Tag: Feature

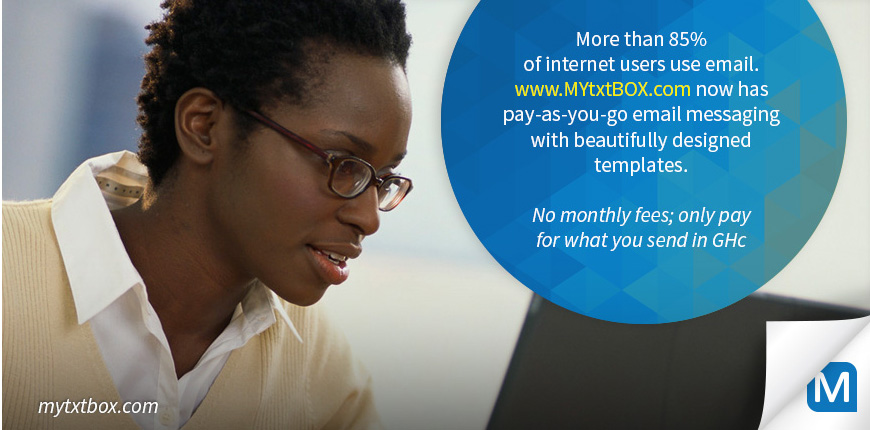

Email is an essential tool for most businesses to communicate and connect with both employees and customers. The proliferation of smartphones and other mobile devices have increased the percentage of emails people read on the go.

Why Email Messaging Is Important For Your Business.

The world is going mobile – and email is going with it. Today’s customer is at the center of sales and marketing, and in order to satisfy their needs, you have to understand and provide before they even realize their need for it. Here is why you should use email messaging:

- Keep your customers informed of new products/services

- Retain customers through constant communication

- Provide information of interest to your customers.

- It’s a very affordable, effective means of customer outreach

- Your audience has gone mobile and receiving emails is only as easy as they receiving SMS messages

- Grow your social network followings by including links to your social media platforms at the bottom of your emails to help your contacts easily subscribe

SMSGH recently launched MYtxtBOX Email offering its customers multiple channels to engage with their audience. Business owners who want to reach their customers using email can do so online here.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Top local mobile value added service (VAS) providers who constitute the Wireless Applications Services Providers Association of Ghana (WASPAG) have suspended all their services on Airtel citing unfair revenue share.

Director of Regulatory and Corporate Affairs for WASPAG, Conrad Nyuur told Adom News that, the mobile network provider, like all other telcos, have over the years been imposing unfair revenue share arrangements on VAS players but this time round “they went too far”.

He explained that Airtel is one of the telcos that keeps 70% of revenue generated by services of VAS providers and gives 30% to the VAS providers, who in turn share their portion with content owners and App developers.

“That revenue share arrangement is bad enough, but just this year they wrote to us and said they will now keep 80% and give us 20% but we resisted and they reviewed it to 75% to 25%, but we still insist it is unfair,” he said.

Nyuur said they therefore gave Airtel one month notice to reverse the decision and that one month ended on March 16, 2016, but they have still not heard anything from Airtel so they have suspended all their services on Airtel until they reserve the decision.

By this action, all premium-rated and subscribed services such as all SMS-based services, caller ring back tone (CRBT), MMS or WAP content services and even some voice services have all been cancelled on the mobile network operator.

This means customers who subscribe to those services, some of which are essential, would no longer enjoy the services until Airtel reaches a compromise with their local VAS partners.

Nyuur noted that this is not the first time VAS players have had to boycott Airtel, saying that in the first instance, Airtel and Tigo failed to pay that exact amount due VAS players as reflected in mutually reconciled financial statement.

“They insisted on paying what they unilaterally collated and we lost money because we had then paid our content providers based on what the reconciled statement said,” he lamented.

He said initially the local VAS players had a 50-50 revenue share arrangement with Airtel but they kept scrapping off part of the share of VAS players every year and claiming it is based on orders from their headquarters in India.

Nyuur said “to add insult to injury”, the network even imposed their Indian-based sister company called ComViva on the local VAS players to play middle man for CRBT services.

“ComViva is nothing but a content provider like us but Airtel forced us to give our content to them in India and then they place it on the Airtel network in Ghana and that has reduced our share of the revenue from CRBT to 11% and not 30% as agreed,” he said.

He said WASPAG is particularly surprised at Airtel because, in India where it is headquartered, it gives VAS players up to 70% of the VAS revenue, but it has decided to shortchange VAS players in Ghana.

“The protest to Airtel’s imposition of unfair revenue share arrangement was necessary because we have endured that unfair cycle for years, where one telco scoops some of our revenue off and once they succeed the other telcos follow and we keep losing,” he noted.

Nyuur said WASPAG is very worried that so far, the telecoms industry regulator, National Communications Authority (NCA) is not providing any real protection for VAS players after licensing special number resources to them at a fee.

He said the last time VAS players took an issue regarding Airtel to NCA, the regulator said it could not interfere in commercial arrangements between two private entities, “but when we suspended our services the NCA said we should restore the services to customers while we negotiate with Airtel.

“We feel that was double standards on the part of the NCA because our commercial arrangement with telcos is always about the customer so why would NCA stay off the arrangement which has ramifications for the customer,” he asked.

Meanwhile, since the WASPAG members suspended their services, Airtel is said to have started feeling the pinch so its officials have called WASPAG for a meeting later today to discuss the way forward, after ignoring the VAS providers all this while.

AIRTEL

Airtel officials reached on the matter confirmed they are aware of the issue but declined comment until after negotiating with the VAS players.

But until then, all VAS services provided by WASPAG members to Airtel customers remain suspended.

WASPAG

WASPAG represents over 20 top VAS providers in the country, and they include MobileContent, SMSGH, TXTGhana, Rancard and many others.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Is it bad to charge your phone overnight? What about charging an iPhone with an iPad adapter? Tech myths… whew!!!

Despite how often we use devices like smartphones and laptops, we have plenty of questions about how they work. And with so much information out there — not all of it true — it’s hard to know if we’re treating our electronics properly.

We’re here to debunk some of the biggest tech myths and misconceptions out there.

Mac computers can’t get viruses

Yes, Apple computers are susceptible to malware, too. Apple used to brag its computers aren’t as vulnerable as Windows PCs to viruses, but the company quickly changed its marketing page after a Trojan affected thousands of Mac computers in 2012.

Private/Incognito browsing keeps you anonymous

There’s a misconception that “incognito” and “private” are synonymous with anonymous. If you’re using Incognito Mode in Google Chrome or Private browsing in Safari, it simply means the browser won’t keep track of your history, import your bookmarks, or automatically log into any of your accounts. Basically, it’s good for keeping other people who use your computer from seeing what you’ve been doing. But it won’t keep your identity hidden from the sites you visit or your ISP — so keep that in mind if you’re visiting sites you shouldn’t be.

Leaving your phone plugged in destroys the battery

If you’re like most people, you probably leave your phone plugged in overnight long after the battery is fully charged. Some used to say this would hurt your phone’s battery life, but in fact, there’s no proof that this damages your phone’s battery in any way. Modern smartphones run on lithium-ion batteries, which are smart enough to stop charging when they’ve reached capacity.

You should always let your iPhone battery completely die before recharging

This, too, is a popular myth. Apple points out that its modern lithium ion batteries mean that “You complete one charge cycle when you’ve used (discharged) an amount that equals 100% of your battery’s capacity — but not necessarily all from one charge.”

More megapixels always means a better camera

What’s the difference between 12-megapixel cameras and 8-megapixel cameras? Not much, as it turns out. The quality of an image is determined in large part by how much light the sensor is able to take in. Bigger sensors may come with larger pixels, and the larger the pixel the more light it can absorb. So, it’s really the size of the pixels that matter as much or more than the sheer number of pixels. (A megapixel is simply shorthand for a million pixels.)

Here’s how TechCrunch’s Matthew Panzarino, who’s also a professional photographer, describes the role of the pixel: “Think of this as holding a thimble in a rain storm to try to catch water. The bigger your thimble, the easier it is to catch more drops in a shorter amount of time.” The thimble is a metaphor for a pixel — using a few buckets would be much more efficient than a bunch of thimbles for catching water.

Higher display resolution is always better on a smartphone

Some have argued that at a certain point, screen resolution doesn’t matter on a smartphone. Gizmodo cites experts in saying the human eye can’t discern nitty-gritty detail when a display packs more than 300 pixels per inch. Earlier this year, LG unveiled its first quad-HD smartphone, the G3, which has a resolution of 2560 x 1440. That’s much higher than the average high-end smartphone, which usually comes with a 1920 x 1080 resolution display.

But it’s unclear if those numbers really matter after a certain point because the eye can’t discern individual pixels beyond a certain resolution. When I tested the G3’s display alongside the 1080 Galaxy S5’s display, there was hardly a difference in terms of sharpness — that’s why companies like Apple tend to focus on brightness, more so than ultra-dense displays.

It’s bad to use your iPad charger for your iPhone

This one is a little trickier than a standard “yes or no” answer. Apple’s official website says its 12-watt iPad adapter can charge both the iPhone and the iPad. However, Steve Sandler, founder and chief technical officer at electronics analysis company AEi Systems, told Popular Mechanics that this could stress your iPhone’s battery over time if you do it regularly. It would take about a year, however, to notice any changes in battery efficiency.

You shouldn’t shut down your computer every day.

While some may believe it’s harmful to shut down your computer every night, the truth is it’s actually good to turn off your computer regularly. It’s easy to get into the habit of putting your laptop in sleep mode so you can easily return to it without having to boot up. But, as Lifehacker points out, shutting it down when not in use conserves power and places less stress on its components, which could enable it to last longer.

Holding a magnet close to your computer will erase all of its data.

This technically isn’t wrong — you may remember how easy it was to wipe a floppy disk using a magnet back in the day. But you would need a really, really big magnet to wipe out your computer’s hard drive. Experts told PCMag that hard drives on modern computers would only be susceptible to really strong magnets with really focused magnetic fields. So your average refrigerator magnet wouldn’t do the trick.

Cell phones give you brain cancer

Although cell phones emit radiation that can be absorbed by human tissue, there isn’t any conclusive evidence showing that cell phones actually cause cancer.

Here’s what a report from the National Cancer Institute in the USA says:

Although there have been some concerns that radiofrequency energy from cell phones held closely to the head may affect the brain and other tissues, to date there is no evidence from studies of cells, animals, or humans that radiofrequency energy can cause cancer.

More signal bars guarantees great cell service

While having more bars helps service, it doesn’t necessarily guarantee excellent reception. The bars just indicate how close you are to the nearest cell tower. But there are other factors that impact how fast the internet on your phone performs, such as how many people are currently using the network.

Credit: Tech Insider

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Cashless Payments and Business In Ghana: New Money Never Closes

March 8, 2016 | 3 minutes read

Over 130 million mobile money transactions in 20151, 5 million mobile wallets and a population of over 25 million2. These times signify limitless possibilities for commerce in Ghana!

In the ever-evolving world of business, a key differentiating factor between businesses that lead the pack and those that are left behind is their ability to rapidly adopt new technologies that increase productivity and outcomes. The local Ghanaian business scene is no different.

Cashless Payments, The Next Business Driver

When it comes to accepting cashless payments for goods and services, mobile payments is becoming the major technological driver. This has been due to its unique characteristic and ability to reach both the underbanked and unbanked sectors of the economy who form 80% of Ghana’s population. There has never been a better time to assess your business’ readiness to exploit the emerging opportunity for commerce in a cashless economy than now.

From cash to cheques, to credit cards and debit cards, and now to online banking and mobile commerce, payment methods and rise of mobile phone penetration is changing the way business accept payments!

MPower Payments, the foremost digital payments enabler in Ghana is propelling new innovative channels for businesses seeking to benefit from the cashless revolution. MPower recently introduced the MPower Mobile Point of Sale application (mPOS) to allow businesses operating from any physical location to accept various forms of cashless payments.

mPOS is designed to work across a wide spectrum of industries; from supermarkets, restaurants, hotels, salons, small shops, to delivery agents. No matter the business size, mPOS is easy to set up for various store locations or at multiple sales points within a single store.

Customers purchasing from mPOS enabled merchants can choose their preferred mode of payment – be it their MPower wallet, mobile money on any network or bank card. The mobile nature of mPOS means the point at which payments is made is not restricted to stationary cash registers and this can potentially go a long way to reduce queues. Businesses on the other hand will no longer lose sales from customers carrying limited cash. mPOS simplifies daily sales management and eliminates the risk of transporting physical cash to the bank.

MPower seeks to make mPOS accessible to every businesses by removing the financial barriers to inclusion hence set up is currently free.

Get started at www.mpower.com.gh or call MPower on 0202532273 to request a demo.

–First published on www.GhanaWeb.com

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

We are in the golden age of technology. Within the larger movement; however, each one of us is directly influenced by the take off of a more recent and rapidly developing financial technology (FinTech) space—an industry projected to attract approximately $20 billion in funding by 2017, estimates Statista.

Financial technology is a democratizing force that can change our lives by making financial tools and services accessible, faster and more easily understood — most times at a lower cost. Complex algorithms now often take the place of traditional advisors, perhaps offering more efficient and personalized products for end users.

From budgeting tools to alternative lending and investment options, payments processing, and philanthropic platforms, we have a lot to gain from the advent of financial technology startups. Learn below about just a few ways in which you can leverage these hot new platforms before they inevitably become common applications for the entire public.

Payments Made Easy

The advent of payments technology has made consumer spending, and all other forms of payment easier, faster, and more secure. Payments technology startups, such as Square, help small businesses get off the ground by adopting easy to use and cheaper credit card payments processing. Instant, reliable transactions are important for day-to-day sales, along with employee payroll processing.

Venmo, a payments app, has provided a “free digital wallet” to the mobile devices of thousands, by allowing friends to connect quickly and securely via Facebook to request and send money to each other in a few taps on their phones. Furthermore, on the consumer side, platforms such as Apple Pay and Bitcoin continue to disrupt the traditional method of pay. When sending money abroad, individuals should consider using money transfer services such as TransferWise to save on international transfer fees.

Lend a Helping Hand

Peer-To-Peer (P2P) business models have fueled a new sharing economy revolution, with many products and services such as home rentals, cleaning services, and anything else under the sun being “uberized.” New FinTech startups have uberized the online lending space, allowing you to access funds through unconventional ways, without the help of big-name banks or a network of established lenders.

Platforms such as U.S.-based LendingClub and Prosper, and U.K-based Zopa have individually issued millions of dollars in loans, joining the rising number of tech unicorns in today’s entrepreneurial space.

Crowdfunding: The New Venture Capital

Investment in crowdfunding platforms may surpass venture capital funding in 2016. Popular sites Indiegogo and Kickstarter have helped thousands of ideas get off the ground – from bizarre video games to social projects and multi-purpose jackets, small businesses and entrepreneurs can now look to the general public for support. Countless other sites such as GoFundMe, which took off by bootstrapping, allow individuals to raise money for any project they like.

A ‘Bankless’ World

The headline of loan refinancing startup, SoFi’s website reads, “Great news: we’re not a bank.” Over the past few decades, we’ve seen a general distrust and loss of confidence in our traditional banking system, dominated by the big banks. After the Global Recession in the late 2000s, a new generation of startups hopes to fix the transparency issue facing big banks and provide consumers with more personalized and comprehensive services online.

Nasir Zubairi, venture partner at FinLeap in Berlin, commented on the FinTech industry, stating that “3 billion people, 50% of the world, do not have access to a banking system, and I think that FinTech can help in solving the problem around credit. There’s a huge opportunity for FinTech companies and of course for people who will benefit from their solutions.” Startups such as Kabbage, a small business lender, take into account a myriad of factors such as eBay data into account when determining risk, providing more of a data-driven service unhindered by the same regulations that restrict the traditional banking system. Countless other platforms such as CreditKarma offer credit risk services at zero or low cost.

Democratizing Investment Products and Services

Robo-advisors continue to gain traction as a provider of investment services once solely accessible to wealthier individuals who could afford their own financial advisor. An online advisor is now available through multiple platforms such as Wealthfront and Betterment. Wealthfront manages your first $10,000 free for a small fee of .25% after that while Betterment charges .35% to .25% annually or $3 per month. A series of questions, including an individual’s age, determines a user’s risk tolerance, which then determines the portfolio allocation for each specific individual. If you are unwilling or unable to invest your money yourself, or through a trusted financial advisor, an online platform is a much better way to direct your savings to their most effective use.

FinTech startups aren’t stopping at stock investment, however. For the growing number of Americans who seek involvement in alternative investing and philanthropic projects, the FinTech industry continues to deliver. Take Neighborly, a social venture helping you get involved in the municipal bond market. Neighborly’s Community Investment Marketplace allows you to make an impact directly in your community through safe and lucrative investing.

Budgeting: A Virtual Piggy Bank

As many tech startups target millennials, there’s a significant opportunity for business to facilitate the process of a new generation beginning to save, lend, and invest their money. Millennials don’t simply want to watch the purchasing power of their money wither away in a bank account; instead, they’re using budgeting and educational platforms to help them with a financial strategy. Alongside their robo-advisors, individuals can use budgeting platforms such as LevelMoney and Acorns that automatically track spending and income to give users a daily allowance for the day. This helps people grasp exactly how they are spending their hard earned dollars. Other platforms find creative ways to save you a dime. For example, Paribus scans users emails for receipts following a purchase to get money back in the case of a price drop.

The Bottom Line

FinTech is on the fast track to growth, and it’s not just investors who can benefit from the success. Be sure to stay up to date on the rapidly evolving FinTech sector, which will help drive a democratization of financial tools and services, from payments to wealth management and philanthropy. Ultimately, whether FinTech will take the place of traditional banking entirely is up for debate. However, the plethora of cost efficient and accessible financial tools and services will undoubtedly force the entire financial sector to transform.

Credit: Investopedia & JumpFon.com

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Technological change has always posed a challenge for companies. But, as we saw once again in 2015, it has never occurred as rapidly, or on as large a scale, as today. As innovation sweeps across virtually every sector, from heavy industry to services, it is transforming the competitive landscape, with the most advanced companies – rather than the largest or most established players – coming out on top.

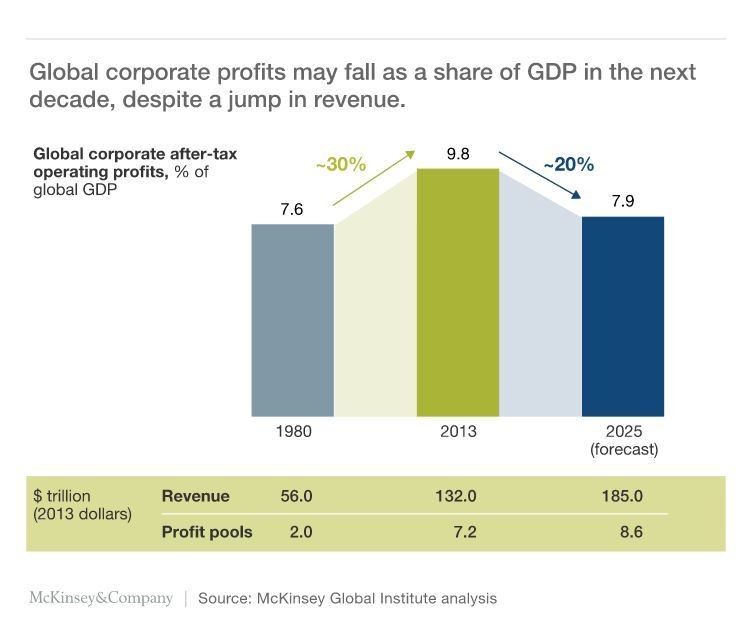

For incumbents, the threat of displacement is very real. The average tenure of a company on the S&P 500 has fallen from 90 years in 1935 to less than 18 years today. Disruptive new players like Uber, which has upended the taxi industry, are tough competitors, often staking out market share by shifting more surplus to consumers. This is part of a broader trend of intensifying competition that, according to recent research from the McKinsey Global Institute, could reduce the global after-tax profit pool from almost 10% of global GDP today to its 1980 level of about 7.9% within a decade.

The effect of technology on competition arises largely from the power of digital platforms and network effects. New digital platforms reduce marginal costs (the cost of producing additional units of a good or service) to nearly zero. Adding, say, a Google Maps user carries negligible costs because the service relies on GPS location data that is already stored on a user’s phone. This allows Google to scale incredibly quickly, and then to leverage this scale (and the convenience of having a single platform) to move into adjacent sectors – such as music (Google Play), payment (Google Wallet), and word processing (Google Docs). In this manner, tech firms can quickly come to challenge incumbents in seemingly unrelated industries.

Of course, tech firms are not the only ones innovating. A handful of leading firms in practically every industry are deploying digital technology in increasingly sophisticated ways – and seeing huge benefits. The use of sensors to monitor livestock, for example, has far-reaching implications for the food industry.

But the most digitally advanced sectors show the greatest progress. Indeed, over the last 20 years, profit margins in these tech-infused sectors have grown 2-3 times faster, on average, than in the rest of the economy. Even within the most advanced sectors, there is a yawning gap between the top-performing companies and the rest of the pack. For example, the retail offerings of digitally advanced multinational banks far outstrip those of local credit unions.

As technology transforms business models and processes, it is also changing the way employees work. Recent McKinsey research finds that already-proven technologies could automate as much as 45% of the tasks individuals are currently paid to perform. In the United States alone, that is the equivalent of about $2 trillion in annual wages.

The potential benefits of this transformation for companies extend far beyond cost savings, as workers gain time to pursue more valuable tasks involving critical thinking and creativity. Financial advisers can spend less time analyzing financials and more time developing solutions that meet clients’ needs. Or interior decorators can shift their attention from taking measurements to devising design concepts, meeting with clients, or sourcing materials.

Technology also allows companies to rethink conventional wisdom on organizational design and governance. New information-sharing technologies deliver greater transparency, making organizations more efficient and, in many cases, less hierarchical.

For example, the CEOs of Apple, Inditex (a multinational clothing company), and Zappos (a large online retailer) have adopted broad spans of control (the number of subordinates directly reporting to a manager) that far exceed the traditional model of “one to four to eight.” Haier, the Chinese white goods manufacturer, reorganized its 80,000-person workforce into 2,000 independent units, each responsible for managing its own profits and losses. Since the move, its market capitalization has soared, tripling from 2011 to 2014.

Moreover, digitization allows companies to operate as “platforms,” not structures, and make greater use of resources outside their company. The insurance company Allstate used the crowdsourcing platform Kaggle to invite programmers to develop a new car accident injury algorithm; the eventual “winner” was 271% more accurate than its existing model.

Likewise, China’s DJI became the world’s largest drone manufacturer by focusing on its products’ core technology, while giving away developer kits for free online so that others could build apps. This approach meant that DJI’s drones were equipped with attractive features far earlier than competitors’ products, which relied on in-house app development.

Similar technology-driven innovations in thought processes and business models can be seen across the economy, reflected in changes in companies’ planning processes. Some have begun creating separate business plans with two-month and 20-year views, reallocating their resources more aggressively, and using new analytical techniques to identify, attract, develop, and retain talent.

Technological innovation enables – indeed, requires – companies to boost their agility and thus their competitiveness. That’s why CEOs’ top priorities in 2016 should be to digitize the core components of their business and rethink organizational design and governance processes. Catching this fast-moving – and rapidly growing – “digital wave” is the only way to avoid getting left behind.

Author: Dominic Barton is the global managing director of McKinsey & Company.

Source: weforum.org

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

“Take Advantage Of Our Robust Infrastructure” — MTN Urges Businesses

October 19, 2015 | 3 minutes read

Telecom giant MTN has urged small and medium enterprises (SMEs) and large corporations to ride on the robust infrastructure it has built over the years to propel their businesses to new heights.

Samuel Addo, General Manager MTN Business — the business unit of MTN Ghana — who focused on providing businesses and institutions with combined network and IT infrastructure, made the call at the 2015 MTN Business Fair held recently at the La Palm Royal Beach Hotel, Accra.

“As a testament of our continuous investment in the right infrastructure for the industry, MTN emerged the only mobile operator to have excelled in the first-ever data quality of service test conducted by the NCA, our regulator, in the two upper regions of Ghana.“

It is against this backdrop that we continue to call on all to ride on the robust infrastructure we have built over the years to propel your businesses to new heights,” he told exhibitors and other stakeholders at the fair’s opening ceremony.

He called on all gathered to take the opportunity of the fair to apprise themselves of the plethora of products, services, and technology available on MTN’s platform. “Indeed, there can be no better time to take advantage of MTN’s technological innovations than now.”

The MTN Business Fair is an initiative by MTN Business Ghana to bring together SMEs and corporate organisations to empower their businesses so as to maximise productivity and enable and inspire growth.

Under the theme ‘Sharing the Values of Growth for Businesses’, exhibitors were Sci-Fi Webtech, Fidelity Bank, Forum Networks, and SMSGH (1188 Directory Services).

Mr. Addo explained that the theme underscored the primary aim of the MTN Business Fair, which is to demystify the bouquet of technology solutions available for businesses and showcase the wide variety of technologies, products, and services available to businesses.

The fair has already been to the Eastern, Western, and Ashanti Regions, where MTN and its partners interacted with various businesses to understand and share ideas on the way forward.

“We have no doubt that through these interactions we can transform our businesses, reduce our operational expenditures and, more importantly, maximize the benefits from using the right technology in our businesses,” he added.

He assured us that the MTN Ghana Business Fair has come to stay and will serve as a platform that continually explores ways of staying in touch with the business community.

“MTN finds it necessary to interact with the business community to establish itself as the place where individuals and organizations from the corporate world meet to take advantage of the varied, tailor-made solutions and products that MTN Business offers to optimize the productivity of SMEs and expand their businesses.”

He added that just a few days ago MTN attained its fifteen millionth subscriber — a historical feat that affirms the fact MTN leads in voice and digital innovations in the industry.

Other speakers including Sofiene Marzouki, Managing Director of Hello Foods — an online food ordering marketplace that connects customers with restaurants — lauded MTN’s efforts in helping businesses operate smoothly through its products and services on offer.

“As an online food-ordering marketplace, the integration of MTN mobile money has helped improve our operations in terms of online payment and enhanced higher customer satisfaction,” he said.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

MPower Payments Removes Debit Card Top Up Charges, Adds Slack Integrations

August 31, 2015 | 3 minutes read

A lot of talk has been going on about how soon it will be till Ghana gets access to payment options that work outside of Ghana. In mid-2013, PayPal opened up its services to a host of African countries, Ghana excluded. We sobbed.

Amidst the various campaigns and petitions, PayPal seems a bit too busy to care about the cry of Ghanaians. However, also in Ghana is a budding payments processing platform, MPower Payments platform, jointly run by Encodev Labs and SMSGH.

MPower Payments is a complete end-to-end online and mobile payment solution for consumers and merchants. MPower offers various payment options that allow you to send and receive money by integrating seamlessly with your preferred mobile or digital wallets, and bank accounts. The web and mobile versions come with a built-in feature known as CornerShop which is convenient for airtime purchases and payments of bills for several utility services.

MPower has come a long way over the years, helping Ghanaians to pay for services and send money across the various mobile money systems in Ghana. Back story: MTN first introduced Mobile Money in Ghana, then Tigo and Airtel followed. Just about a month ago, Vodafone introduced Vodafone Cash and Airtel introduced its Tap-To-Pay systems. Considering that these three telecom networks are powering the mobile money system in Ghana, MPower Payments’ presence helps customers to send mobile money across these networks easily.

Another major helpful feature that MPower supports is to top up your MPower wallet via a debit card. This has been an issue since most of banks charge transactional fees when you make such top-ups. And now it’s free! About two weeks ago, MPower announced to customers that topping up via their debit card is now free.

This has been received favorably and helps make the barrier to adoption almost non-existent. In effect, you can now send mobile money to another mobile money subscriber for free even if you’re not a registered mobile money user. This initially attracted a charge of 5%.

Later last week, the CTO of MPower Payments made an announcement which will excite most developers who use MPower Payments – they now have Slack integrations. So much has been talked about Slack’s success and secret sauce and its ease of use, I need not say more. This integration will make it way easier to track payments, without having to comb through SMS and emails.

For a product that needs a lot of user-friendliness and education in the customer journey to be adopted, these subtle but important changes will surely increase its adoption now that Ghana doesn’t have any “internationally acclaimed” payment options in place. This a good one from the folks at MPower Payments.

Related

Hubtel Completes Biggest Upgrades to Developer Portal

July 24, 2024| 3 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

SMSGH In The News – How Ghanaian startups are making an impact on the global stage

August 3, 2015 | 7 minutes read

“Startups are the seed corn of the future economy,” our partner Steve Case, co-founder of AOL and chairman of Case Foundation, often says.

Today, Silicon Valley is envy of the entrepreneurial world, but 50 years ago, Silicon Valley was apple orchards. Detroit, then the wealthiest city in the US in terms of median income because it was the center of the half-century’s greatest innovation (the car) has now slipped to becoming the poorest major city in the US, because it stopped innovating.

As we’ve traveled from Kenya to Ghana, we’ve seen how planting seeds in an entrepreneurial ecosystem can really mature.

The first thing to know about the Ghanaian startup ecosystem is that the Ghanaian economy is itself a startup. The country only adopted capitalism in 1992, so only one generation has lived in a free-market society.

But the new next generation is fully embracing startups and the country is on the move.

We visited SMSGH, a ten-year-old startup employing dozens of people and powering mobile transactions across East Africa; DTRT, a manufacturing factory employing hundreds of people in great working conditions; nine exciting companies pitch in the ImpactHub Accra; followed by a very fun happy hour that felt more like a beach party than a networking session.

Nairobi vs Accra

If you simply compared first impressions from Nairobi and Accra, you might have thought the startup ecosystem was really rough around the edges here in Ghana. But to me, the Kenya to Ghana transition was encouraging.

Ghana today, seems not too far away from Kenya five years ago. Back then, Erik Hersman and his team were solidifying the iHub. About 20 investment groups that are now active in Kenya were not active then, and the entrepreneurial ecosystem was fragmented.

Based on the evidence of promise we saw in Ghana today, Accra can get there.

1. Local investment is impressive

We spent several days with local investors: the Oasis Fund, the African Angels Network, and Eric Osiakwan, who has a Steve Case-like reputation in Ghana as the startup champion in the country.

One of the more difficult conversations I had to have over the years in Kenya — where the ecosystem is thriving — is with local Kenyan investors. In Kenya, successful businesspeople do not invest in startups very often. It is difficult sometimes for me to justify why we invest internationally in Kenya when successful local entrepreneurs won’t do it.

Now, that is changing. And Julian Kyula of MODE, who partnered with us on the Pitch for Impact competition in Kenya is a great example — but in Ghana, successful business people have been investing in startups for quite a while.

As a few examples: the Oasis Fund has 40% of its limited partner base in-country; the Ghanaian angels’ network has over 25 locals who have done a deal in the last two years, and Eric Osiakwan walked us around SMSGH — one of his portfolio companies — as a bigger cheerleader than the CEO.

One Ghanaian said that local self-reliance, as a relatively closed economy, was an important trait for a very long time. And in Africa, when it comes to locals investing in the next generation, Ghana may well be leading the way.

2. Culture and policy both pose challenges and opportunities.

At the same time, Ghana still has a long way to go. Unlike Kenya, where entrepreneurship is encouraged, stepping out and starting your own company isn’t in Ghana.

Whether it’s cultural or whether it’s a vestige of a socialist system that didn’t reward the free market, one entrepreneur said: “In Ghana, everyone is afraid of getting too big.”

Policy and economic conditions are difficult too. Kwami, whose company, Moringa Connect, is a great agribusiness that mentioned how difficult startup investment was to raise for one major reason—bank interest rates are 28%, and it’s difficult even for an exceptional startup to outperform that.

Yet despite these challenges, Ghana has several local conditions that make it globally competitive. The factory we visited, DTRT, can employ hundreds of people in quality working conditions and sell to major US retailers because Ghana’s port is a free trade zone (a vestige of Ghana’s exports of coffee and other cash crops), and also has an agreement with the US to not impose tariffs on imports of the 48 poorest countries in Africa.

Ghana has the ability to create 1 million manufacturing jobs, estimated our leader at DTRT—thanks to policy that supports small manufacturing businesses.

Finally, while Ghanaian culture could be a challenge, its creativity and vibrancy also have major advantages. We had a breakfast with creatives from across Ghana, which is becoming a burgeoning fashion and entertainment industry. The talk was about An African City (Ghana’s Sex in the City equivalent), where the producer joined artists, fashion designers, and more to show off Ghana’s edge in cultural leadership.

3. Great assets can make Ghana globally relevant

Despite the challenges, at a spirited dinner, businesspeople and investors were bullish on Ghana’s prospects. In discussing the entrepreneurial potential of Africa, they settled on the KINGS (Kenya, Ivory Coast, Nigeria, Ghana, and South Africa) as the top five highest-potential entrepreneurial ecosystems, and Ghana ended up third.

How come? Ghana had strong assets that were exportable across Africa and the world: the most educated population in Sub-Saharan Africa, an English language background, relatively good infrastructure, a good and functioning port, and more.

In the Pitch for Accra competition, we saw these assets on display. Farmerline, which delivers information to farmers over mobile — helping them to increase their income through better understanding of crop prices and more—is off to a great start in Ghana and importing to East Africa.

Flippy Campus, a mobile solution that helps schools manage information (replacing paper noticeboards), is building on Ghana’s asset of having the best educational system in Sub-Saharan Africa.

And amazingly, Bitsoko, a blockchain-powered financial services solution, that has an early customer in a food market in Detroit — helping power the entrepreneurial revolution that is rebuilding a once-great American city.

African solutions are not just solving problems in Africa, but helping around the world.

4. Africa keeps going

The winner of Pitch for Accra was Yago Baatuolku, a wonderful leader whose company, Wanjo, produces juice sourced from 250 women farmers in Ghana. Ghana is one of the leading juice consumers worldwide, and if Ghanaians only drank juice produced in Ghana, they would send US$ 250 million a year to farmers. Currently, it’s only US$ 10 million.

Yago has a wonderful business but never felt like she was ready to pitch. When Sheila Herrling of the Case Foundation encouraged her to be “fearless” and pitch, though, she brought down the house, treated the happy hour to Wanjo juice, and took home a US$25, 000 investment.

“I’m so glad I decided to show up,” she said. In a culture that doesn’t always encourage entrepreneurs, showing up is critical.

We asked the CEO of SMSGH what advice he would give — 10 years in — to a Ghanaian entrepreneur starting out. He said, “Just keep going.” He said that there would be a lot of social, cultural, and maybe even political pressure to slow down, not get too big, not get too visible, and a lot of unexpected bumps along the way. The only reason he was able to build a company was that he kept on going.

If Ghana just keeps going, and Africa just keeps going, we’ll see a transformed ecosystem and Ghana can move light years in the next five years. Who knows what we can see in the next 50 years.

Source: Ventureburn

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

App Developers Win Big At Dev:Congress MPower API Hackathon 2013

October 24, 2013 | 3 minutes read

iSpace, Osu, Accra, Ghana – SMSGH and Dev: Congress teamed up for Ghana’s first ever eCommerce Hackathon. The event dubbed the Dev:Congress MPower API Hackathon 2013 was hosted at the iSpace, Osu in Accra.

The winning entry was “Fundr-Africa” a crowdsourcing platform where individuals can create campaigns to generate funds to help with social problems in Africa. It was developed by Osborn Kwarteng, Bright Ahedor, and Kingston Tagoe, and out of the other applications presented, it was judged to have the highest levels of creativity, technical difficulty, polish, usefulness, and overall complete utilization of the MPower API.

The DevCongress team worked out the modality of the event and managed to convince SMSGH, the brain behind MPower, to provide sponsorships. The event brought over 50 developers and web enthusiasts together to take part in collaborative computer programming. As a result, the 60-second presentation time limit was pretty strictly enforced, but teams still had plenty of chance to wow the judges and the audience.

“It’s a value exercise. It allows you to quickly think about a lot of different things,” Yaw Boakye, co-founder of Dev: Congress said of the event. “It’s an opportunity to try something you might not otherwise.”

Hackers were restricted to utilizing first the MPower API plus other SMSGH APIs to work on an application of their choosing. C.T.O of SMSGH, Kwadwo Seinti suggested in advance that some consider creating an application that “benefits the society in some way”.

Fueled by soothing music and fortified by a range of nourishment and cocktails, the young hackers worked for 10 consecutive hours on their applications. The majority of applications hacked at the event revolved around Fund Raising. This goes a long way to emphasize the difficulty and need to apply technology and commerce in the generation of funds for groups and the advancement of socially relevant causes.

The 1st and 2nd runner-ups took home GHs1,000 and GHs500 respectively. Prizes were issued instantly into the winning teams’ MPower account which was projected for all to see. Hackers who were unable to complete their apps were given the chance to do so within 14 days. The first team to present its final app wins GHs500.

The Judges for the event were, Kwadwo Seinti (C.T.O of SMSGH), Alfred Rowe (nCodeDevLab), and Reginald Royston from Berkeley University (Researcher)

The Hackathon also attracted professionals in the banking sector. Attendees found the topics of the event applicable to many different fields. “MPower Payments API is the single most complete API for dealing with Telecos in Ghana and electronic money business”. These were the words of a merchant who has successfully implemented the API for processing payments online.

The event was crowned with a charged party atmosphere with great music from DJ Loft and cocktail engineering by Desny’s Cocktail Engineering.

*****************************************************************************************

DevCongress is a budding developers movement aimed at becoming the most vibrant across the software developers space in Ghana and Africa.

SMSGH remains Ghana’s leading mobile value-added-services company with services and applications in use by more than 7 million mobile subscribers. The company aims at blending communication, content, and commerce to create Africa’s most useful technology aggregation company. Its flagship solutions include MPower, MYtxtBOX, and Jumpfon.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

SMSGH In The News – 5 Promising Ghanaian Tech Startups That May Soon Become Multinational

October 16, 2013 | 4 minutes read

Ghana’s technology and software industry is relatively a younger one and with this comes many challenges for those who are in these fields. Countries like Kenya, South Africa, and Nigeria have received some level of international recognition for their software industries. In some of these countries, they have had huge multinational companies buy out some of their budding startups.

In Ghana, the software industry is growing and already is seeing some promising startups that may soon become multinational. In this article, I take a look at five of such startups that are ready to be skyrocketed.

- RetailTower

RetailTower is an e-commerce marketing solution. RetailTower enables merchants to create campaigns on price comparison engines.

They seamlessly integrate between e-commerce platforms and comparison shopping engines. With a few clicks, merchants can export their inventory product descriptions, images, and prices from e-commerce platforms such as Shopify, Magento, and osCommerce to publish their products on shopping websites.

RetailTower has over 11,000 online retailers who are all outside of Ghana an indication of their potential in terms of growth and expansion.

The company was adjudged the Utility APP of the Year 2013 at TopAppAwards, Ghana.

2. Dropifi

Dropifi is a smart contact widget that helps small businesses better analyze, visualize, and respond to incoming messages. They promise to help small businesses offer better customer support, capture leads and drive sales through the roof.

Dropifi has over 8000 small businesses as customers all over the world which include TKC Apparel, Colombia International, and ALMA Soul among others.

With the nature of their business and customers, it is expected that they will soon have offices in some countries in Europe and the US to address their growing customer base.

Dropifi has been featured on many international platforms including Forbes, the Huffington Post, and TechCrunch, and was recently selected as the first and only African startup to be among the 500 Startups.

3. Leti Arts

Leti Arts is a startup that is focused on Africa’s superheroes. Leti Arts is bringing Africa’s rich folklore to life through the media of comics and mobile gaming.

This tech company is set to launch The Epic of Ananse, an exciting new comic book series, and mobile game that reimagines the ancient fable of the African trickster god.

With their target market and intentions of running TV series around these superheroes, they might soon expand into other African countries. Already, they have offices in Ghana and Kenya.

Leti Arts has been featured on the BBC World Service, and Polygon, and were recently selected as World Summit Award (WSA) Nominee. They were winners of the Entertainment APP and APP Developer category of the TopAPPSaward 2013, Ghana.

4. mPawa

mPawa is a job-matching service developed by Innokiq. mPawa supports the posting of jobs and the onward notification to blue-collar workers in Africa.

They wish to bridge the gap that exists in the current blue-collar recruitment space; that is getting blue-collar workers into a centralized location and allowing employers to easily reach them.

Their focus on the African continent and the successes in the countries they are already in indicates a possible expansion into other African zones.

mPawa has offices in Ghana and Kenya.

5. SMSGH

SMSGH is a Ghanaian tech company that provides bulk SMS, corporate SMS solutions, mobility, and web solutions among others.

Their story of three young graduates coming together to build Ghana’s first non-telco internet SMS messaging gateway and software is an inspiring one.

They have not only succeeded in building an idea into just a company but a company that sees millions of cedis as yearly revenue. Their turnover is expected to reach GHC10 million in 2013.

SMSGH processes about 10.8 messaging requests every second and over 28 million business-critical & subscriber messages monthly with more than 7 million mobile subscribers relying on them to inform, alert, notify, transact, interact, monetize, and share mobile data.

Their vision of becoming an international brand for business messaging is on course and we might soon see them expand into other African countries.

They were adjudged the APP company of the year 2013 at the Topappawards. One of their products, Mpower Payments was also adjudged the most innovative new app 2013, finance app 2013, top user experience app and was the overall winner, the top app of the year 2013 at the same TopAppAwards, Ghana.

Source: opinionghana.com

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

SMSGH In The News – MPower, DevCongress assemble Software Developers to fight problems

October 4, 2013 | 2 minutes read

DevCongress in partnership with MPower Payments and SMSGH is hosting Ghana’s first ever E-Commerce Hackathon, which would gather software programmers to build services that solve everyday problems.

The maiden event dubbed ‘DevCongress MPower Hackathon’, is slated for Saturday, October 5, 2013, from 08:00am to 10:00pm at the iSpace Foundation, Osu Ako Adjei.

Chief Solutions Architect at SMSGH, Kwadwo Seinti told Adombusiness, Hackathon is an opportunity for business owners, entrepreneurs, IT managers, sales managers, customer care managers, and finance managers to register their website programmers to join other app developers in learning how to accept mobile and electronic payments online.

According to him, the gathering would also provide the opportunity for the website managers of various businesses to be introduced to the MPower Payment platform, which is Ghana’s most comprehensive payment platform that integrates all e-payment services such as Visa Cards and Mobile Money.

Seinti recalled, for instance, that paying for adverts on Myjoyonline is still manual and cumbersome, but that could also be made electronically and be integrated with the MPower Payment platform to enable Myjoyonline clients to place ads and pay directly online.

He is therefore urging businesses to “take advantage of this perfect opportunity to turn your business into a thriving online business where customers can buy, and actually pay for your goods and services online.”

“Free registration for the e-commerce hackathon is available on www.EgoTickets.com,” Seinti said. “This event will be powered by programming interfaces from Ghana’s only real online payment service, www.MPower.com.gh, and SMSGH.com.”

Meanwhile, electronic transactions on MPower Payment platform have shot up from 4,000 in July to about 13,000 currently, and the financial value of those transactions has also shot up from about GHC120,000 to more than a million Ghana cedis now.

The main transactions used to be the purchase of mobile phone airtime, but now ticket purchase, particularly for Roverman Production plays and other events by National Theatre are also on the increase.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read