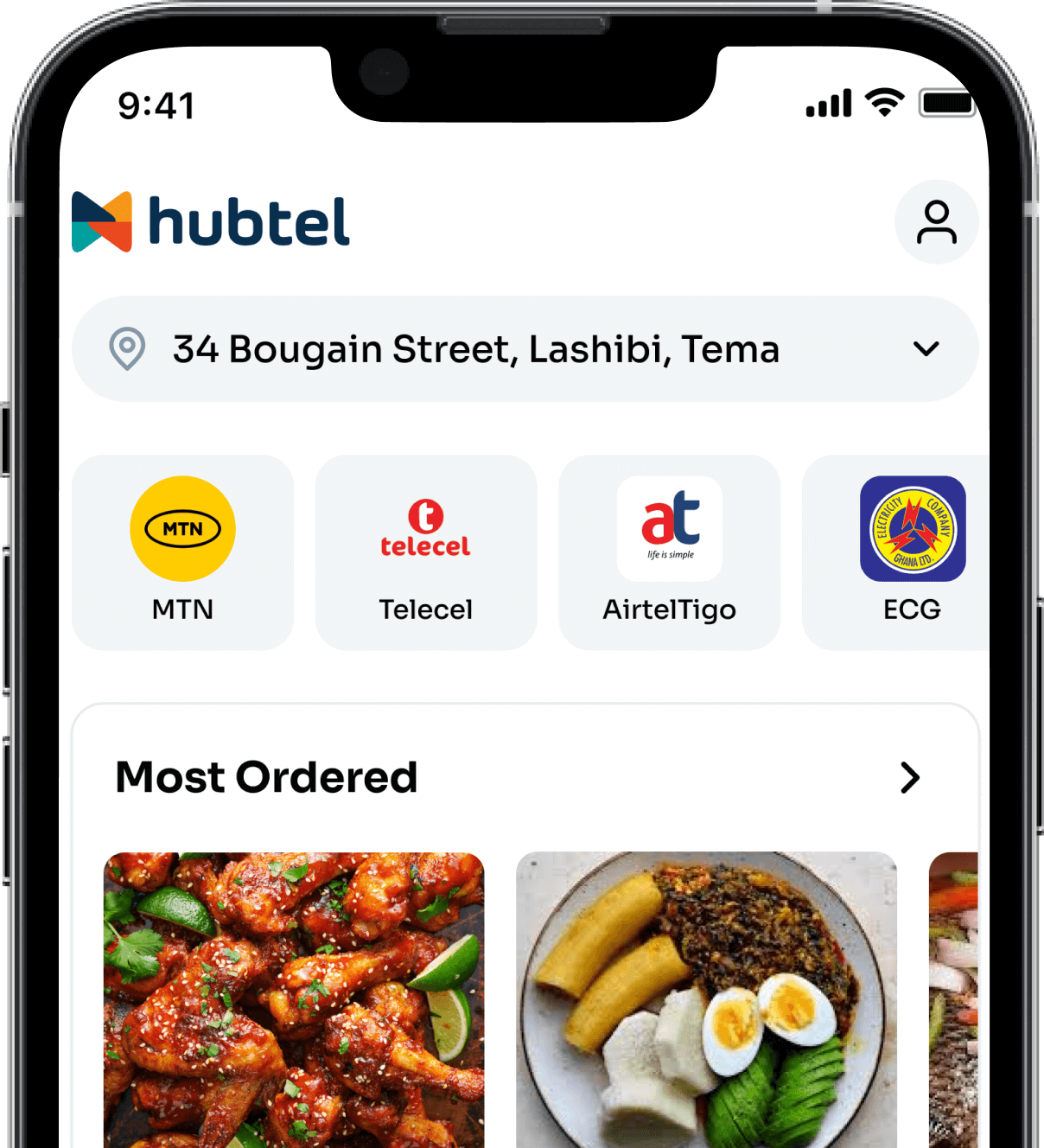

As Hubtel we have carefully reinvented our products into intuitive everyday services. Today we introduce our customers to our new Hubtel platform which hosts all our services, on one single integrated and user-friendly platform.

We wish to share this important day with all our users, and in doing so express our heartfelt gratitude for their patience during our transition to Hubtel, and for their support and loyalty throughout the years.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Hubtel has formally opened its new office in Nairobi, Kenya. The move is a commitment to Hubtel’s continued growth in East Africa to continuously improve its product offerings to businesses in Kenya and beyond.

After 3 years of operations in Nairobi, the office opening was yet another thing to be proud of for the company. Hubtel, which has been in operation for over 11 years, with 30 million customers across 4 African countries; Ghana, Kenya, and Cameroon, and Nigeria has seen immense growth and success since.

CEO of Hubtel, Alexander Adjei Bram said, “ It is a great time in Africa. We’ve never been more connected in our history, we’ve never been at a time where you had the freedom to do what our parents used to do. It is a good time for us to dream. For us at Hubtel, our dream is to ensure that businesses are given the simple tools they can have to make their customers happy; and we believe that Africa will be a better place when businesses make customers happy.”

The office was officially opened by its Chairman, Hans Nilsson, who in his address stated that “Hubtel uses mobile communication which one if not the best infrastructure across Africa, using that to drive and improve business processes is a big opportunity for us as a business but is a more important opportunity to businesses and customers to help drive their own businesses and using the power of it”. In attendance were several of Hubtel’s partners and customers, who were given a tour of the office

The expansion of Hubtel to Nairobi, Kenya will allow the company to better serve and more efficiently handle its East Africa operations as it continues to grow.

About Hubtel

Hubtel is a leading technology company, and provider of customer engagement solutions; such as messaging, payments, and loyalty for businesses across African countries. Founded in 2005, Hubtel has a presence in Ghana, Kenya, Cameroon, and Nigeria. Its clientele comprises of banks, insurance companies, large enterprises, manufacturers, government and utility providers, and many more.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read