Tag: businesses

Mobile Telecommunications Network (MTN) hosted this year’s SME Business fair in Takoradi for interaction and networking opportunities for SMEs within the Western Region.

The two-day MTN SME Business Fair, organized under the theme “Accelerating SME growth with smart ICT solutions and partnerships” officially opened on 23rd March 2016 at the Akroma Plaza in Takoradi . The fair brought together about a number of companies including SMSGH Solutions Limited, Fidelity Bank, Association of Ghana Industries (AGI), GCB Bank, TXT Ghana, Glico and other businesses, who engaged participants in various products/ services they offer.

Participants had the opportunity to experience MTN’s ICT offers which includes Corporate Voice Solutions, Internet Messaging Solutions, Data Centre Services and Security Solutions. Other products showcased included MTN’s vehicle tracking devices, modems, routers, and corporate devices.

SMSGH, one of MTN’s leading partners was privileged to be a part of this event and had the opportunity to present to participants one of its products MYtxtBOX. Mr. Emmanuel Offei talked about the various advantages of using the right communication tools for customer engagement, explaining the benefits of using MYtxtBOX, its features and various offerings especially the recently launched MYtxtBOX Email.

Visitors at the SMSGH booth were taken through live demonstrations on various features of MYtxtBOX such as the #HashTag for feedback; real time messaging reports; multimedia messaging; voice messaging; e-mail messaging among others.

The Business Fair was proudly sponsored by MTN in partnership with the Association of Ghana Industries (AGI) and the Western Ghana Chamber of Commerce.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

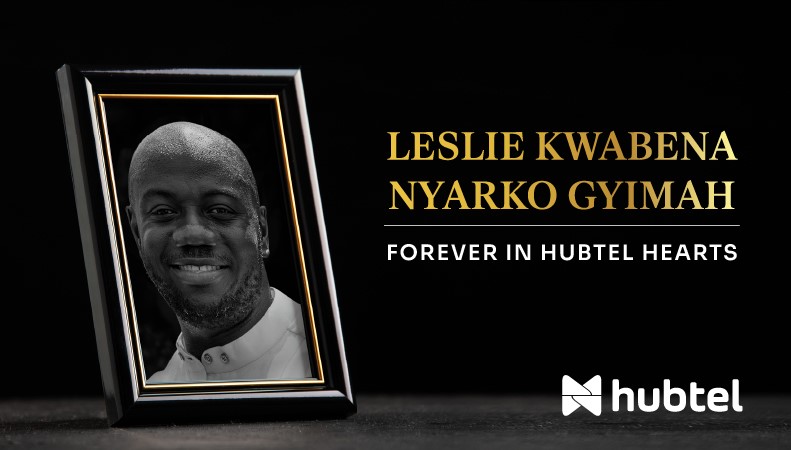

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Cashless Payments and Business In Ghana: New Money Never Closes

March 8, 2016 | 3 minutes read

Over 130 million mobile money transactions in 20151, 5 million mobile wallets and a population of over 25 million2. These times signify limitless possibilities for commerce in Ghana!

In the ever-evolving world of business, a key differentiating factor between businesses that lead the pack and those that are left behind is their ability to rapidly adopt new technologies that increase productivity and outcomes. The local Ghanaian business scene is no different.

Cashless Payments, The Next Business Driver

When it comes to accepting cashless payments for goods and services, mobile payments is becoming the major technological driver. This has been due to its unique characteristic and ability to reach both the underbanked and unbanked sectors of the economy who form 80% of Ghana’s population. There has never been a better time to assess your business’ readiness to exploit the emerging opportunity for commerce in a cashless economy than now.

From cash to cheques, to credit cards and debit cards, and now to online banking and mobile commerce, payment methods and rise of mobile phone penetration is changing the way business accept payments!

MPower Payments, the foremost digital payments enabler in Ghana is propelling new innovative channels for businesses seeking to benefit from the cashless revolution. MPower recently introduced the MPower Mobile Point of Sale application (mPOS) to allow businesses operating from any physical location to accept various forms of cashless payments.

mPOS is designed to work across a wide spectrum of industries; from supermarkets, restaurants, hotels, salons, small shops, to delivery agents. No matter the business size, mPOS is easy to set up for various store locations or at multiple sales points within a single store.

Customers purchasing from mPOS enabled merchants can choose their preferred mode of payment – be it their MPower wallet, mobile money on any network or bank card. The mobile nature of mPOS means the point at which payments is made is not restricted to stationary cash registers and this can potentially go a long way to reduce queues. Businesses on the other hand will no longer lose sales from customers carrying limited cash. mPOS simplifies daily sales management and eliminates the risk of transporting physical cash to the bank.

MPower seeks to make mPOS accessible to every businesses by removing the financial barriers to inclusion hence set up is currently free.

Get started at www.mpower.com.gh or call MPower on 0202532273 to request a demo.

–First published on www.GhanaWeb.com

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read