Author: Hubtel

Top local mobile value added service (VAS) providers who constitute the Wireless Applications Services Providers Association of Ghana (WASPAG) have suspended all their services on Airtel citing unfair revenue share.

Director of Regulatory and Corporate Affairs for WASPAG, Conrad Nyuur told Adom News that, the mobile network provider, like all other telcos, have over the years been imposing unfair revenue share arrangements on VAS players but this time round “they went too far”.

He explained that Airtel is one of the telcos that keeps 70% of revenue generated by services of VAS providers and gives 30% to the VAS providers, who in turn share their portion with content owners and App developers.

“That revenue share arrangement is bad enough, but just this year they wrote to us and said they will now keep 80% and give us 20% but we resisted and they reviewed it to 75% to 25%, but we still insist it is unfair,” he said.

Nyuur said they therefore gave Airtel one month notice to reverse the decision and that one month ended on March 16, 2016, but they have still not heard anything from Airtel so they have suspended all their services on Airtel until they reserve the decision.

By this action, all premium-rated and subscribed services such as all SMS-based services, caller ring back tone (CRBT), MMS or WAP content services and even some voice services have all been cancelled on the mobile network operator.

This means customers who subscribe to those services, some of which are essential, would no longer enjoy the services until Airtel reaches a compromise with their local VAS partners.

Nyuur noted that this is not the first time VAS players have had to boycott Airtel, saying that in the first instance, Airtel and Tigo failed to pay that exact amount due VAS players as reflected in mutually reconciled financial statement.

“They insisted on paying what they unilaterally collated and we lost money because we had then paid our content providers based on what the reconciled statement said,” he lamented.

He said initially the local VAS players had a 50-50 revenue share arrangement with Airtel but they kept scrapping off part of the share of VAS players every year and claiming it is based on orders from their headquarters in India.

Nyuur said “to add insult to injury”, the network even imposed their Indian-based sister company called ComViva on the local VAS players to play middle man for CRBT services.

“ComViva is nothing but a content provider like us but Airtel forced us to give our content to them in India and then they place it on the Airtel network in Ghana and that has reduced our share of the revenue from CRBT to 11% and not 30% as agreed,” he said.

He said WASPAG is particularly surprised at Airtel because, in India where it is headquartered, it gives VAS players up to 70% of the VAS revenue, but it has decided to shortchange VAS players in Ghana.

“The protest to Airtel’s imposition of unfair revenue share arrangement was necessary because we have endured that unfair cycle for years, where one telco scoops some of our revenue off and once they succeed the other telcos follow and we keep losing,” he noted.

Nyuur said WASPAG is very worried that so far, the telecoms industry regulator, National Communications Authority (NCA) is not providing any real protection for VAS players after licensing special number resources to them at a fee.

He said the last time VAS players took an issue regarding Airtel to NCA, the regulator said it could not interfere in commercial arrangements between two private entities, “but when we suspended our services the NCA said we should restore the services to customers while we negotiate with Airtel.

“We feel that was double standards on the part of the NCA because our commercial arrangement with telcos is always about the customer so why would NCA stay off the arrangement which has ramifications for the customer,” he asked.

Meanwhile, since the WASPAG members suspended their services, Airtel is said to have started feeling the pinch so its officials have called WASPAG for a meeting later today to discuss the way forward, after ignoring the VAS providers all this while.

AIRTEL

Airtel officials reached on the matter confirmed they are aware of the issue but declined comment until after negotiating with the VAS players.

But until then, all VAS services provided by WASPAG members to Airtel customers remain suspended.

WASPAG

WASPAG represents over 20 top VAS providers in the country, and they include MobileContent, SMSGH, TXTGhana, Rancard and many others.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

SMSGH has launched Email Messaging on MYtxtBOX in addition to its SMS and Voice messaging. The primary aim is to give users multiple channels to engage with their audience.

MYtxtBOX is a communication tool useful for businesses and individuals to reach a large number of people through bulk messaging. The addition of email messaging is in response to the demands of customers for messaging content that promotes visual advertising.

Research shows that more than 85% of internet users use email and users have a one-stop communication tool that improves customer satisfaction, saves costs, and inevitably increases revenue.

Features

- Create your own marketing campaigns using Email messaging on MYtxtBOX

- Professionally designed email templates for different email campaigns.

- Preview to check how your emails will look like.

- About 60% cheaper than most email messaging providers

- Pay-as-you-go service

MYtxtBOX remains the most effective communication tool useful for reaching a large number of people with personalized information at the lowest costs.

Send an email on www.MYtxtBOX.com

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Four Things To Consider When Choosing The Right SMS Pricing Plan

March 15, 2016 | 3 minutes read

Over the years, SMS has proven to be a cost-effective communication channel with a 98% open rate. It is accessible by both feature phones and smartphones. Knowing the right SMS pricing plan to use can greatly help you reach your target audience.

The following are useful tips to guide you to choose the right SMS pricing plan.

1. Remain Within Character Limit.

To remain within character limit, you have to take note of the pricing scheme used by your SMS provider. Most SMS providers price an SMS based on the number of characters in the message.

A normal SMS has a maximum limit of 160 characters. For example, if you send a message of 180 characters, you will be charged for the price of two message bodies.

You can adopt shorthand texts to ensure that you use the fewest number of characters possible but still convey your message in the most comprehensible form. For example you can replace for your information with FYI or adopt emoticons.

2. Segment Your Contact List

You can also reduce your messaging costs greatly by ensuring that you are not sending messages to people on your contact list who may not be your target audience.

You can segment your contact list into various groups to ensure that you target your communication at the right audience.

The people who are really in need of your message are most likely going to act on the information you provide them.

3. Take Advantage of Price Discounts

Another point to consider is price discounts. You can take advantage of discount offers that come with high volume thresholds. At SMSGH we offer competitive discounted prices for clients who send lots of messages.

4. Choose The Right SMS Provider

Finally, it is very important to choose the right SMS provider that offers you with the best pricing plan to meets your needs.

You do not want to make the painful mistake of engaging the services of a poor SMS provider. A poor provider will hurt your reputation with your audience with system failures. They will also increase your cost of messaging in re-engaging the services of a better provider.

Note that choosing the right SMS pricing plan is key to the success of your communication.

Contact our sales team at sales@smsgh for more information. You can also check out our pricing page for more details www.smsgh.com/pricing.

Create a free account on MYtxtBox to receive free credit for your messaging needs.

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

Is it bad to charge your phone overnight? What about charging an iPhone with an iPad adapter? Tech myths… whew!!!

Despite how often we use devices like smartphones and laptops, we have plenty of questions about how they work. And with so much information out there — not all of it true — it’s hard to know if we’re treating our electronics properly.

We’re here to debunk some of the biggest tech myths and misconceptions out there.

Mac computers can’t get viruses

Yes, Apple computers are susceptible to malware, too. Apple used to brag its computers aren’t as vulnerable as Windows PCs to viruses, but the company quickly changed its marketing page after a Trojan affected thousands of Mac computers in 2012.

Private/Incognito browsing keeps you anonymous

There’s a misconception that “incognito” and “private” are synonymous with anonymous. If you’re using Incognito Mode in Google Chrome or Private browsing in Safari, it simply means the browser won’t keep track of your history, import your bookmarks, or automatically log into any of your accounts. Basically, it’s good for keeping other people who use your computer from seeing what you’ve been doing. But it won’t keep your identity hidden from the sites you visit or your ISP — so keep that in mind if you’re visiting sites you shouldn’t be.

Leaving your phone plugged in destroys the battery

If you’re like most people, you probably leave your phone plugged in overnight long after the battery is fully charged. Some used to say this would hurt your phone’s battery life, but in fact, there’s no proof that this damages your phone’s battery in any way. Modern smartphones run on lithium-ion batteries, which are smart enough to stop charging when they’ve reached capacity.

You should always let your iPhone battery completely die before recharging

This, too, is a popular myth. Apple points out that its modern lithium ion batteries mean that “You complete one charge cycle when you’ve used (discharged) an amount that equals 100% of your battery’s capacity — but not necessarily all from one charge.”

More megapixels always means a better camera

What’s the difference between 12-megapixel cameras and 8-megapixel cameras? Not much, as it turns out. The quality of an image is determined in large part by how much light the sensor is able to take in. Bigger sensors may come with larger pixels, and the larger the pixel the more light it can absorb. So, it’s really the size of the pixels that matter as much or more than the sheer number of pixels. (A megapixel is simply shorthand for a million pixels.)

Here’s how TechCrunch’s Matthew Panzarino, who’s also a professional photographer, describes the role of the pixel: “Think of this as holding a thimble in a rain storm to try to catch water. The bigger your thimble, the easier it is to catch more drops in a shorter amount of time.” The thimble is a metaphor for a pixel — using a few buckets would be much more efficient than a bunch of thimbles for catching water.

Higher display resolution is always better on a smartphone

Some have argued that at a certain point, screen resolution doesn’t matter on a smartphone. Gizmodo cites experts in saying the human eye can’t discern nitty-gritty detail when a display packs more than 300 pixels per inch. Earlier this year, LG unveiled its first quad-HD smartphone, the G3, which has a resolution of 2560 x 1440. That’s much higher than the average high-end smartphone, which usually comes with a 1920 x 1080 resolution display.

But it’s unclear if those numbers really matter after a certain point because the eye can’t discern individual pixels beyond a certain resolution. When I tested the G3’s display alongside the 1080 Galaxy S5’s display, there was hardly a difference in terms of sharpness — that’s why companies like Apple tend to focus on brightness, more so than ultra-dense displays.

It’s bad to use your iPad charger for your iPhone

This one is a little trickier than a standard “yes or no” answer. Apple’s official website says its 12-watt iPad adapter can charge both the iPhone and the iPad. However, Steve Sandler, founder and chief technical officer at electronics analysis company AEi Systems, told Popular Mechanics that this could stress your iPhone’s battery over time if you do it regularly. It would take about a year, however, to notice any changes in battery efficiency.

You shouldn’t shut down your computer every day.

While some may believe it’s harmful to shut down your computer every night, the truth is it’s actually good to turn off your computer regularly. It’s easy to get into the habit of putting your laptop in sleep mode so you can easily return to it without having to boot up. But, as Lifehacker points out, shutting it down when not in use conserves power and places less stress on its components, which could enable it to last longer.

Holding a magnet close to your computer will erase all of its data.

This technically isn’t wrong — you may remember how easy it was to wipe a floppy disk using a magnet back in the day. But you would need a really, really big magnet to wipe out your computer’s hard drive. Experts told PCMag that hard drives on modern computers would only be susceptible to really strong magnets with really focused magnetic fields. So your average refrigerator magnet wouldn’t do the trick.

Cell phones give you brain cancer

Although cell phones emit radiation that can be absorbed by human tissue, there isn’t any conclusive evidence showing that cell phones actually cause cancer.

Here’s what a report from the National Cancer Institute in the USA says:

Although there have been some concerns that radiofrequency energy from cell phones held closely to the head may affect the brain and other tissues, to date there is no evidence from studies of cells, animals, or humans that radiofrequency energy can cause cancer.

More signal bars guarantees great cell service

While having more bars helps service, it doesn’t necessarily guarantee excellent reception. The bars just indicate how close you are to the nearest cell tower. But there are other factors that impact how fast the internet on your phone performs, such as how many people are currently using the network.

Credit: Tech Insider

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Cashless Payments and Business In Ghana: New Money Never Closes

March 8, 2016 | 3 minutes read

Over 130 million mobile money transactions in 20151, 5 million mobile wallets and a population of over 25 million2. These times signify limitless possibilities for commerce in Ghana!

In the ever-evolving world of business, a key differentiating factor between businesses that lead the pack and those that are left behind is their ability to rapidly adopt new technologies that increase productivity and outcomes. The local Ghanaian business scene is no different.

Cashless Payments, The Next Business Driver

When it comes to accepting cashless payments for goods and services, mobile payments is becoming the major technological driver. This has been due to its unique characteristic and ability to reach both the underbanked and unbanked sectors of the economy who form 80% of Ghana’s population. There has never been a better time to assess your business’ readiness to exploit the emerging opportunity for commerce in a cashless economy than now.

From cash to cheques, to credit cards and debit cards, and now to online banking and mobile commerce, payment methods and rise of mobile phone penetration is changing the way business accept payments!

MPower Payments, the foremost digital payments enabler in Ghana is propelling new innovative channels for businesses seeking to benefit from the cashless revolution. MPower recently introduced the MPower Mobile Point of Sale application (mPOS) to allow businesses operating from any physical location to accept various forms of cashless payments.

mPOS is designed to work across a wide spectrum of industries; from supermarkets, restaurants, hotels, salons, small shops, to delivery agents. No matter the business size, mPOS is easy to set up for various store locations or at multiple sales points within a single store.

Customers purchasing from mPOS enabled merchants can choose their preferred mode of payment – be it their MPower wallet, mobile money on any network or bank card. The mobile nature of mPOS means the point at which payments is made is not restricted to stationary cash registers and this can potentially go a long way to reduce queues. Businesses on the other hand will no longer lose sales from customers carrying limited cash. mPOS simplifies daily sales management and eliminates the risk of transporting physical cash to the bank.

MPower seeks to make mPOS accessible to every businesses by removing the financial barriers to inclusion hence set up is currently free.

Get started at www.mpower.com.gh or call MPower on 0202532273 to request a demo.

–First published on www.GhanaWeb.com

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

We are in the golden age of technology. Within the larger movement; however, each one of us is directly influenced by the take off of a more recent and rapidly developing financial technology (FinTech) space—an industry projected to attract approximately $20 billion in funding by 2017, estimates Statista.

Financial technology is a democratizing force that can change our lives by making financial tools and services accessible, faster and more easily understood — most times at a lower cost. Complex algorithms now often take the place of traditional advisors, perhaps offering more efficient and personalized products for end users.

From budgeting tools to alternative lending and investment options, payments processing, and philanthropic platforms, we have a lot to gain from the advent of financial technology startups. Learn below about just a few ways in which you can leverage these hot new platforms before they inevitably become common applications for the entire public.

Payments Made Easy

The advent of payments technology has made consumer spending, and all other forms of payment easier, faster, and more secure. Payments technology startups, such as Square, help small businesses get off the ground by adopting easy to use and cheaper credit card payments processing. Instant, reliable transactions are important for day-to-day sales, along with employee payroll processing.

Venmo, a payments app, has provided a “free digital wallet” to the mobile devices of thousands, by allowing friends to connect quickly and securely via Facebook to request and send money to each other in a few taps on their phones. Furthermore, on the consumer side, platforms such as Apple Pay and Bitcoin continue to disrupt the traditional method of pay. When sending money abroad, individuals should consider using money transfer services such as TransferWise to save on international transfer fees.

Lend a Helping Hand

Peer-To-Peer (P2P) business models have fueled a new sharing economy revolution, with many products and services such as home rentals, cleaning services, and anything else under the sun being “uberized.” New FinTech startups have uberized the online lending space, allowing you to access funds through unconventional ways, without the help of big-name banks or a network of established lenders.

Platforms such as U.S.-based LendingClub and Prosper, and U.K-based Zopa have individually issued millions of dollars in loans, joining the rising number of tech unicorns in today’s entrepreneurial space.

Crowdfunding: The New Venture Capital

Investment in crowdfunding platforms may surpass venture capital funding in 2016. Popular sites Indiegogo and Kickstarter have helped thousands of ideas get off the ground – from bizarre video games to social projects and multi-purpose jackets, small businesses and entrepreneurs can now look to the general public for support. Countless other sites such as GoFundMe, which took off by bootstrapping, allow individuals to raise money for any project they like.

A ‘Bankless’ World

The headline of loan refinancing startup, SoFi’s website reads, “Great news: we’re not a bank.” Over the past few decades, we’ve seen a general distrust and loss of confidence in our traditional banking system, dominated by the big banks. After the Global Recession in the late 2000s, a new generation of startups hopes to fix the transparency issue facing big banks and provide consumers with more personalized and comprehensive services online.

Nasir Zubairi, venture partner at FinLeap in Berlin, commented on the FinTech industry, stating that “3 billion people, 50% of the world, do not have access to a banking system, and I think that FinTech can help in solving the problem around credit. There’s a huge opportunity for FinTech companies and of course for people who will benefit from their solutions.” Startups such as Kabbage, a small business lender, take into account a myriad of factors such as eBay data into account when determining risk, providing more of a data-driven service unhindered by the same regulations that restrict the traditional banking system. Countless other platforms such as CreditKarma offer credit risk services at zero or low cost.

Democratizing Investment Products and Services

Robo-advisors continue to gain traction as a provider of investment services once solely accessible to wealthier individuals who could afford their own financial advisor. An online advisor is now available through multiple platforms such as Wealthfront and Betterment. Wealthfront manages your first $10,000 free for a small fee of .25% after that while Betterment charges .35% to .25% annually or $3 per month. A series of questions, including an individual’s age, determines a user’s risk tolerance, which then determines the portfolio allocation for each specific individual. If you are unwilling or unable to invest your money yourself, or through a trusted financial advisor, an online platform is a much better way to direct your savings to their most effective use.

FinTech startups aren’t stopping at stock investment, however. For the growing number of Americans who seek involvement in alternative investing and philanthropic projects, the FinTech industry continues to deliver. Take Neighborly, a social venture helping you get involved in the municipal bond market. Neighborly’s Community Investment Marketplace allows you to make an impact directly in your community through safe and lucrative investing.

Budgeting: A Virtual Piggy Bank

As many tech startups target millennials, there’s a significant opportunity for business to facilitate the process of a new generation beginning to save, lend, and invest their money. Millennials don’t simply want to watch the purchasing power of their money wither away in a bank account; instead, they’re using budgeting and educational platforms to help them with a financial strategy. Alongside their robo-advisors, individuals can use budgeting platforms such as LevelMoney and Acorns that automatically track spending and income to give users a daily allowance for the day. This helps people grasp exactly how they are spending their hard earned dollars. Other platforms find creative ways to save you a dime. For example, Paribus scans users emails for receipts following a purchase to get money back in the case of a price drop.

The Bottom Line

FinTech is on the fast track to growth, and it’s not just investors who can benefit from the success. Be sure to stay up to date on the rapidly evolving FinTech sector, which will help drive a democratization of financial tools and services, from payments to wealth management and philanthropy. Ultimately, whether FinTech will take the place of traditional banking entirely is up for debate. However, the plethora of cost efficient and accessible financial tools and services will undoubtedly force the entire financial sector to transform.

Credit: Investopedia & JumpFon.com

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Short Code – The Definitive Guide to Mobile Messaging & Marketing

February 9, 2016 | 4 minutes read

“Text HOT to short code 1901 for the best music from your favourite artistes on your phone!”

“Be the first to know! Text NEWS to 1944.”

“Win airtime every day! Text FREE to 1902.”

You have most likely seen hundreds of these text messaging campaigns or heard about them, but wondered what these funky 4 or 5 digit numbers are, or where they come from.

Well, here’s your answer.

They’re called Short Codes.

As an individual or business, reaching out to friends, clients and customers in the most personal way – their mobile phones – should be of great interest to you. These days, more organizations and businesses are turning to short codes as the backbone of their SMS messaging and marketing campaigns, as they have realized that text message marketing is a very quick, inexpensive, and more productive way to reach their customers (or potential customers).

Short codes have also been made more popular in the last few years by a number of television shows that allow viewers to text a message to a short number. Examples include viewers sending a text message to a short code to vote for their favorite contestant of a reality TV show, or to make a charitable donation.

What is a Short Code?

An SMS short code is short numeric number (typically 4-5 digits) that is used to opt-in consumers to SMS programs, and then used to send text and multimedia messages, offers, promotions and more, to those customers that had previously opted-in. A consumer interacts with an SMS short code by composing a new text message on their mobile device, and addressing it to the SMS short code. In the examples below, the SMS short codes used are 1901, 1944 and 1902.

SMS Keywords

When a customer wants to opt-in to an SMS campaign, they’ll not only need to know the SMS short code, but they’ll also need to know the SMS keyword for that specific campaign. The SMS keyword helps a provider like SMSGH determine which SMS campaign the consumer is trying to opt-in to. Once received, the SMS provider routes the message through the SMS software, which then would send back a confirmation text message to the subscriber who originated the message. In the first example above, the SMS short code used by this business is 1901, and the SMS keyword is “HOT”.

Here are five things to appreciate about short codes, and how and where to get them.

1. An SMS short code service is one of the quickest and most effective ways to get your marketing campaign off the ground.

2. SMS marketing enables you to engage your prospective customers at the point of display, and you can quickly generate sales leads using SMS marketing. Wireless subscribers send text messages to common short codes with relevant keywords to access a wide variety of mobile content.

3. There are two kinds of short codes: shared and dedicated. Dedicated short codes are owned and managed by one body, are costly and take a while to set up. In Ghana it can cost anywhere from GHs5,000 to GHs7,000 per year and take up to 72 hours to get ready. Click here to get more info.

4. Shared short codes are used by many different bodies. Each business sharing a short code would be assigned a unique SMS keyword, which helps an SMS provider like SMSGH determine which SMS campaign a user is trying to opt-in to. The cost involved in setting up a shared short code is less than that for a dedicated short code.

5. If you text STOP or HELP to a short code, the service would respond. This is implemented to help users respectively end a subscription or learn more about the short code service, and is useful for managing these services.

Can’t wait to see what you can do with short codes? Get started today. Talk to a sales expert now. Or see short code pricing here.

Related

Now, Pay Small Small for the Things You Love

December 23, 2024| 2 minutes read

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

What You Need To Know To Run A Successful SMS Marketing Campaign

February 4, 2016 | 10 minutes read

If you haven’t started looking for ways to add Short Messaging Services to your marketing mix, now is the time.

Yes, I know apps are the craze these days but we’re still at about 15% smartphone penetration in Ghana.

That means there may still be a lot of your customers that don’t have smartphones. Also, just because they have a smartphone doesn’t mean they use it for all that it’s capable of. Just ask my dad—he has the latest and greatest of phones at all times and all I get from him are texts with photos of my niece.

One of the greatest things about SMS is that nearly 100% of all devices on the market are SMS enabled, making it the mobile channel that offers the widest reach possible.

Some of the top brands invest heavily in SMS today to communicate with customers because over 90% of SMS messages are read within 3 minutes of receipt.

Yes, that immediate!

In fact, it’s been reported that Coca-Cola historically has invested 70% of its mobile budget in SMS marketing.

When asked why, Tom Daily, the Director of Mobile, Search, and Global Connections replied, “It is important to invest your energy into things you know work, and we know that SMS works and is a thing to focus on.”

In addition to its reach and immediacy, SMS is very affordable and offers an amazing ROI for marketers when used properly.

If you’re ready to dive into SMS marketing and leverage this amazingly powerful channel it’s important that you’re set up for success and not just using mobile for mobile sake.

- Understand Your Goals

When diving into mobile marketing, it’s common to approach it as its own initiative.

That’s typically the worst direction to take.

Businesses that approach mobile as a silo will almost never get the results they were hoping for or even expected.

Before diving into your execution, it’s wise to review your business and marketing goals so that you’re creating your SMS campaign through a lens that takes your current business goals into account.

Having S.M.A.R.T goals (Specific, Measurable, Achievable, Relevant, and Time Specific) will assure your SMS campaign is executed in a way that meets your objectives.

It’s important to understand that your SMS campaign will likely impact many parts of your organization, so communicating your goals and strategy clearly throughout the organization is critical.

- Build An Ark

Your SMS mobile campaign will impact many departments of your company. Having a cross-functional team to help conceive and operate the SMS programs will be one of the most important parts to winning with SMS.

For example, let’s say you’re building a mobile loyalty list to drive customers to retail.

Having led the mobile efforts for Cabela’s previously, I know very well just how many people this type of effort can impact.

We had a cross-functional team that included members from teams responsible for retail, in-store signage, digital creative, email, IT, social media, promotions, and the discounts budget, as well as two external teams.

Build out your ark and make sure everyone is on the same page when it comes time for execution.

- Clear Call-To-Action

One of the most common reasons SMS campaigns fail is that the call-to-action isn’t presented in a way that the consumer recognizes or understands what to do.

Take this example from Pepsi. They tell consumers to Text “PEPSIMAX” to 710710.

Having been involved in SMS since 2005, I can tell you that a significant amount of people probably texted with quotations around the keyword, which actually doesn’t trigger the campaign.

SMS campaigns are driven by two factors – the keyword and a short code. In this example, PEPSIMAX is the keyword and 710710 is the short code.

It’s common and best practice to capitalize the keyword and shortcode to make them stand out within the call-to-action.

One thing Pepsi is doing really well here is making the SMS call-to-action the focal point of the creative. I’ve found SMS CTA’s in the fine print far too many times.

If you want to drive engagement, give your SMS CTA the priority it deserves.

For instance, JumpFon, a premium content provider employs this catchy creative banner to advertise its Lifestyle content services.

The call-to-action is bold and straightforward, well highlighted by the difference in color to draw emphatic attention to the focus of the banner, which is the Keyword and Shortcode.

This presents the message clearly to users avoiding any ambiguity in the expected action to take to subscribe to the service.

- Leverage Incentives

Let’s not kid ourselves. Our mobile device is one of if not the most personal device we have. The consumers that welcome you into their phone, especially through SMS, should be considered some of your most loyal customers.

With that said, you want to treat your most loyal customers with some extra love, and a great way to do that is to incentivize customers to opt in by giving something of value.

Typically, you’ll see brands doing a percent off or dollar off coupons to save a few bucks.

In the early stages of your SMS campaign, as you’re building your list, starting with a low-value offer (say up to $20 off) can really help drive opt-ins and spark your initial list growth.

Once you’ve got people opted-in, you can leverage “spend and get” campaigns or “Buy One Get One” campaigns (also known as BOGOs).

I personally love “spend and gets” because they can really help you increase your average order value (AOV) while self-funding the campaign (great when your discount budget is super tight).

Let’s look at an example:

Say your AOV is $100.

Sending an SMS message to your database with an offer: “Get $20 when you spend over $150” can be really effective.

A customer will come in and be inclined to spend $50 more than they usually do knowing they’ll get back $20.

For the sake of the example, let’s say they spend $150 exactly.

You’ve just increased your AOV by $50. When you give the customer their $20 voucher, you’re left with a $30 incremental lift for that customer.

Multiply that by the soon-to-be hundreds, if not thousands of people that redeemed your offer, and you just drove some significant revenue with one message.

Now remember, incentives don’t always have to be monetary.

I know a lot of brands that are not “discounters”. I worked for one of them.

You can still have an effective SMS campaign by offering non-monetary incentives.

Your non-monetary incentives can focus on:

- Personalization – “We’ll notify you when your favorite item comes in.”

- Reminders – “Your shipment will be delivered today.”

- Engagement – “Tell us how we can help you.”

- Access – “Here is early access to this special thing just because you’re a loyal SMS subscriber.”

- Privileges – “Here is this special thing we only share with our SMS VIPs.”

Try incorporating your incentives in your call-to-action from number three and really drive opt-ins.

- Permission Is Required

Just like email, SMS is a permission-based opt-in channel.

Your customer needs to clearly opt in to receive what you’re offering.

This can happen in one of two ways:

- By texting a keyword to a short code (such as the Pepsi and JumpFon example from above), or

- By submitting their number via a web form.

Either way, it needs to be obvious the customer has consented to receive these messages.

You can’t just look through old customer records and add mobile numbers to your database and then message those customers.

- Leverage Immediacy

Over 90% of SMS messages are read within 3 minutes.

That makes SMS one of, if not the most immediate channel available to connect with your audience.

Understanding this immediacy is important to your success and driving customer action.

If you have an event on Friday evening, sending an SMS message any time before Thursday evening is too soon.

With your messages guaranteed to reach your customer and disrupt whatever it is they are doing, it’s important that you aim to deliver extremely high value via a very clear and concise call to action.

Since SMS messages only allow for 160 characters (some of which require your compliance language from above) it’s important to be short, sweet, and to the point.

- Consistency

One of the biggest mistakes businesses make when using SMS is not sending messages consistently enough.

Like any other aspect of marketing, you should be leveraging any marketing or promotional character at your disposal. If there isn’t one, you should be sure to create one and use that as the foundation for your messaging calendar.

When it comes to messaging your customers, you obviously want to have something of value to say within each message, but going months without connecting via SMS is likely going to cause a high unsubscribe rate with every send.

Some of the most successful businesses leveraging SMS today, such as Starbucks, Target, Macy’s, and JC Penney, are sending at least one message a week to stay at the top of the minds of their customers.

- Media Integration

In general, mobile is one of the most dependent marketing channels that exist. When it comes time to promote your SMS program and drive adoption, it’s important to leverage all of your existing media outlets, whether that’s TV, radio, print, in-store signage, online, social, email, etc.

Performing an audit of your existing media assets to identify where you can integrate your SMS calls-to-action will help align you with the right teams to make sure the creative development process includes SMS integration.

Remember, you’ll want to make sure the SMS CTA is clear and easy to read—not buried somewhere in the signage.

Your goal isn’t to check a box by having an SMS CTA integrated within your existing media; it’s to extend the reach and interactivity of your existing media and create an opportunity for continued engagement.

Performing an audit will identify all of the media outlets to integrate your CTA so that you can be on the same page as the rest of your cross-functional team.

- Measurement

The only way to determine if your SMS campaign is successful or not is by measuring.

When it comes to SMS there are a handful of things you can do from a measurement perspective. The great thing is that they are all fairly easy to manage. Here are a few metrics to follow when executing an SMS campaign:

- Subscriber Growth: Monitor your growth rate each week and identify which activities make the list grow.

- Subscriber Churn Rate: This is the frequency at which people are opting out of your SMS program over time. Ideally, your program never goes over a 2-3% churn rate.

- Cross Channel Engagement (by keyword): By using different SMS keywords within different media outlets, you can quickly measure which types of media and media locations are performing best and optimize based on engagement.

- Redemption Rate: This is something you’ll monitor on a campaign-by-campaign basis (or by message) to determine the percentage of customers that redeem your offers and what rates.

- Cost Per Redeeming Subscriber: From the redemption rate, you can determine the cost of communicating with each customer that receives your SMS messages.

When it comes time to plan and launch your next SMS marketing campaign, be sure to account for these 10 components and you’ll be well on your way to a successful SMS marketing campaign.

Have you tried using SMS yet in your business? If so, have you seen success? If you haven’t started, are you thinking of giving it a shot? Sign up for business messaging tools on MYtxtBOX.com.

Original story found at convinceandconvert.com

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Technological change has always posed a challenge for companies. But, as we saw once again in 2015, it has never occurred as rapidly, or on as large a scale, as today. As innovation sweeps across virtually every sector, from heavy industry to services, it is transforming the competitive landscape, with the most advanced companies – rather than the largest or most established players – coming out on top.

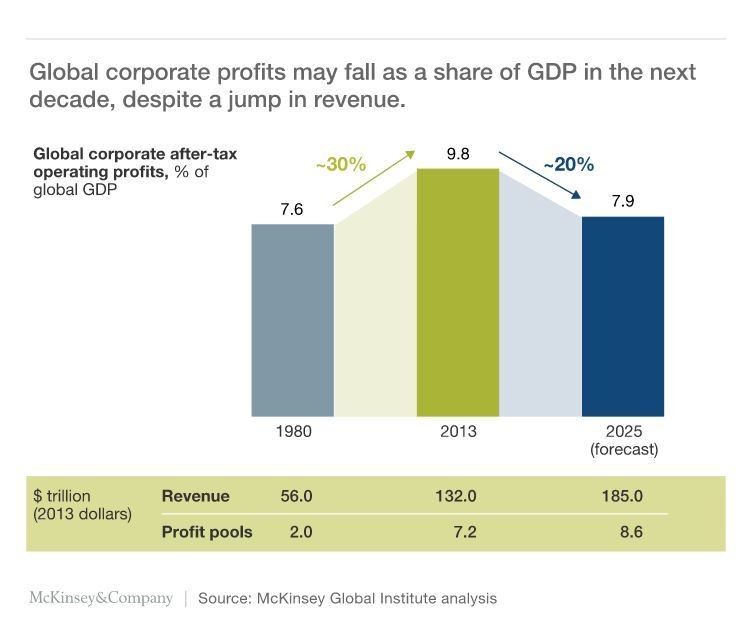

For incumbents, the threat of displacement is very real. The average tenure of a company on the S&P 500 has fallen from 90 years in 1935 to less than 18 years today. Disruptive new players like Uber, which has upended the taxi industry, are tough competitors, often staking out market share by shifting more surplus to consumers. This is part of a broader trend of intensifying competition that, according to recent research from the McKinsey Global Institute, could reduce the global after-tax profit pool from almost 10% of global GDP today to its 1980 level of about 7.9% within a decade.

The effect of technology on competition arises largely from the power of digital platforms and network effects. New digital platforms reduce marginal costs (the cost of producing additional units of a good or service) to nearly zero. Adding, say, a Google Maps user carries negligible costs because the service relies on GPS location data that is already stored on a user’s phone. This allows Google to scale incredibly quickly, and then to leverage this scale (and the convenience of having a single platform) to move into adjacent sectors – such as music (Google Play), payment (Google Wallet), and word processing (Google Docs). In this manner, tech firms can quickly come to challenge incumbents in seemingly unrelated industries.

Of course, tech firms are not the only ones innovating. A handful of leading firms in practically every industry are deploying digital technology in increasingly sophisticated ways – and seeing huge benefits. The use of sensors to monitor livestock, for example, has far-reaching implications for the food industry.

But the most digitally advanced sectors show the greatest progress. Indeed, over the last 20 years, profit margins in these tech-infused sectors have grown 2-3 times faster, on average, than in the rest of the economy. Even within the most advanced sectors, there is a yawning gap between the top-performing companies and the rest of the pack. For example, the retail offerings of digitally advanced multinational banks far outstrip those of local credit unions.

As technology transforms business models and processes, it is also changing the way employees work. Recent McKinsey research finds that already-proven technologies could automate as much as 45% of the tasks individuals are currently paid to perform. In the United States alone, that is the equivalent of about $2 trillion in annual wages.

The potential benefits of this transformation for companies extend far beyond cost savings, as workers gain time to pursue more valuable tasks involving critical thinking and creativity. Financial advisers can spend less time analyzing financials and more time developing solutions that meet clients’ needs. Or interior decorators can shift their attention from taking measurements to devising design concepts, meeting with clients, or sourcing materials.

Technology also allows companies to rethink conventional wisdom on organizational design and governance. New information-sharing technologies deliver greater transparency, making organizations more efficient and, in many cases, less hierarchical.

For example, the CEOs of Apple, Inditex (a multinational clothing company), and Zappos (a large online retailer) have adopted broad spans of control (the number of subordinates directly reporting to a manager) that far exceed the traditional model of “one to four to eight.” Haier, the Chinese white goods manufacturer, reorganized its 80,000-person workforce into 2,000 independent units, each responsible for managing its own profits and losses. Since the move, its market capitalization has soared, tripling from 2011 to 2014.

Moreover, digitization allows companies to operate as “platforms,” not structures, and make greater use of resources outside their company. The insurance company Allstate used the crowdsourcing platform Kaggle to invite programmers to develop a new car accident injury algorithm; the eventual “winner” was 271% more accurate than its existing model.

Likewise, China’s DJI became the world’s largest drone manufacturer by focusing on its products’ core technology, while giving away developer kits for free online so that others could build apps. This approach meant that DJI’s drones were equipped with attractive features far earlier than competitors’ products, which relied on in-house app development.

Similar technology-driven innovations in thought processes and business models can be seen across the economy, reflected in changes in companies’ planning processes. Some have begun creating separate business plans with two-month and 20-year views, reallocating their resources more aggressively, and using new analytical techniques to identify, attract, develop, and retain talent.

Technological innovation enables – indeed, requires – companies to boost their agility and thus their competitiveness. That’s why CEOs’ top priorities in 2016 should be to digitize the core components of their business and rethink organizational design and governance processes. Catching this fast-moving – and rapidly growing – “digital wave” is the only way to avoid getting left behind.

Author: Dominic Barton is the global managing director of McKinsey & Company.

Source: weforum.org

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

2015 has been an exciting year at SMSGH in many ways. With the launch of JumpFon Stream, MYtxtBOX.com’s extension to include voice messaging, the celebration of its tenth anniversary, and the growth of the SMSGH team across Ghana, Kenya, Cameroon, and Nigeria, the company is making strides to deliver topmost services to customers.

The year got even more exciting on Friday 18th December 2015, when SMSGH once again reaffirmed its position as a leading brand for technology, value addition, and market acceptance with its recognition as the Overall Best Performing Content Provider and the Top Contributor at the 2015 Meeting with the CEO, organized by MTN Ghana for all Value Added Services (VAS) partners operating via the network’s infrastructure.

The afternoon commenced with an overview of the performance of the VAS business division led by the MTN VAS team. Chief Marketing Officer of MTN Ghana, Cynthia Lumor, led another session on corporate and legal regulations surrounding the provision of content services. She also touched on the outlook for new regulations in the coming year, reminding players in the VAS industry of the importance of strict adherence to NCA guidelines and urging their cooperation in ensuring fairness among providers as well as the protection of consumers. Then followed a review of top performing Content Providers within the 2015 business year.

While we are extremely honored by these prestigious awards, we are even more delighted by the opportunity to enable our customers’ success. SMSGH recognizes the role users played in reaching this level of performance. In this light, the company dedicates the award to its current user base who have remained loyal in patronizing the top services offered.

Partner Sales Manager of SMSGH, Nana Kwame Adu-Gyamfi, summed it up well, saying, “Winning the VAS provider of the year award is a nice way to round off a year in which we had a number of significant milestones. Thanks to our customers for their trust in SMSGH in 2015. We look forward to working together to support their growth in 2016. Thanks also to everyone at SMSGH for all of their hard work in making all of this possible!”

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

MPower is saying welcome to its new customers in a special way this holiday season. by giving away GHS5.00 free for the first wallet top-up. This means any customer who opens an account on MPower will receive GHS5.00 upon topping up their account for the first time.

MPower is an online payments service in Ghana offering a complete end-to-end web and mobile payment transactions solution to enable consumers and businesses send, spend and receive money. The aim is to redefine payments and transactions in Ghana by empowering businesses and consumers to do more with their money conveniently.

MPower has integrated with major local ecommerce merchants to enable users buy and pay for goods online from the comfort of their homes and offices.

To cash in on this offer, users only need to create an account and top up their wallet with mobile money, bank deposit or debit card.

Creating an account on MPower takes 4 simple steps:

1. Go to www.mpower.com.gh.

2. Click Create an account to sign up.

3. Complete the form and submit

4. Activate the account with the activation code sent to your phone.

With many ways to spend money on MPower one can shop from their favorite online shop, buy airtime and pay bills from the MPower CornerShop. Fees and charges that apply per the various transactions performed are listed on the MPower Service Fees page.

The offer started on 10th December and the first 2000 users to sign up and top up will be receiving the GHS5.00 in their accounts to spend.

Visit MPower today at www.mpower.com.gh or simply dial *714*44#.

MPower is saying ‘Be MPower’ed’ this festive season!

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

The MTN Career Fair is an initiative by MTN Ghana to bridge the career guidance and counseling gap for graduates and final-year students and also assist them in their search for employment. Since its inception in 2013, the fair has been held annually and this year’s event took place at the National Theatre on the 9th December, 2015, from 9am to 4pm.

The event was patronized by thousands of students and unemployed graduates as well as companies from various industries in search of the best talents to occupy available positions in these firms.

The fair opened with a welcome address from the Chief Marketing Officer (CMO) of MTN, Noel Ganson, who said it was a platform for students and young graduates to acquire the knowledge and the necessary empowerment needed to start a professional career and to meet the challenges of a dynamic corporate world.

A key highlight of the event was a presentation on career planning by Ama Benneh, Human Resource Director of MTN; registered participants received guidance on how to write compelling CVs and prepare for job interviews.

Other notable speakers present at the fair included the host of Accra-based Citi FM, Bernard Avle, seasoned speaker, Emmanuel Dei-Tumi, respected author, Comfort Ocran, and the Head of Research and Engineering at DreamOval, Henry Sampson.

Attendees also had the opportunity to meet recruitment agencies and prospective employers for job interviews during the fair.

SMSGH was present at this year’s event to interact with job seekers and to find the relevant talent to join the team.

SMSGH sought various skilled individuals to fill positions in its Technology, Sales, Marketing, and Operations departments. These roles specifically include software development, customer support, copywriting, visual designing, and event management.

Details on open positions at SMSGH can be found on the careers page on the website. Interested candidates who qualify for these roles may apply directly on the page or submit their CVs to [email protected].

Related

Hubtel Attains ISO 27001:2022 Certification

February 24, 2025| 2 minutes read

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read