Tag: Technology

Mobile Telecommunications Network (MTN) hosted this year’s SME Business fair in Takoradi for interaction and networking opportunities for SMEs within the Western Region.

The two-day MTN SME Business Fair, organized under the theme “Accelerating SME growth with smart ICT solutions and partnerships” officially opened on 23rd March 2016 at the Akroma Plaza in Takoradi . The fair brought together about a number of companies including SMSGH Solutions Limited, Fidelity Bank, Association of Ghana Industries (AGI), GCB Bank, TXT Ghana, Glico and other businesses, who engaged participants in various products/ services they offer.

Participants had the opportunity to experience MTN’s ICT offers which includes Corporate Voice Solutions, Internet Messaging Solutions, Data Centre Services and Security Solutions. Other products showcased included MTN’s vehicle tracking devices, modems, routers, and corporate devices.

SMSGH, one of MTN’s leading partners was privileged to be a part of this event and had the opportunity to present to participants one of its products MYtxtBOX. Mr. Emmanuel Offei talked about the various advantages of using the right communication tools for customer engagement, explaining the benefits of using MYtxtBOX, its features and various offerings especially the recently launched MYtxtBOX Email.

Visitors at the SMSGH booth were taken through live demonstrations on various features of MYtxtBOX such as the #HashTag for feedback; real time messaging reports; multimedia messaging; voice messaging; e-mail messaging among others.

The Business Fair was proudly sponsored by MTN in partnership with the Association of Ghana Industries (AGI) and the Western Ghana Chamber of Commerce.

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Is it bad to charge your phone overnight? What about charging an iPhone with an iPad adapter? Tech myths… whew!!!

Despite how often we use devices like smartphones and laptops, we have plenty of questions about how they work. And with so much information out there — not all of it true — it’s hard to know if we’re treating our electronics properly.

We’re here to debunk some of the biggest tech myths and misconceptions out there.

Mac computers can’t get viruses

Yes, Apple computers are susceptible to malware, too. Apple used to brag its computers aren’t as vulnerable as Windows PCs to viruses, but the company quickly changed its marketing page after a Trojan affected thousands of Mac computers in 2012.

Private/Incognito browsing keeps you anonymous

There’s a misconception that “incognito” and “private” are synonymous with anonymous. If you’re using Incognito Mode in Google Chrome or Private browsing in Safari, it simply means the browser won’t keep track of your history, import your bookmarks, or automatically log into any of your accounts. Basically, it’s good for keeping other people who use your computer from seeing what you’ve been doing. But it won’t keep your identity hidden from the sites you visit or your ISP — so keep that in mind if you’re visiting sites you shouldn’t be.

Leaving your phone plugged in destroys the battery

If you’re like most people, you probably leave your phone plugged in overnight long after the battery is fully charged. Some used to say this would hurt your phone’s battery life, but in fact, there’s no proof that this damages your phone’s battery in any way. Modern smartphones run on lithium-ion batteries, which are smart enough to stop charging when they’ve reached capacity.

You should always let your iPhone battery completely die before recharging

This, too, is a popular myth. Apple points out that its modern lithium ion batteries mean that “You complete one charge cycle when you’ve used (discharged) an amount that equals 100% of your battery’s capacity — but not necessarily all from one charge.”

More megapixels always means a better camera

What’s the difference between 12-megapixel cameras and 8-megapixel cameras? Not much, as it turns out. The quality of an image is determined in large part by how much light the sensor is able to take in. Bigger sensors may come with larger pixels, and the larger the pixel the more light it can absorb. So, it’s really the size of the pixels that matter as much or more than the sheer number of pixels. (A megapixel is simply shorthand for a million pixels.)

Here’s how TechCrunch’s Matthew Panzarino, who’s also a professional photographer, describes the role of the pixel: “Think of this as holding a thimble in a rain storm to try to catch water. The bigger your thimble, the easier it is to catch more drops in a shorter amount of time.” The thimble is a metaphor for a pixel — using a few buckets would be much more efficient than a bunch of thimbles for catching water.

Higher display resolution is always better on a smartphone

Some have argued that at a certain point, screen resolution doesn’t matter on a smartphone. Gizmodo cites experts in saying the human eye can’t discern nitty-gritty detail when a display packs more than 300 pixels per inch. Earlier this year, LG unveiled its first quad-HD smartphone, the G3, which has a resolution of 2560 x 1440. That’s much higher than the average high-end smartphone, which usually comes with a 1920 x 1080 resolution display.

But it’s unclear if those numbers really matter after a certain point because the eye can’t discern individual pixels beyond a certain resolution. When I tested the G3’s display alongside the 1080 Galaxy S5’s display, there was hardly a difference in terms of sharpness — that’s why companies like Apple tend to focus on brightness, more so than ultra-dense displays.

It’s bad to use your iPad charger for your iPhone

This one is a little trickier than a standard “yes or no” answer. Apple’s official website says its 12-watt iPad adapter can charge both the iPhone and the iPad. However, Steve Sandler, founder and chief technical officer at electronics analysis company AEi Systems, told Popular Mechanics that this could stress your iPhone’s battery over time if you do it regularly. It would take about a year, however, to notice any changes in battery efficiency.

You shouldn’t shut down your computer every day.

While some may believe it’s harmful to shut down your computer every night, the truth is it’s actually good to turn off your computer regularly. It’s easy to get into the habit of putting your laptop in sleep mode so you can easily return to it without having to boot up. But, as Lifehacker points out, shutting it down when not in use conserves power and places less stress on its components, which could enable it to last longer.

Holding a magnet close to your computer will erase all of its data.

This technically isn’t wrong — you may remember how easy it was to wipe a floppy disk using a magnet back in the day. But you would need a really, really big magnet to wipe out your computer’s hard drive. Experts told PCMag that hard drives on modern computers would only be susceptible to really strong magnets with really focused magnetic fields. So your average refrigerator magnet wouldn’t do the trick.

Cell phones give you brain cancer

Although cell phones emit radiation that can be absorbed by human tissue, there isn’t any conclusive evidence showing that cell phones actually cause cancer.

Here’s what a report from the National Cancer Institute in the USA says:

Although there have been some concerns that radiofrequency energy from cell phones held closely to the head may affect the brain and other tissues, to date there is no evidence from studies of cells, animals, or humans that radiofrequency energy can cause cancer.

More signal bars guarantees great cell service

While having more bars helps service, it doesn’t necessarily guarantee excellent reception. The bars just indicate how close you are to the nearest cell tower. But there are other factors that impact how fast the internet on your phone performs, such as how many people are currently using the network.

Credit: Tech Insider

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

We are in the golden age of technology. Within the larger movement; however, each one of us is directly influenced by the take off of a more recent and rapidly developing financial technology (FinTech) space—an industry projected to attract approximately $20 billion in funding by 2017, estimates Statista.

Financial technology is a democratizing force that can change our lives by making financial tools and services accessible, faster and more easily understood — most times at a lower cost. Complex algorithms now often take the place of traditional advisors, perhaps offering more efficient and personalized products for end users.

From budgeting tools to alternative lending and investment options, payments processing, and philanthropic platforms, we have a lot to gain from the advent of financial technology startups. Learn below about just a few ways in which you can leverage these hot new platforms before they inevitably become common applications for the entire public.

Payments Made Easy

The advent of payments technology has made consumer spending, and all other forms of payment easier, faster, and more secure. Payments technology startups, such as Square, help small businesses get off the ground by adopting easy to use and cheaper credit card payments processing. Instant, reliable transactions are important for day-to-day sales, along with employee payroll processing.

Venmo, a payments app, has provided a “free digital wallet” to the mobile devices of thousands, by allowing friends to connect quickly and securely via Facebook to request and send money to each other in a few taps on their phones. Furthermore, on the consumer side, platforms such as Apple Pay and Bitcoin continue to disrupt the traditional method of pay. When sending money abroad, individuals should consider using money transfer services such as TransferWise to save on international transfer fees.

Lend a Helping Hand

Peer-To-Peer (P2P) business models have fueled a new sharing economy revolution, with many products and services such as home rentals, cleaning services, and anything else under the sun being “uberized.” New FinTech startups have uberized the online lending space, allowing you to access funds through unconventional ways, without the help of big-name banks or a network of established lenders.

Platforms such as U.S.-based LendingClub and Prosper, and U.K-based Zopa have individually issued millions of dollars in loans, joining the rising number of tech unicorns in today’s entrepreneurial space.

Crowdfunding: The New Venture Capital

Investment in crowdfunding platforms may surpass venture capital funding in 2016. Popular sites Indiegogo and Kickstarter have helped thousands of ideas get off the ground – from bizarre video games to social projects and multi-purpose jackets, small businesses and entrepreneurs can now look to the general public for support. Countless other sites such as GoFundMe, which took off by bootstrapping, allow individuals to raise money for any project they like.

A ‘Bankless’ World

The headline of loan refinancing startup, SoFi’s website reads, “Great news: we’re not a bank.” Over the past few decades, we’ve seen a general distrust and loss of confidence in our traditional banking system, dominated by the big banks. After the Global Recession in the late 2000s, a new generation of startups hopes to fix the transparency issue facing big banks and provide consumers with more personalized and comprehensive services online.

Nasir Zubairi, venture partner at FinLeap in Berlin, commented on the FinTech industry, stating that “3 billion people, 50% of the world, do not have access to a banking system, and I think that FinTech can help in solving the problem around credit. There’s a huge opportunity for FinTech companies and of course for people who will benefit from their solutions.” Startups such as Kabbage, a small business lender, take into account a myriad of factors such as eBay data into account when determining risk, providing more of a data-driven service unhindered by the same regulations that restrict the traditional banking system. Countless other platforms such as CreditKarma offer credit risk services at zero or low cost.

Democratizing Investment Products and Services

Robo-advisors continue to gain traction as a provider of investment services once solely accessible to wealthier individuals who could afford their own financial advisor. An online advisor is now available through multiple platforms such as Wealthfront and Betterment. Wealthfront manages your first $10,000 free for a small fee of .25% after that while Betterment charges .35% to .25% annually or $3 per month. A series of questions, including an individual’s age, determines a user’s risk tolerance, which then determines the portfolio allocation for each specific individual. If you are unwilling or unable to invest your money yourself, or through a trusted financial advisor, an online platform is a much better way to direct your savings to their most effective use.

FinTech startups aren’t stopping at stock investment, however. For the growing number of Americans who seek involvement in alternative investing and philanthropic projects, the FinTech industry continues to deliver. Take Neighborly, a social venture helping you get involved in the municipal bond market. Neighborly’s Community Investment Marketplace allows you to make an impact directly in your community through safe and lucrative investing.

Budgeting: A Virtual Piggy Bank

As many tech startups target millennials, there’s a significant opportunity for business to facilitate the process of a new generation beginning to save, lend, and invest their money. Millennials don’t simply want to watch the purchasing power of their money wither away in a bank account; instead, they’re using budgeting and educational platforms to help them with a financial strategy. Alongside their robo-advisors, individuals can use budgeting platforms such as LevelMoney and Acorns that automatically track spending and income to give users a daily allowance for the day. This helps people grasp exactly how they are spending their hard earned dollars. Other platforms find creative ways to save you a dime. For example, Paribus scans users emails for receipts following a purchase to get money back in the case of a price drop.

The Bottom Line

FinTech is on the fast track to growth, and it’s not just investors who can benefit from the success. Be sure to stay up to date on the rapidly evolving FinTech sector, which will help drive a democratization of financial tools and services, from payments to wealth management and philanthropy. Ultimately, whether FinTech will take the place of traditional banking entirely is up for debate. However, the plethora of cost efficient and accessible financial tools and services will undoubtedly force the entire financial sector to transform.

Credit: Investopedia & JumpFon.com

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Technological change has always posed a challenge for companies. But, as we saw once again in 2015, it has never occurred as rapidly, or on as large a scale, as today. As innovation sweeps across virtually every sector, from heavy industry to services, it is transforming the competitive landscape, with the most advanced companies – rather than the largest or most established players – coming out on top.

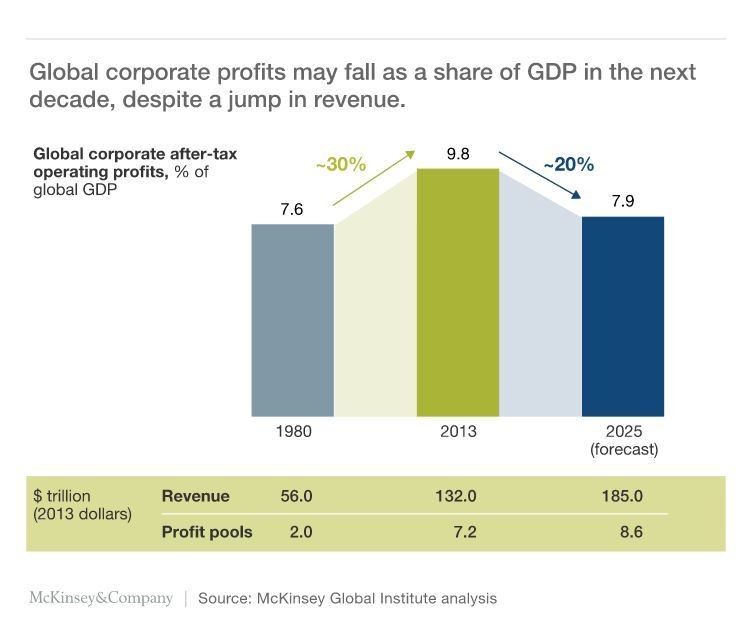

For incumbents, the threat of displacement is very real. The average tenure of a company on the S&P 500 has fallen from 90 years in 1935 to less than 18 years today. Disruptive new players like Uber, which has upended the taxi industry, are tough competitors, often staking out market share by shifting more surplus to consumers. This is part of a broader trend of intensifying competition that, according to recent research from the McKinsey Global Institute, could reduce the global after-tax profit pool from almost 10% of global GDP today to its 1980 level of about 7.9% within a decade.

The effect of technology on competition arises largely from the power of digital platforms and network effects. New digital platforms reduce marginal costs (the cost of producing additional units of a good or service) to nearly zero. Adding, say, a Google Maps user carries negligible costs because the service relies on GPS location data that is already stored on a user’s phone. This allows Google to scale incredibly quickly, and then to leverage this scale (and the convenience of having a single platform) to move into adjacent sectors – such as music (Google Play), payment (Google Wallet), and word processing (Google Docs). In this manner, tech firms can quickly come to challenge incumbents in seemingly unrelated industries.

Of course, tech firms are not the only ones innovating. A handful of leading firms in practically every industry are deploying digital technology in increasingly sophisticated ways – and seeing huge benefits. The use of sensors to monitor livestock, for example, has far-reaching implications for the food industry.

But the most digitally advanced sectors show the greatest progress. Indeed, over the last 20 years, profit margins in these tech-infused sectors have grown 2-3 times faster, on average, than in the rest of the economy. Even within the most advanced sectors, there is a yawning gap between the top-performing companies and the rest of the pack. For example, the retail offerings of digitally advanced multinational banks far outstrip those of local credit unions.

As technology transforms business models and processes, it is also changing the way employees work. Recent McKinsey research finds that already-proven technologies could automate as much as 45% of the tasks individuals are currently paid to perform. In the United States alone, that is the equivalent of about $2 trillion in annual wages.

The potential benefits of this transformation for companies extend far beyond cost savings, as workers gain time to pursue more valuable tasks involving critical thinking and creativity. Financial advisers can spend less time analyzing financials and more time developing solutions that meet clients’ needs. Or interior decorators can shift their attention from taking measurements to devising design concepts, meeting with clients, or sourcing materials.

Technology also allows companies to rethink conventional wisdom on organizational design and governance. New information-sharing technologies deliver greater transparency, making organizations more efficient and, in many cases, less hierarchical.

For example, the CEOs of Apple, Inditex (a multinational clothing company), and Zappos (a large online retailer) have adopted broad spans of control (the number of subordinates directly reporting to a manager) that far exceed the traditional model of “one to four to eight.” Haier, the Chinese white goods manufacturer, reorganized its 80,000-person workforce into 2,000 independent units, each responsible for managing its own profits and losses. Since the move, its market capitalization has soared, tripling from 2011 to 2014.

Moreover, digitization allows companies to operate as “platforms,” not structures, and make greater use of resources outside their company. The insurance company Allstate used the crowdsourcing platform Kaggle to invite programmers to develop a new car accident injury algorithm; the eventual “winner” was 271% more accurate than its existing model.

Likewise, China’s DJI became the world’s largest drone manufacturer by focusing on its products’ core technology, while giving away developer kits for free online so that others could build apps. This approach meant that DJI’s drones were equipped with attractive features far earlier than competitors’ products, which relied on in-house app development.

Similar technology-driven innovations in thought processes and business models can be seen across the economy, reflected in changes in companies’ planning processes. Some have begun creating separate business plans with two-month and 20-year views, reallocating their resources more aggressively, and using new analytical techniques to identify, attract, develop, and retain talent.

Technological innovation enables – indeed, requires – companies to boost their agility and thus their competitiveness. That’s why CEOs’ top priorities in 2016 should be to digitize the core components of their business and rethink organizational design and governance processes. Catching this fast-moving – and rapidly growing – “digital wave” is the only way to avoid getting left behind.

Author: Dominic Barton is the global managing director of McKinsey & Company.

Source: weforum.org

Related

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read

Honoring the Legacy of Our Co-founder Leslie Kwabena Nyarko Gyimah

May 8, 2024| 2 minutes read

Fairy lights on Christmas trees can cause slower broadband speeds, according to Ofcom.

The communications watchdog says wireless networks in homes and offices are often set up incorrectly or they’re suffering from “interference” from electronics with wiring like baby monitors and things like microwaves.

Ofcom has launched a free app called Wi-Fi Checker which allows you to test the quality of your signal and ways to make it better.

Here’s our 10-point guide to making your signal strength stronger.

1. Upgrade your router

The routers that come with your broadband packages are fairly decent these days.

But if you want a really fast wi-fi connection at home, why not ask for a new router for Christmas?

The latest bits of hardware will make your broadband go further and perform better.

2. Move your router

Probably best to make sure your router doesn’t have a plant on it

This may be common sense to some but the higher up, the better.

So put your router on the top floor of your house if you can, on top of furniture and near the middle of the house. And keep it off the floor if you want a decent signal.

But you’ll obviously have to think about how practical that may be as the router needs an Ethernet cable, power, and/or coax.

3. Change the channel on your router

This one’s a bit more technical, but most routers these days come with dual bandwidths (look in the booklet your hardware came with).

Basically – most routers run on the 2.4GHz frequency – but so do many other household appliances like microwaves, baby monitors, Bluetooth, CCTV, and cordless phones.

If you change to the 5GHz frequency you should have less interference. Your neighbor will also probably still be using 2.4GHz as well, so that’s one less source of interference – or in this case “contention”.

4. Cut down on interference (attenuation)

Lots of things can affect your Wi-Fi signal, which is why Ofcom mentioned fairy lights.

Make sure your cat doesn’t interfere with your signal either…

But any electrical cable can have a negative impact if they’re in the way – as can metal doors, aluminium studs, wall insulation, water (fish tanks, etc), mirrors, halogen lamps, filing cabinets, brick, glass and concrete.

Anything that affects signal strength is actually called attenuation – just so you know.

5. Update your software

Make sure your router has the latest updates.

Software is improved constantly plus the newest mobiles and laptops will obviously connect at higher speeds to a stronger wi-fi signal.

More important though is what’s called Signal to Noise Ratio (SNR) which will actually determine the data speeds at which a device will connect.

Just because you can see five bars on your device doesn’t mean you’re guaranteed high data rates.

6. Think about extenders

Extenders work by pushing your existing signal further. You can use older routers to do this for you, but it’s a bit technical to hack into them.

The easiest thing to do is to buy an extender, or even better, use powerline technology.

That’s when you plug an adapter into your mains sockets and the Wi-Fi is amplified using the electrical wiring in your walls.

Probably best not to use the household wiring if it looks like this though…

Also, if you have an older router with antennas, you can buy better ones.

7. Share with your neighbours?

If you live in a block of flats and get on with your neighbours, you could share a shiny new router.

That way the person at the top of your block (see point two) could beam Wi-Fi into the rest of the building and you share the cost. But if you live at the bottom you may get a weaker signal.

You could also use your phone or laptop as a hotspot or get MiFi.

If there’s someone using lots of bandwidth in the house (we’re thinking gamer or heavy video streamer), you can also use Quality of Service to prioritise what gets the best Wi-Fi signal.

8. Secure your wi-fi

If you don’t like your neighbours, or if you just want a more secure network, use a different Wireless Security Protocol – WPA/WPA2 instead of WEP (this is quite complicated but basically just search for your router online and ask the web how to change it).

Quiz fact: WEP is Wired Equivalent Privacy and WPA is Wi-Fi Protected Access.

You can also limit the number of devices your wi-fi will support with something called MAC addresses (media access control addresses). Again there are lots of self-help guides online.

9. Don’t publicise your signal

You know when you search for public wi-fi and it comes up with lots of options (depending on where you live obviously)?

Well, if you haven’t secured your network, other people can obviously use your wi-fi signal.

You can make your network private by adding a password but you can also make it even more secure by going to your administration page and unchecking “Enable SSID Broadcast”.

This will take your signal off most people’s wi-fi smartphone lists but there are apps that can find your “hidden” signal.

10. And if all else fails… use tin foil

This one’s a bit more left field, and seemingly unproven, but seems to work sometimes.

Just get some tin foil from your kitchen, curve it around the back of your router, and away you go.

You may want to download a free Wi-Fi speed-checking app to test signal strength before and after.

People have also used a variety of other metal objects behind their routers from beer cans to sieves and graters. We’ll leave that one up to you.

Credit: BBC Newsbeat

Related

October 11, 2019| 2 minutes read

October 4, 2019| 2 minutes read

The History of Online Shopping

September 20, 2019| 2 minutes read

MPower Payments is rewarding users for their loyalty in using its payment services. To achieve this, MPower will be giving out rewards in the form of funds to several account owners.

MPower is an online payments service in Ghana offering a complete end-to-end web and mobile payment transactions solution to enable consumers and businesses to send, spend and receive money.

The rewards have been packaged as a standard amount of GHs100 for selected users who keep an active MPower account. The goal here is to reward active users hence the selected user must have completed at least two transactions within the week of selection.

Transactions performed on MPower currently take place in 3 main ways:

- Users transfer/send money or tokens to other accounts including MPower, bank, and the various mobile wallets of local network operators.

- Users also make payments to merchants:

- Purchasing products from online stores that have integrated MPower as a payment option.

- Paying for services from providers who accept remote payments via MPower.

- Purchases on MPower CornerShop:

- Airtime top-ups for all networks

- Internet bundles purchases

- Utility bills payments

- Vouchers vended by services

Users can also initiate another transaction type by making requests to other account owners via PayPal, mobile money wallets, and MPower tokens using the receive money feature on MPower.

Fees and charges that apply per the various transactions performed are listed on the MPower Service Fees page.

The giveaway/offer, which began on October 30, 2015, is set to run weekly till the end of December this year; coinciding with the gifting tradition of Xmas and New Year holidays.

Selections will be made each Friday and payouts will occur instantly to furnish the recipient’s MPower account with the reward. This amount can be spent in the same way as regular funds on MPower.

The MPower service is accessible via web at www.mpower.com.gh and also via mobile on MPower’s android application.

Related

Gen Z vs Millennials: What are they ordering?

June 24, 2024| 2 minutes read

Hubtel Ranked Ghana's Fastest Growing Company for 2022

May 16, 2024| 2 minutes read

May 12, 2024| 3 minutes read