Tag: payments in Ghana

In the early 2000’s, researchers found out that some mobile phone users would sell their airtime to friends and family for cash. This clever, but improvised use of airtime as a substitute for money transfer was the precedent on which mobile money was created.

Over the years, mobile money in Ghana has seen significant development because of the many advantages it carries. The service, which was introduced in Ghana in 2009 by Ghana’s leading Telecommunications Company MTN is now offered by tiGO, Airtel and Vodafone. In fact, one out of every five Ghanaians has a mobile money account.

Setting up a mobile money account is fairly easy. Once you have a valid national ID card and a SIM card, you just visit your network provider and an account will be created and linked to your mobile number. The only thing you need to make transactions is your PIN number. Fin. Comparing this with traditional banking, where you would actually have to walk into banking hall, fill out documents, make a minimum deposit and walk out with a cheque book and an ATM, it is easy to understand why many Ghanaians are opting for mobile money instead.

The fact that there are many mobile money agents in Ghana makes it easier and more convenient when you have to withdraw money. Let’s say you live and work in Kumasi and need to transfer some money to your sister in a village. Before the onset of mobile money, you may have had to transfer the money through someone, say a friend or a distant relative. This comes with some delay and risk of your sister receiving less than expected. But with mobile money, no matter which network you use, there is at least one agent who can assist your sister cash out almost immediately you transfer the cash.

Gone are the days when local traders would ply long distances without fear of being robbed of valuables by armed bandits in the middle of their journey. Rather than carrying large amounts of money and hoping for event-free trips, more and more traders now transferring money to their mobile money accounts, travelling light and redeeming their money when they arrive safely at their destination.

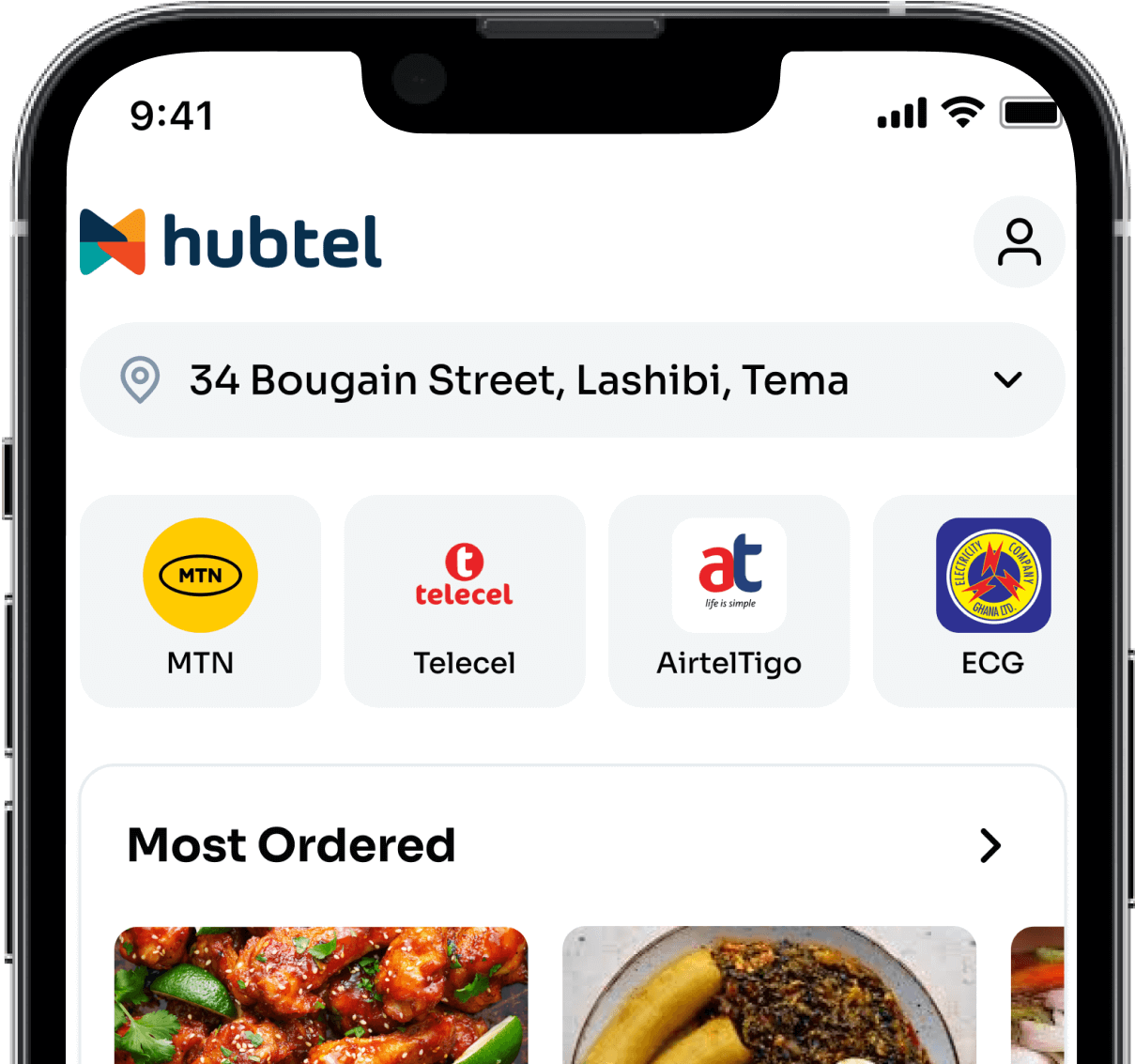

Even though there has been a mass adoption of the service, Ghanaians primarily use the service for cash in/cash out transactions. They do not use mobile money to pay for utilities and make other online purchases as is the norm in Kenya and Tanzania. This indicates that the service is guaranteed to get better as companies begin to take advantage of the unique opportunities opened up by mobile money. Hubtel, for one, offers a Point of Sale (POS) software for businesses who have products or services to sell and want to give their customers the convenience of paying with a variety of payment options including mobile money.

With the burgeoning and innovative use of the service, mobile money in Ghana is guaranteed to continue rising. Who knows, it could even disrupt traditional banking.

Related

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read