Tag: Feature

Is a Loyalty Rewards program right for your business? Every business runs on customers – loyal customers. One way to keep them coming back for more is to reward them for using your product/service.

Will Loyalty Rewards Work For Your Type of Business?

Appreciating your customers with loyalty rewards sounds like a good plan, and it is. The question is: Does your business model support this type of customer engagement/retention plan? Depending on how your business is set up, implementing this type of customer retention strategy might seem hard to do. A typical example is a real estate agent/broker. It’s not every day that people buy homes. Most of your customers may buy a house or two in their lifetime. But all the same, you can think of other creative ways to get your customers to refer you to other potential buyers. A referral is always a great way to get new customers.

What Kind of Businesses Need This Strategy?

Let’s look at another example: A fast food joint. People eat every day. So employing a loyalty rewards system can work fine for such a business. Other examples include a barber shop, restaurant, shopping mall, pharmacy, etc. Any kind of business that has returning customers will benefit well from a reward system. The amount of returns the customers make also adds up to whether or not you need to implement this customer retention/engagement strategy.

Do You Have a Way to Efficiently Implement a Rewards Program?

The biggest obstacle to running a loyalty program is implementing it. Going the old-school route and printing out loyalty cards is a pain, and often expensive. Luckily, digital loyalty reward schemes like the one included in Hubtel POS for customers of businesses remove this obstacle by making it easy to create rewards, engage customers, and keep track of your customers.

Any business that signs up on Hubtel POS has a loyalty reward system implemented automatically. All you have to do is ask your customers to provide their phone numbers at the point of sale. Once you have their number, they’ll get free points which they can redeem for airtime, internet bundle, and even mobile money after each successful sale. All this is handled by Hubtel without you lifting a finger. Sounds awesome? Sign up for a free Hubtel POS account at hubtel.com/pos and start rewarding all your customers so they keep coming back for more.

Hubtel – What We Do

We help businesses with a very easy-to-setup software to process sales in-store, online, and mobile so they can continuously delight their customers.

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

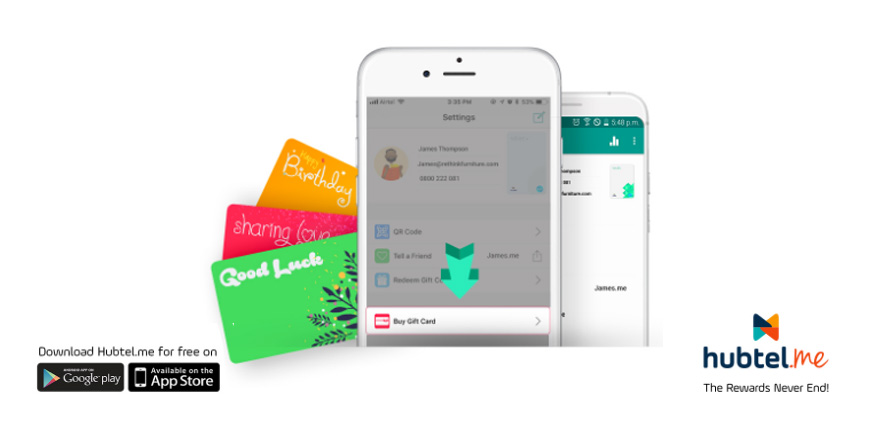

Hubtel.me – The Rewards Never End

You’ve probably bought airtime or internet bundle today. The question is: Did you get anything extra after making the purchase?? That’s aside from the actual internet bundle or airtime you paid for. If not, this is a chance to jump on some freebies – cash actually.

I bet you’ve spent more than GHS100 this month alone on airtime. Unless you’re not monitoring – which you should. Plus if you bought the said airtime using the Hubtel.me app, you’d have a history of the transaction right in the app?

The Only App That Rewards You For Using It

Hubtel.me is a loyalty app from Hubtel. It gives you free loyalty points for every transaction you make on the app. These points can be redeemed for cash, internet bundle, and even mobile money. Sweet huh?

If you want to view just how much you can earn with this app for every transaction, check out the expected rewards at www.hubtel.me. See the example below. This is assuming you spend GHS100 cedis on airtime, internet bundle, mobile money, etc:

From the image above, you’ll realize there are various levels with varying expected rewards. You can easily increase your membership level based on the volume of transactions you perform in a given period. It’s a win-win situation here – perform more transactions to earn more free cash.

One interesting thing about the app is that you can still perform transactions when you have no internet access. Simply dial *711# to access the basic functions the app provides such as purchasing airtime and bundle.

Download Hubtel.me

The app is available for both Android and iPhone With Hubtel.me, the rewards never end?

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Goodbye Mobile Money Fraud ?

As part of efforts to improve the security of Mobile Money payments, MTN has introduced a new way for customers to approve transactions. Starting Monday 6th August, 2018.

Customers will no longer receive prompts to enter their PIN to confirm transactions. Instead, they will have to approve the transaction themselves on their phone.

All other services which require debits on a customer’s wallet will have to go through the approval process before it can be completed.

This move is meant to help reduce the number of fraud activities that occurs regularly on Mobile Money. If this goes well, we may see a new form of added security on Mobile Money transactions. It will mean that customers will have to “intentionally approve” payment requests from a vendor or third party.

Here’s how to approve a payment request:

- Dial *170# and select Option 10, My Wallet.

- Select Option 2 for My Approvals.

- Enter PIN to get your Pending Approval List.

- Select pending transaction to approve.

- Select Option 1 YES to approve the transaction OR Option 2 NO to reject the transaction

Customer receives an SMS as confirmation for a successful transaction.

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

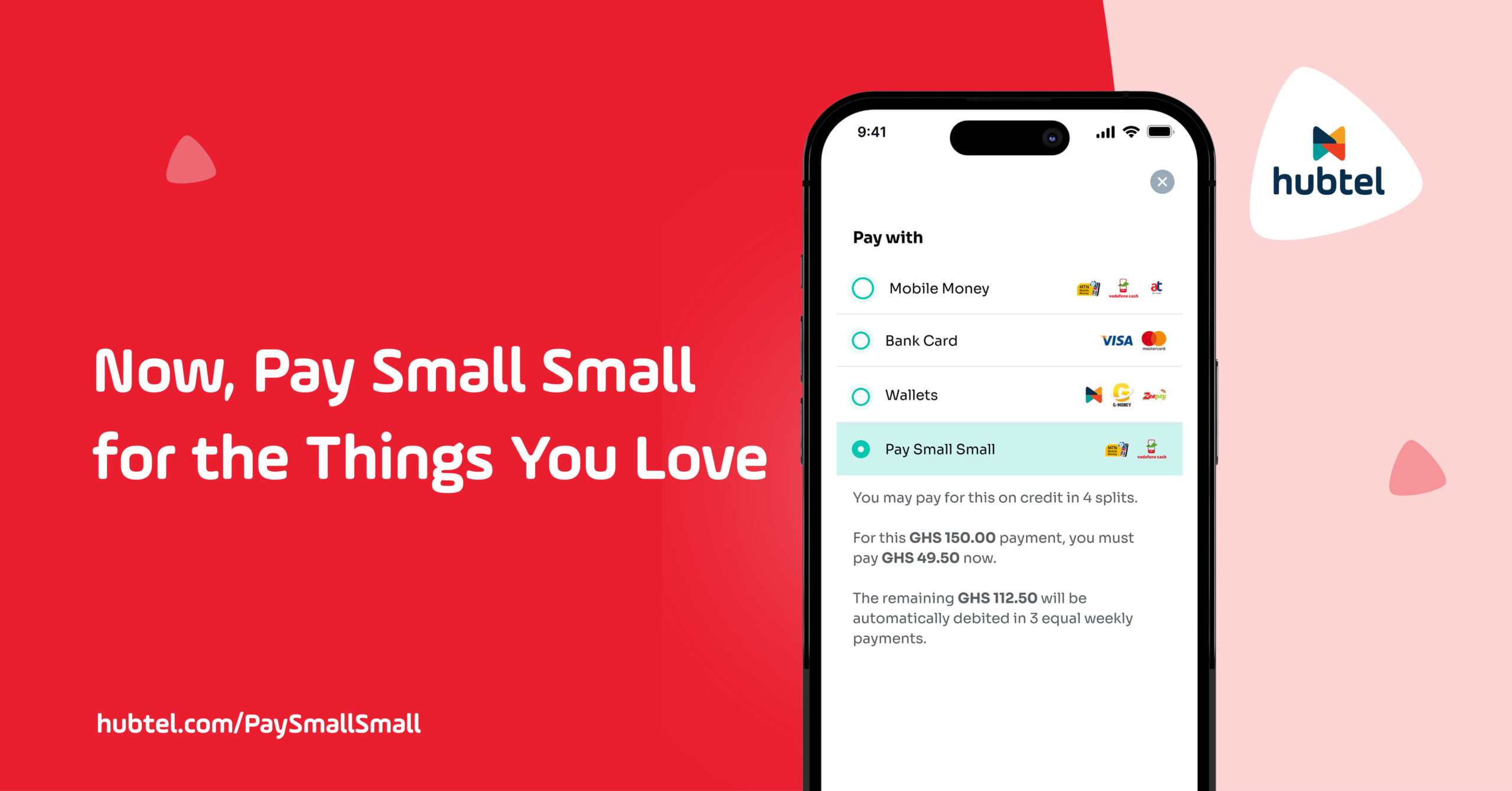

Now, Pay Small Small for the Things You Love

December 23, 2024| 2 minutes read

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

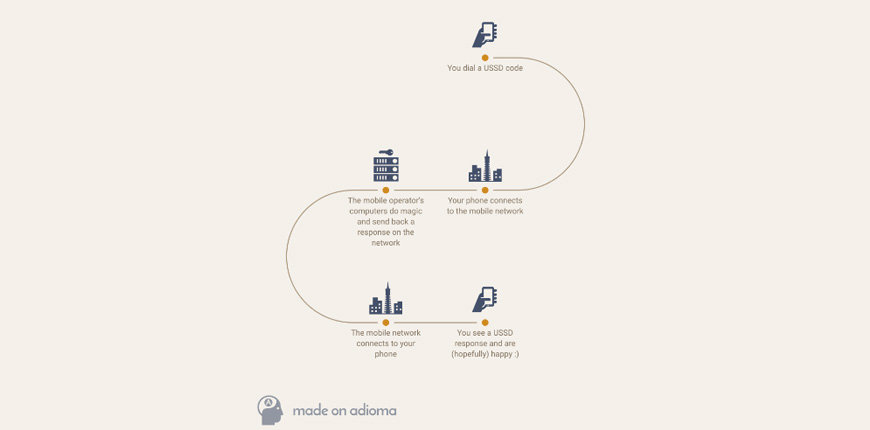

How a 20-year Old Mobile Technology Protocol is Revolutionising Africa

June 6, 2018 | 1 minute read

In the past, developing USSD applications was a specialized activity that was typically performed by network engineers who had some level of professional training. Just see how many USSD developer jobs are listed on LinkedIn.

Over the last few years, banks and other large companies have deployed their USSD applications at great cost due to the engineering effort and equipment required. Until very recently, individuals and small organizations could never even dream of building their own USSD apps.

But now, something truly incredible has happened, with the end result being that:

- It’s suddenly very easy for developers to build USSD apps

- The utility of USSD has exceeded use cases far beyond what its designers originally imagined

In order for us to understand the incredibly unlikely sequence of events that took place to cause this, we must go all the way back, to the beginning of the mobile revolution.

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Do you agree that hospitals can be daunting? Think about it – there are queues everywhere; right from your first step in the outpatient department, to looking for your folder, having your vital readings taken, getting to see your doctor, and then finally picking up medication at the pharmacy. In some cases, the need to be admitted or run extra recommended laboratory tests or scans without adequate financial preparation can be a punch below the belt if one has little time on their hands and can’t visit a bank.

Despite all these challenges, health institutions have one aim in mind – saving lives and improving health. Access to quality healthcare is an integral and necessary part of every nation’s development. With health care comes the need for money transfers and payments either for services or medication purchased. Countless lives have been lost in times past due to the “cash and carry system” in our nation’s health delivery.

The desire to solve these problems and improve patient convenience with payments led healthcare providers like the Airport Women’s Hospital and Equity Pharmacy to find innovative ways to solve the challenges that come with money payments for their service. Their search led them right to Hubtel.

Augustine, the accountant of Airport Women’s Hospital cites an example of a woman who was admitted for a day and was discharged that same day but had no paper money to pay. Her ability to pay via Mobile Money saved her the cost of staying an extra day until she had access to cash. Augustine further mentions the added convenience of varying forms of payment and the ability to track all Mobile Money transactions on all networks. With Hubtel’s POS service, errors can also be eliminated by being able to first verify the client’s name before any transaction is made. With the Health and Fertility Centre just about 9 minutes drive from the Kotoka International Airport, one would have no worries about carrying paper money before being attended to, with the added benefit of payment convenience.

With an unwavering desire to provide the best customer service in health delivery, payments for services and medication has seen some innovation. A glowing example is Equity Pharmacy, a pharmacy that now boasts of a doorstep delivery service to clients as a result of signing on to Hubtel’s POS service. Clients can now send prescriptions and electronic payments and expect their medication at their chosen point of delivery. Tracking of sales made and reconciliation of accounts through Hubtel’s platform has also been easier.

At Hubtel, we take pride in our ability to rethink customer service. Now we urge you to rethink Mobile Money: it is more than just a convenient tool that saves time; it can equally save lives.

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

Been to the Dansoman KFC recently? They now accept any form of payment when you order your favorite chicken – whether you pay with a mobile money wallet or bank card. No need to carry cash for your next order.

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

KFC Marina Mall Receives Mobile Money And Bank Cards As Payment Options

February 26, 2018 | 1 minute read

KFC Marina Mall has joined the trail of businesses that use Hubtel POS to power their payments. Anyone can now order any KFC pack and pay using Mobile Money or a Ghanaian-issued Bank Card. This is good news for both KFC and their clients. Hubtel POS is a more convenient way to receive payments in your shop or store.

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Imagine paying for your next KFC order using any mobile wallet or bank card. That is just how KFC receives payment now using Hubtel POS. Your customers need a better way of making payments to you in your store. Use Hubtel POS and experience a new kind of payment.

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Let your customers pay you using any mobile wallet or Ghanaian-issued bank card. It is convenient for both you and your customers. Boulevard Menswear just joined the club. They accept all forms of payment because they signed up on Hubtel POS. Rethink your customers’ payment experience with Hubtel.

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

The time is 4:30am Monday morning and the signs on the doors of most banks in Ghana will read “Closed”. Yes, the “brick and mortar” bank at the corner of the busy road is closed, but not your mobile phone, not your telecom network, not your mobile money which you carry in your pocket wherever you go. With a smile on your face, you can stare at that sign reading “closed” and yet get the chance to transfer the funds to your son in university who needs to purchase that textbook tomorrow. Mobile money has caused a stir in traditional banking in Ghana in the last 5 to 10 years, and like it or not, its impact would be greatly felt.

Just as every new idea and improved ways of doing things comes with its own benefits and implications across various civilizations, cultures, and industries, the banking and financial sector in Ghana is currently experiencing another phase in its life through the Calvary charge of the “mobile phone” which is quickly sweeping over the country like a wildfire or a plague.

Financial inclusion: Out of every 10 Ghanaians about 4 of them have traditional bank accounts and only 3 may have their accounts active. The introduction of mobile money has given the banking industry the opportunity to reach out to the unbanked through their mobile phones. One can now open a traditional bank account even with a mobile phone. The days of needing to walk into a bank and fill out some forms are fast fading away. Currently, almost all telecom companies are making moves to synchronize one’s mobile money account with traditional banks in order to have ease of moving funds across accounts. This will expand the banking industry in terms of deposits through mobile money, and having a bank account could be as easy as dialing “1,2,3”

Cash-lite banking: Do you recall the smell of notes and money when you enter a typical banking hall? Or perhaps it is the sound of the money-counting machine. What about the “bam-bam” stamp sounds of the teller as she stamps the white band on the bank notes… All of these familiar things in traditional banks may be experienced less if mobile money continues to be successful in making the Ghanaian economy cash-lite. One may not need to carry thick wads of cash which may attract thieves as soon as one steps out of a banking hall. With the dawn of mobile money, hundreds of cedis can be wired across the nation without moving a foot. If mobile money gains more ground and capacity is built to handle bigger transactions and transfers, physical cash may exchange hands less often and traditional banks may equally be visited far less often.

General fear of unemployment: It is feared that with automation and making transactions electronic and convenient, fewer people may actually visit a traditional bank occasionally to make transfers or withdrawals. Introducing the automatic teller machine (ATM) saw a drop in walk-in clients making withdrawals. This move into automation and mobile money is speculated to cut down on the number of staff traditional banks may actually need for that aspect of operations (account opening, money transfers, and others) in the long run. However, mobile money has created thousands of employment opportunities for mobile money agents across the country. Traditional banks can equally innovate and provide core banking services to telecom firms that do not have banking as their core business. In the long run, traditional banking may move from being more staff to client related when mobile money takes over certain traditional frontline banking roles.

It is however important to note that with moves of merging mobile money accounts with traditional bank accounts through financial technology, your Mobile Money account may gradually be an extension of your traditional bank account, only this time, you will carry the “brick and mortar bank” in your pocket everywhere you go.

Related

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

Hubtel Announces Completion of Commercial Agreement with ECG

March 28, 2024| 6 minutes read

In the past few years in Ghana, two popular words have surfaced when it comes to payments and they are “Mobile Money”. In a country where 7 out of 10 people are without bank accounts but yet have more mobile phones than people, (due to multi-sim users), what role can mobile play in impacting our nation’s growth and development?

Financial Inclusion: Between Circle and Adabraka, you are likely to come across 5 different banks yet only 3 out of 10 Ghanaians have bank accounts. The birth of mobile money along with the recent partnerships between banks and telcos in Ghana have made great strides in reaching the unbanked sections of society. Since 1 out of 5, Ghanaians use mobile money banking regularly, free movement of money in the economy that hitherto was hoarded by the unbanked and exchanged just a few hands will be enabled. The movement of money in the economy through mobile money banking will equally affect credit availability because these monies from mobile money transactions end up in the banks and work hand in hand with the telecom companies. The ability to link one’s mobile number to a traditional bank account may further encourage the unbanked to open bank accounts with the confidence that their monies will still be in their “pockets” in the form of a mobile wallet.

Micro Insurance penetration: With Ghana’s insurance penetration to GDP hovering a little below 2%, the use of mobile phones does not only have a place for banks but also a place for the insurance industry as well. In recent times, some telecom companies offer a form of microinsurance via mobile by providing life and health insurance covers to willing phone subscribers. This is made possible through agreed and controlled data sharing between telecom firms and traditional insurance companies who underwrite the policies. One can send a message to a short code and pay a flat rate per month through a direct mobile money monthly debit and enjoy health insurance or life cover. This innovation in insurance in the mobile money sector puts in place a positive outlook for the future of insurance in Ghana. It will also help improve healthcare service delivery in the nation if millions subscribe to this coverage monthly. Imagine 20 million phone users signing on to a minimum GHS5 a month for a GHS1000 hospital bill cover. The income generated by these subscribers will be at least GHS100 million a month and at least GHS1.2 billion a year. If the mathematics of the fund is managed well by actuaries using good data, mobile money could rejuvenate life and health insurance in Ghana. These funds could equally be invested and turned around to earn higher returns in order to positively stabilize the economy.

Employment: The impact of mobile money on employment is a blessing and curse, but more of a blessing. With increased automation of money transactions, certain roles of traditional brick-and-mortar banks will grow dysfunctional, causing a possible retrenchment in areas that have been taken over by mobile and online banking. Imagine, where would the 72,000 mobile money agents littered across the country have been if the innovation of mobile money had never seen the light of day? The private sector through mobile money has hence helped the nation solve the menace of unemployment to a degree.

Tax revenue generation for the State: The government of Ghana relies on funds from various sources in national development and one of these is tax. The generation of transactional taxes from money transfers, corporate taxes from telecom firms, and income tax from commissions of mobile money agents all help drive the developmental agenda of the nation. This is a positive impact indeed for a developing nation like Ghana. One can be assured every successful transaction done via mobile money contributes a quota to national development through tax.

Avenue for financial cybercrime: We cannot speak about the positive impact of mobile money without the threats it also presents. One such key threat is the avenue mobile money creates for financial cyber fraud. Lately, issues of fraudsters hacking or attempting to hack into mobile money subscribers’ accounts are becoming a menace. People of ill motives are devising various means of getting subscribers’ passwords and some successful cases result in huge aggregate sums of money. This issue of mobile money fraud can in the end lead to mistrust of the financial platform and it could result in the possible collapse and lack of interest in the mobile money sector if firm steps are not taken. Because risk presents an opportunity, cyber and financial risk experts can equally take advantage of this to serve as consultants in telecom firms to ensure the financial integrity and safety of the mobile money subscriber are maintained.

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Hubtel Joins 30-year-old’s GHc87,000 Fundraising Bid To Help Him Walk Again

October 3, 2017 | 3 minutes read

Ever since we at Hubtel heard Baffour Awuah Tabury’s touching story on Citi FM, we have made it one of our 2017 goals to “Make Baffour Walk Again.”

Before everything changed on the road to realizing his dreams and making his mother proud, Baffour was a final-year student at the University of Cape Coast and getting ready to graduate. He was involved in a motor accident that left him paralyzed from his waist down in 2007. Due to this unfortunate turn of events, Baffour had difficulty controlling his urine and bowels. Like any loving and caring mother will do, Baffour’s mum resolved to do everything in her power to see her son walk again. This included burning over GHS 200,000 of her personal savings and investments on various procedures and two surgeries in Ghana. Last year, Baffour successfully had another surgery in China which restored his urinary and bowel control.

For Baffour to walk again, the next step will be to undergo physiotherapy at NextStep Orlando (no pun intended). This physiotherapy center in Orlando, Florida treats patients who have injured their spinal cords so they can fully recover their functions. Amazing right? Yes, but this procedure will cost a cool GHS 87,000 ($19,200). And this is where Hubtel comes in.

We have developed a Point of Sale platform called the Hubtel POS. This platform is tailored to allow businesses to accept payments and charity organizations to receive funds from all mobile money wallets and bank cards in their stores, online, or on the go into one account. With our POS, we eliminate the burden of having to hold four different phone numbers to receive payments. Making it easier for everyone who is touched to help resolve situations like Baffour’s, to make a donation to help Baffour walk again.

So now how do I donate to this cause? It’s simple – just dial *713*7140# on your phone – it doesn’t matter which network you’re on, follow the instructions, and make a donation. Think of it this way: if 8,700 individuals make a donation of GHS10, Baffour’s dream of walking again will be realized.

Hubtel has not only provided this shortcode to ease Baffour’s access to donations for his surgery, we are also waiving all network charges associated with mobile money transfers made to this donation.

So go ahead. Dial *713*7140#, and let’s make Baffour walk again!

Related

Celebrating Leadership: Alex Bram Awarded EMY 2024 "Man of the Year – Technology"

December 31, 2024| 2 minutes read

Correction of False Claims About ECG Commercial Agreement

September 29, 2024| 6 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read